A Holiday Message

Dear readers, as the holiday season approaches, we want to take a moment to express our appreciation for your support throughout the year. This will be our final newsletter of 2024, but we look forward to resuming with fresh updates starting the week of January 6, 2025!

Without further ado, let’s dive into this week’s updates.

值得关注的趋势

[Ocean - TPEB]

- Rates: Shipping lines successfully implemented a General Rate Increase (GRI) as of December 15th, with only minor adjustments and rate corrections observed so far. The first Peak Season Surcharge (PSS) announcements indicate a planned increase for January 2025.

- Blank sailing: A moderate blank sailing program was in place for December 2024, with 92% available capacity. For January 2025, capacity is expected to be 97%. Additional blank sailings are likely to be announced soon for January and February to account for the Lunar New Year and network changes on the Transpacific trade lane.

- Equipment: No significant equipment (EQ) issues have been reported at origin.

[Ocean - FEWB]

- Demand: Market demand matches operating capacity, supporting stable rates.

- Supply: Market volume is stronger compared to November, but supply capacity is sufficient. Vessel return speed is a key factor influencing the supply side.

- Rates: 2H December FEWB FAK rates remain stable, with Shanghai Containerized Freight Index (SCFI) fluctuations within a narrow range.

- Equipment: There have been occasional equipment shortages at major Chinese ports, but they remain manageable. Timely Equipment Interchange Receipt (EIR) printing and earlier equipment pickups can reduce the risk of missed cargo loading for clients.

[Ocean - TAWB]

- Capacity: Demand remains high due to the possibility of a potential ILA strike on the 15th of January. Canadian ports still face congestion due to recent strikes.

- Space: Space is still limited, primarily in the WMED, where even extra loaders are running full for WMED and NEUR. EMED services are almost running full.

- Rates: 2H of December followed the same trend as 1H of December, along with November. For January, the majority of carriers are extending their rates.

[Air – Global] Mon 02 Dec – Sun 08 Dec 2024 (Week 49):

- Spot rate growth (Week 49, WoW & YoY): Global average spot rates rose by +4% WoW to $3.30/kg, reaching a 2024 high. Asia-Pacific origins saw an +8% WoW increase to $4.86/kg, up +19% YoY. Spot rates from Africa increased +12% WoW, while Europe origins rose +3% WoW to $2.93/kg, with a +4% WoW rise to North America ($3.97/kg).

- Regional spot rate trends (Asia to Europe): Taiwan to Europe rates surged +20% WoW to $4.76/kg, while China to Europe increased +12% WoW to $5.52/kg. Hong Kong to Europe rates dipped slightly (-1% WoW), but remained elevated at $6.22/kg. Significant YoY increases to Europe were noted from Indonesia (+94%), Thailand (+67%), Malaysia (+50%), Singapore (+42%), and Vietnam (+30%).

- Tonnage trends (Week 49, WoW): Global air cargo tonnages rose +1% WoW, driven by a +14% WoW rebound from North America origins (+15% from the U.S.). Notable WoW volume increases were seen on lanes from China to the U.S. (+10%) and Europe (+12%).

- Year-on-year (YoY) spot rate overview (Week 49): Average worldwide spot rates rose +21% YoY, led by Middle East & South Asia origins (+62%), the Asia-Pacific (+19%), and Europe (+19%).

来源: Worldacd.com

请与您的客户代表联系,了解货运所受影响的详情。

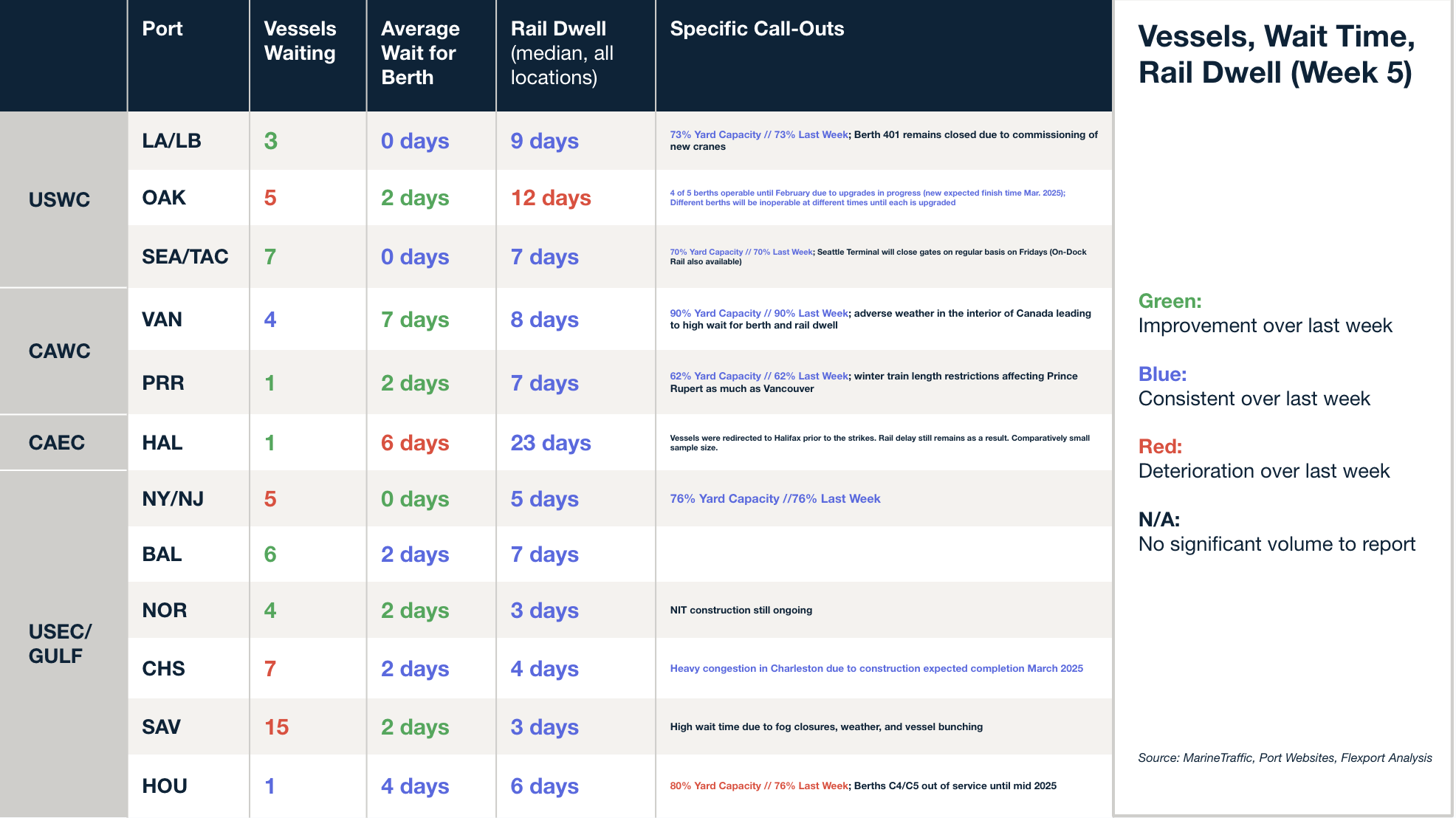

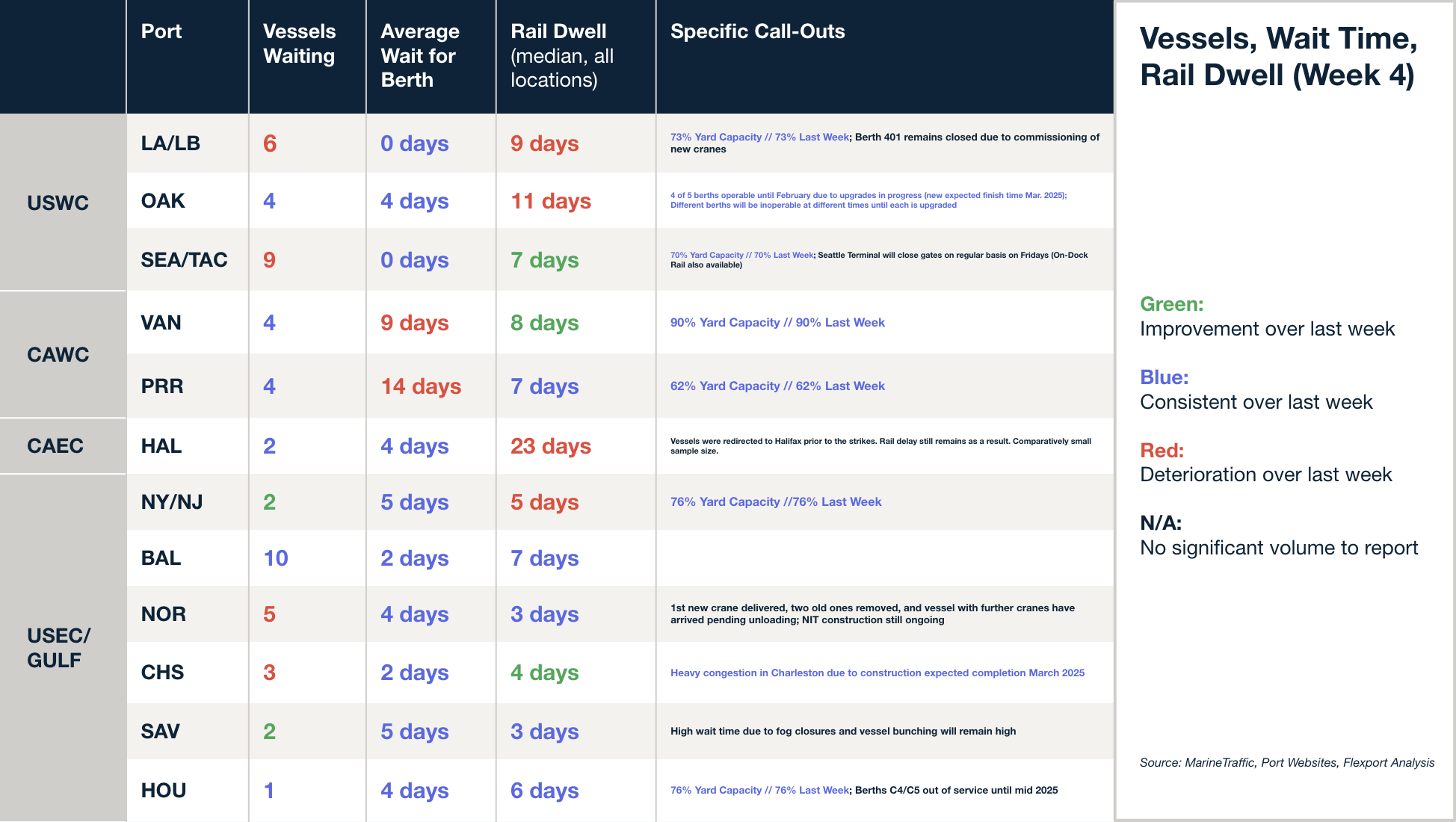

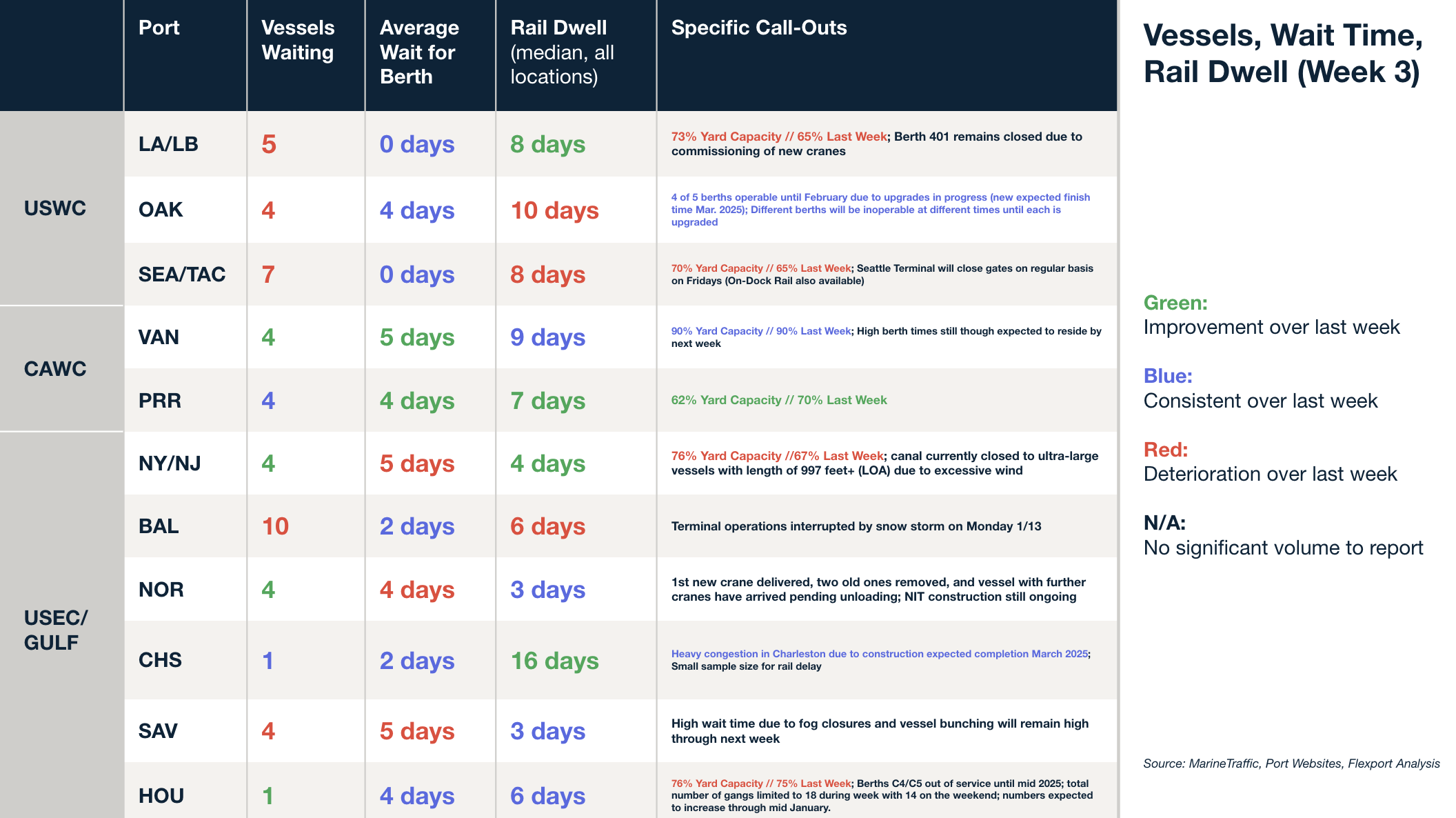

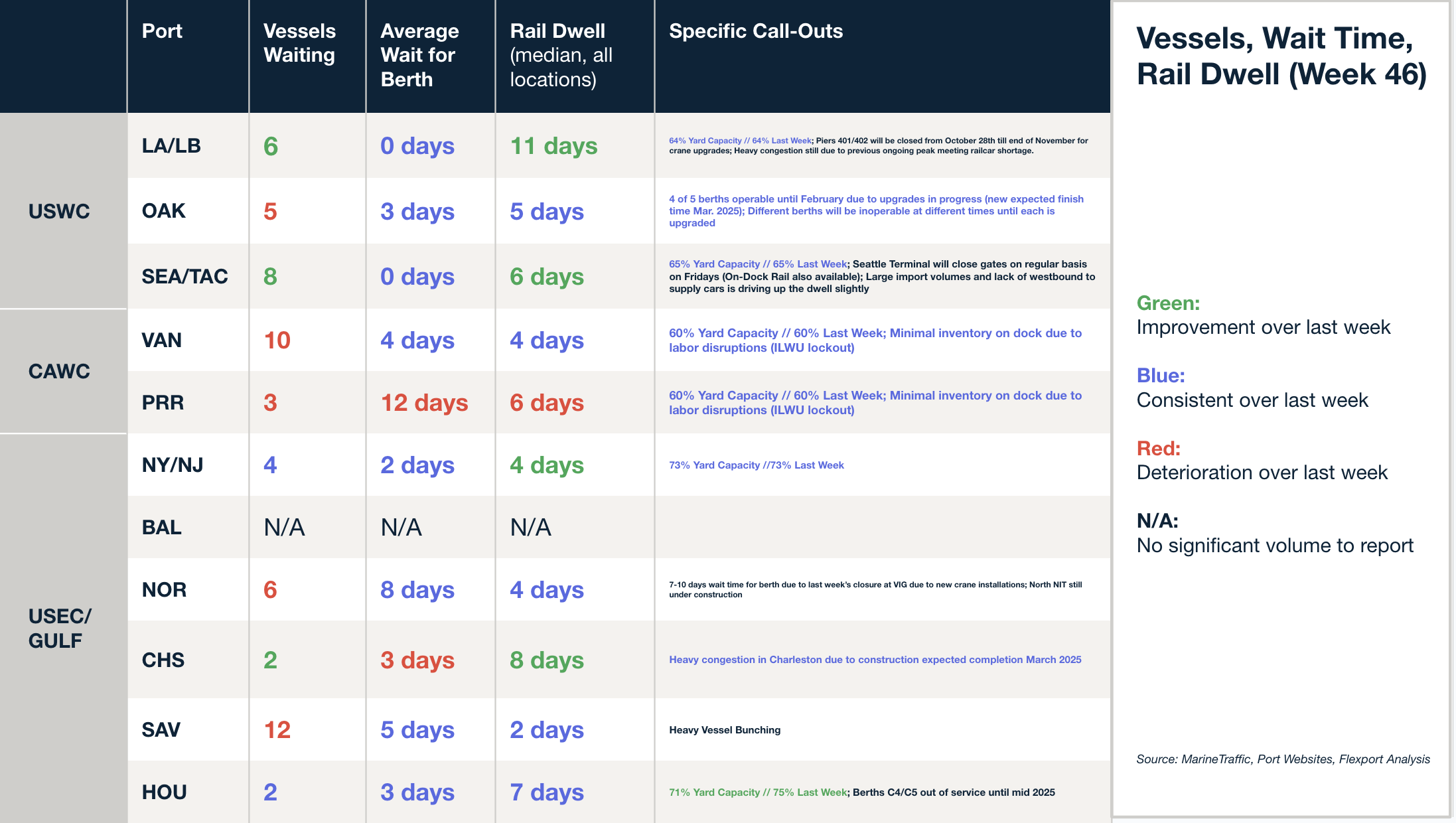

北美船舶停留时间

Webinars On-Demand

In case you missed one our webinars this month, watch the on-demand versions below:

Air Market Predictions for 2025

Global Logistics Outlook: Key Trends, Technology, and Strategies for 2025

Unboxing Holiday Trends: Learnings from Black Friday & Cyber Monday

Flexport Customs: Navigating T86, Section 321, and Potential Regulatory Changes

北美Freight Market Update Live

UNICEF & Flexport: The Complexities of Shipping Humanitarian Aid

本周新闻

Domino effects await if ILA strikes again: analyst

With negotiations stalled between the ILA and the US Maritime Alliance, a potential January 15th strike is already shaking up supply chains. Importers have rushed to move cargo, but options like rerouting are quickly disappearing. A strike would bring vessel delays, cargo diversions, export capacity shortages, and prolonged port congestion, especially with new shipping alliance networks adding to the disruption. If the strike drags on, the ripple effects could impact global trade well into March, making a resolution increasingly urgent.

Lunar cargo rush, poor weather clog major Asia ports

Major Asian ports, including Shanghai, Tokyo, Ningbo, Busan, and Manila, face berthing delays of up to five days due to a pre-Lunar New Year cargo rush and weather disruptions. High yard density, vessel bunching, and seasonal closures are compounding the congestion, with similar delays reported at European ports like Rotterdam and Hamburg. Delays are expected to worsen as late vessels return to Asia.

Growth in air cargo demand to decelerate in 2025, IATA says

Air cargo growth will slow to 5.8% in 2025, reaching 80 million tons, fueled by ecommerce and ocean shipping delays, IATA reports. Revenue is expected to rise to $157 billion, with yields remaining 30% above pre-pandemic levels. Capacity growth will lag demand due to freighter production delays. Global airline revenues are set to reach $1 trillion, with $36.6 billion in net profits. Lower fuel costs and efficiency gains will support margins, but rising labor and nonfuel expenses, along with supply chain and regulatory uncertainties, pose challenges. Airlines must focus on cost control to maintain profitability.

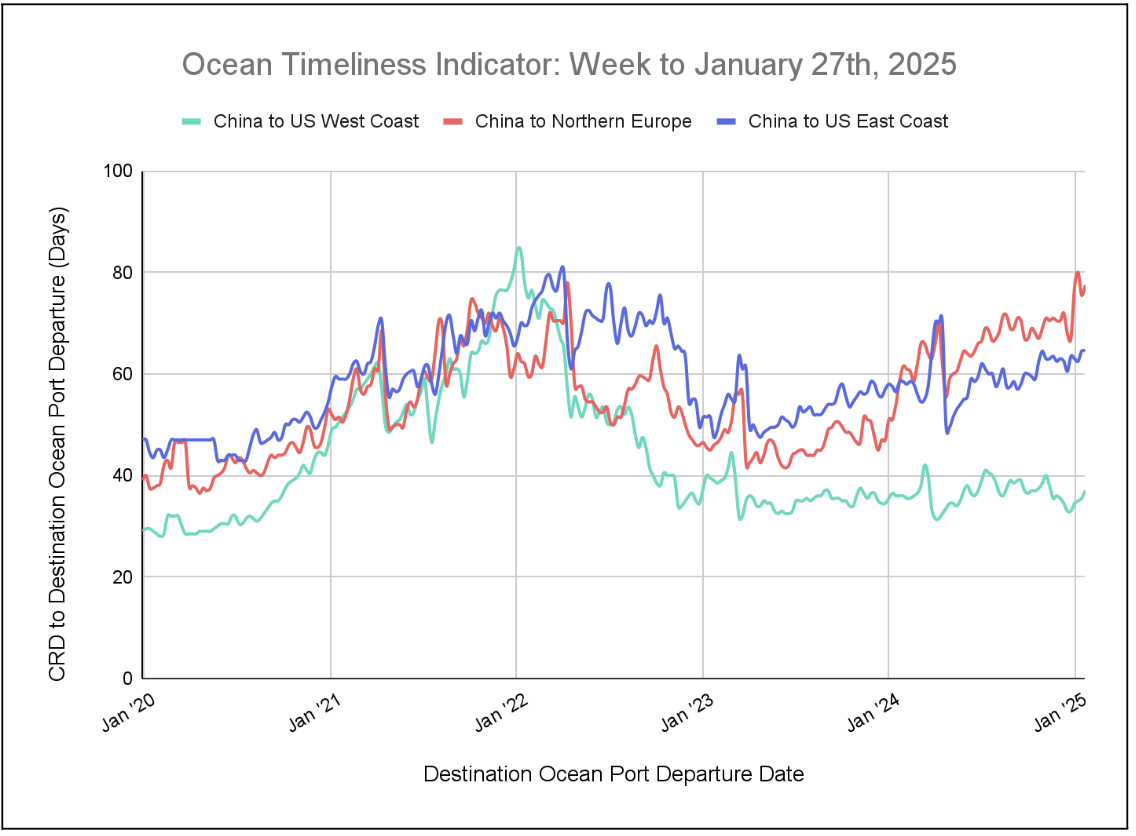

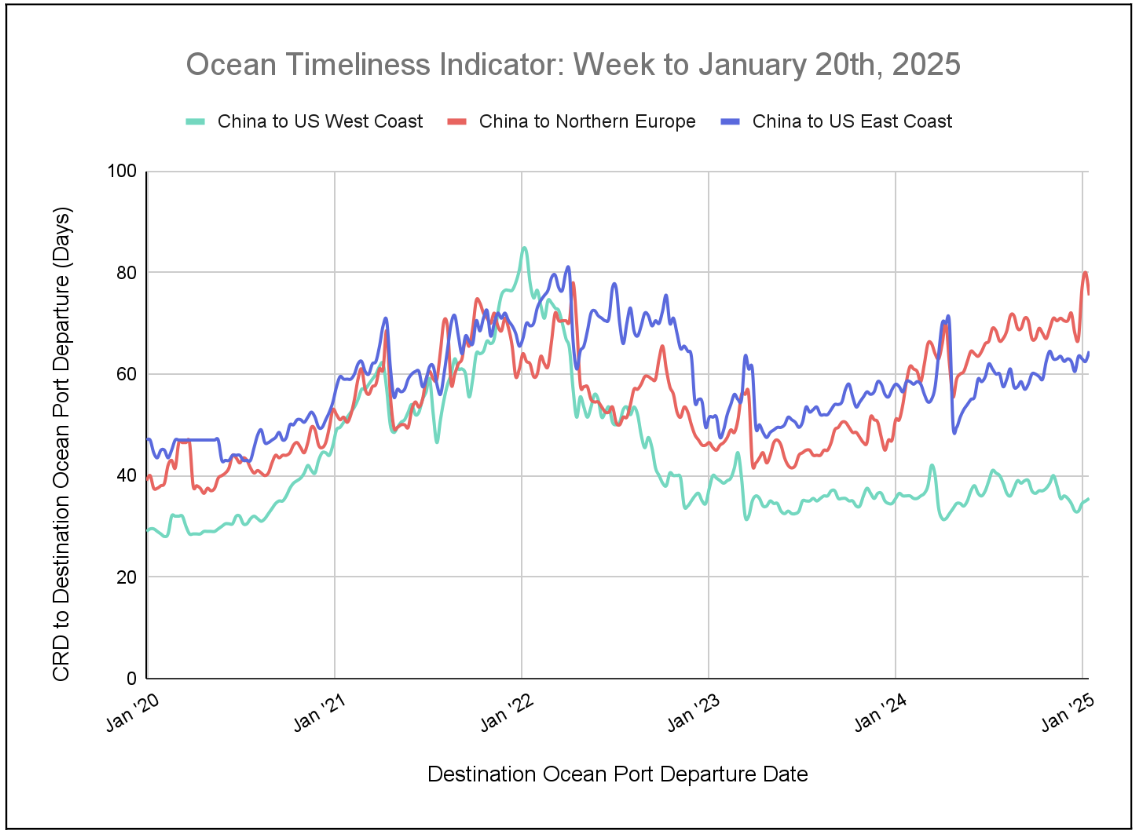

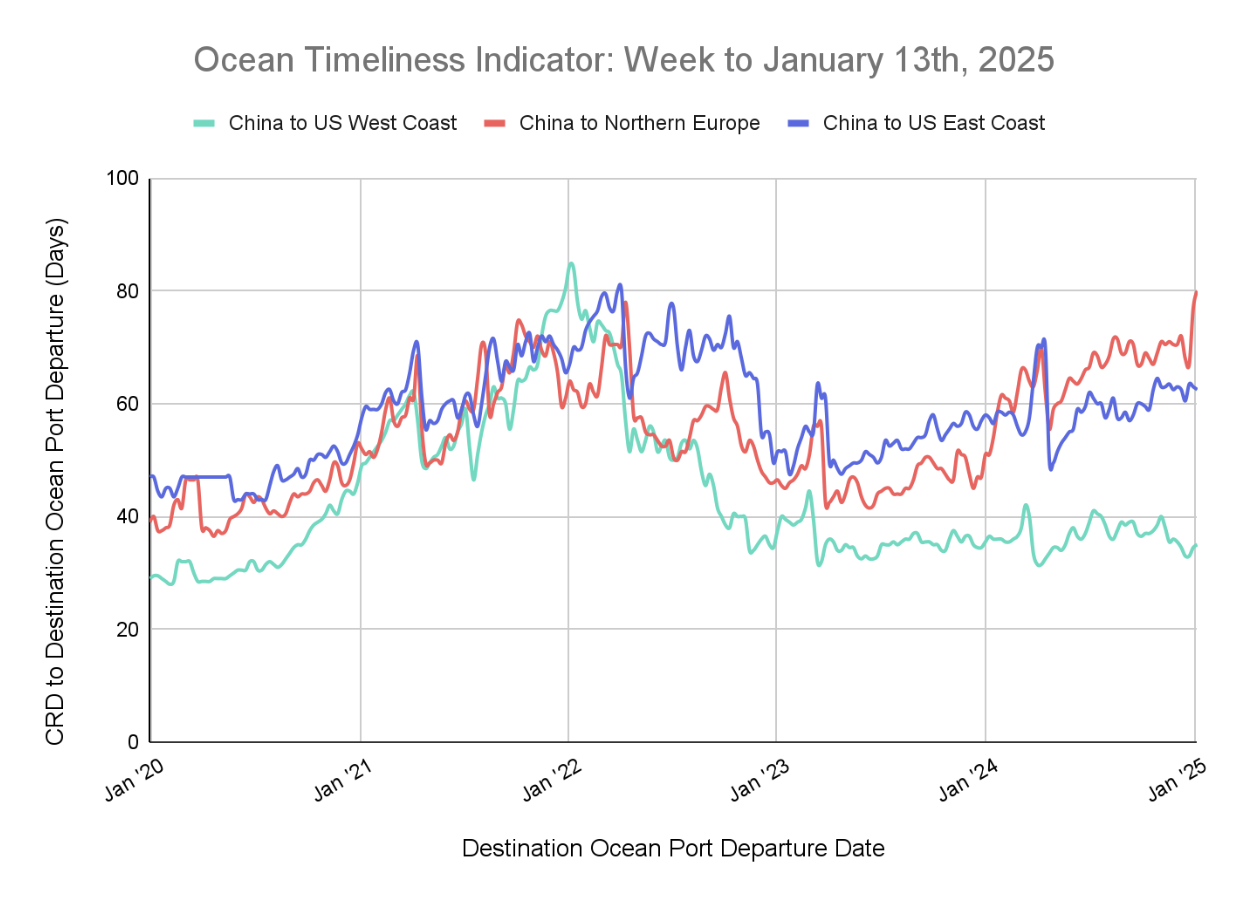

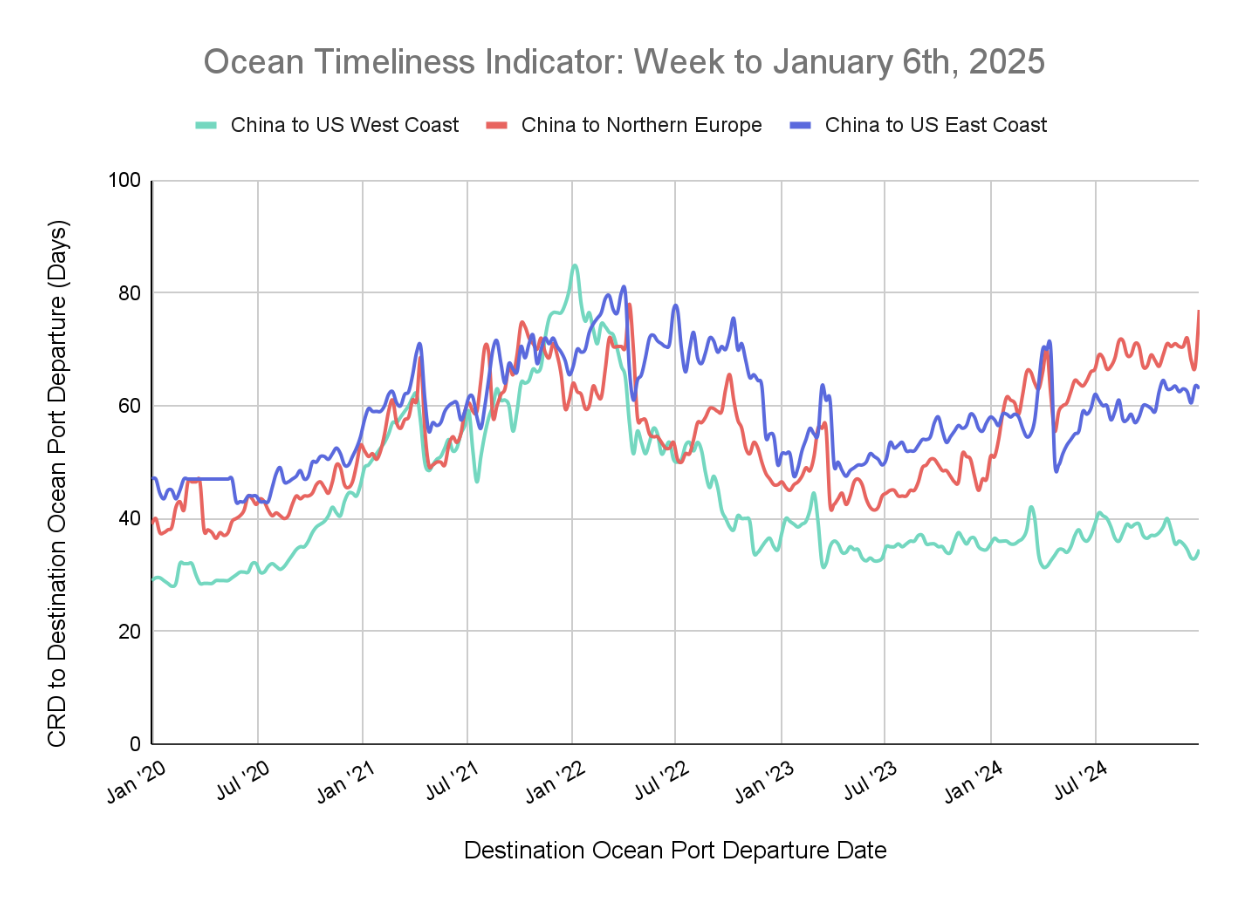

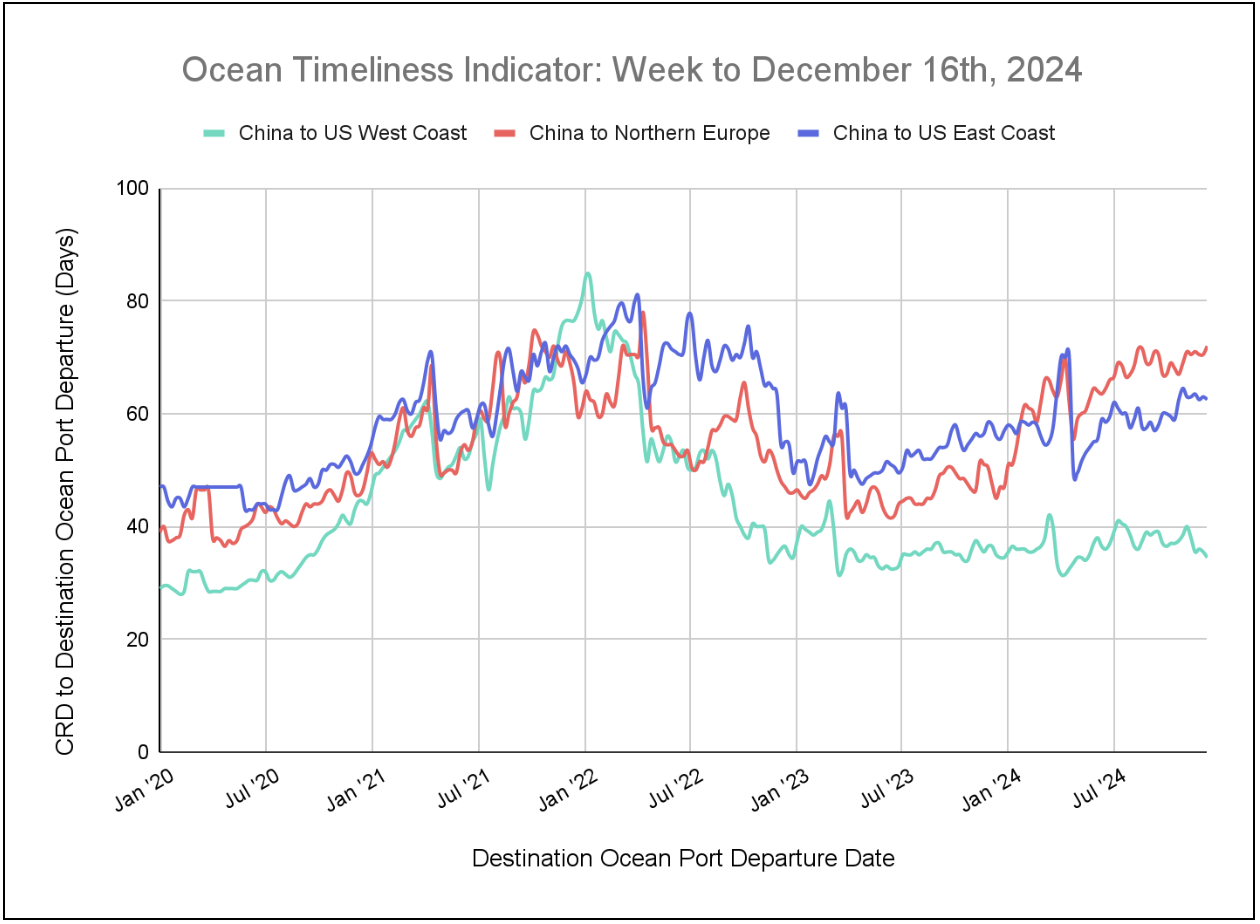

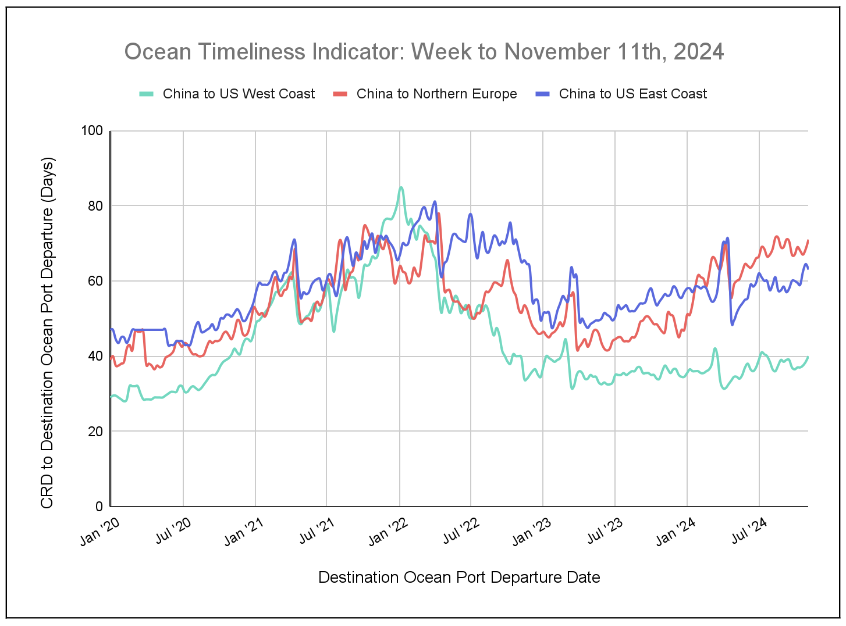

柔性海运及时性指标

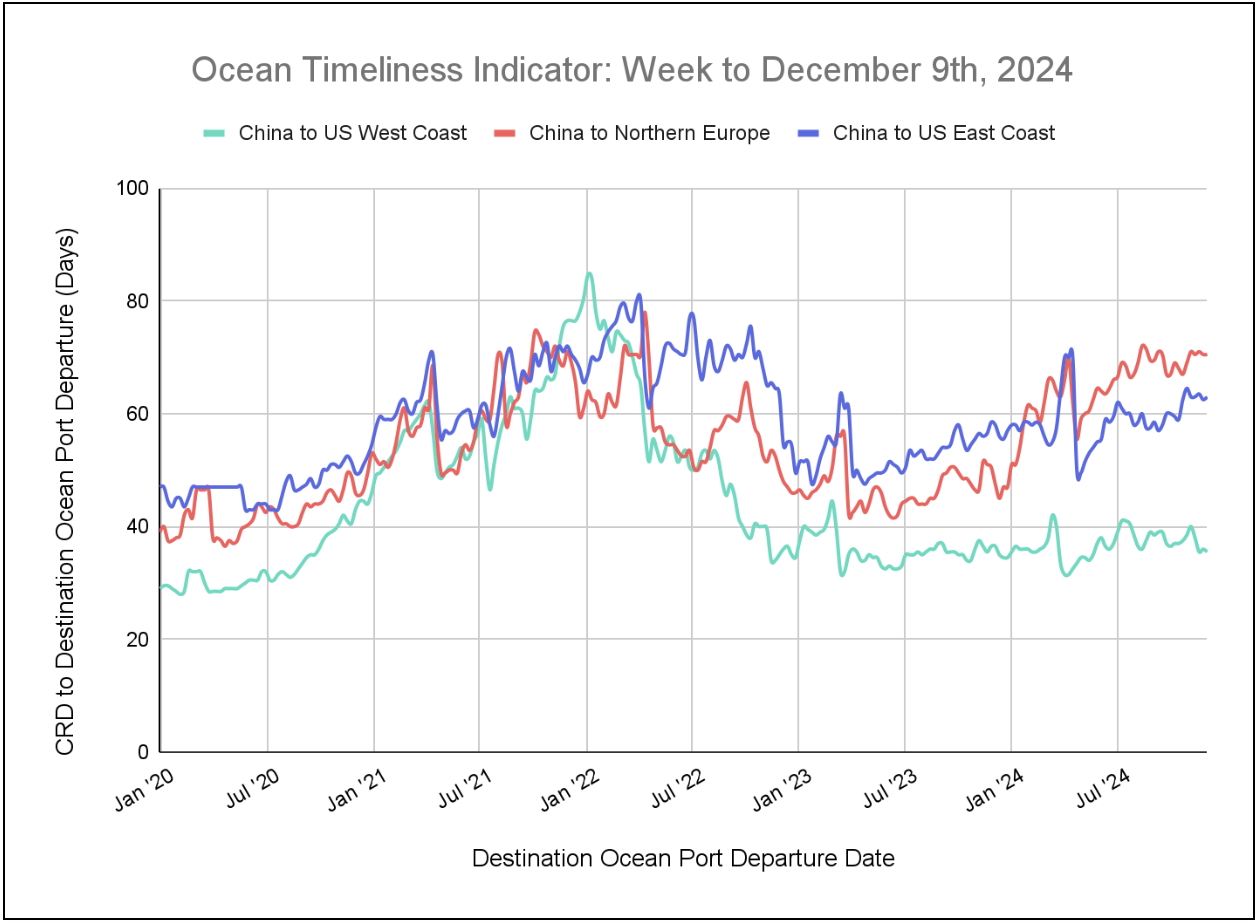

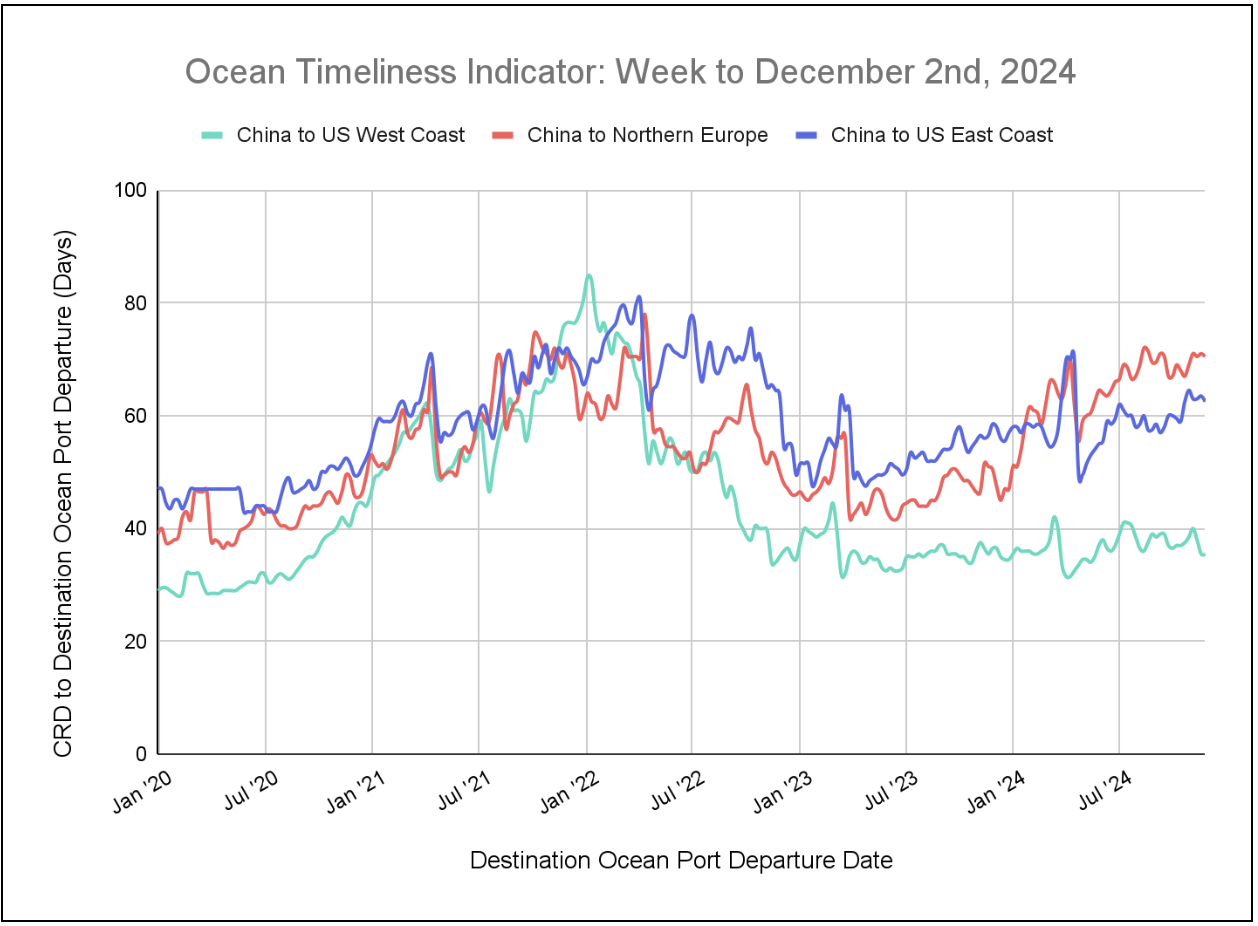

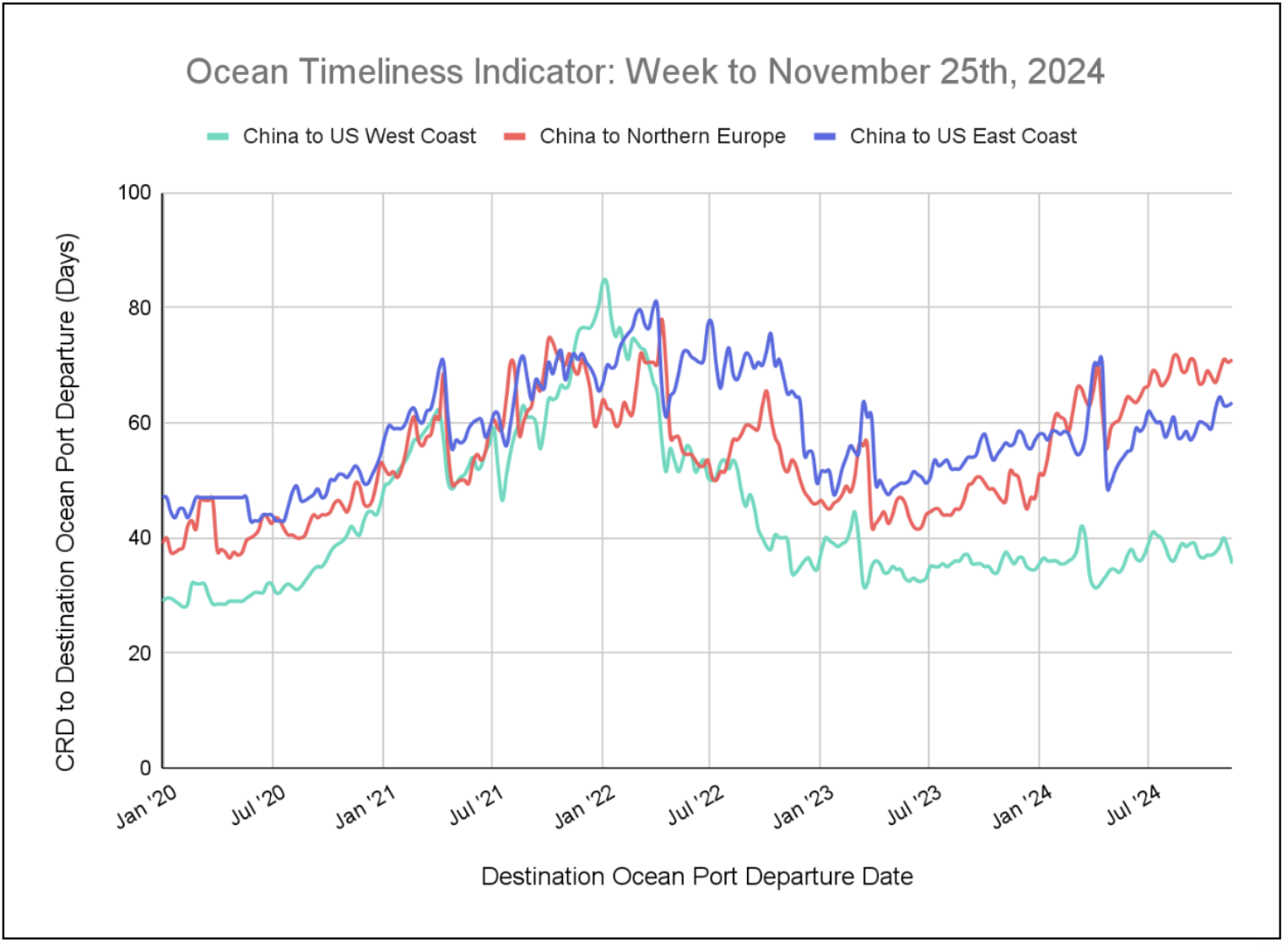

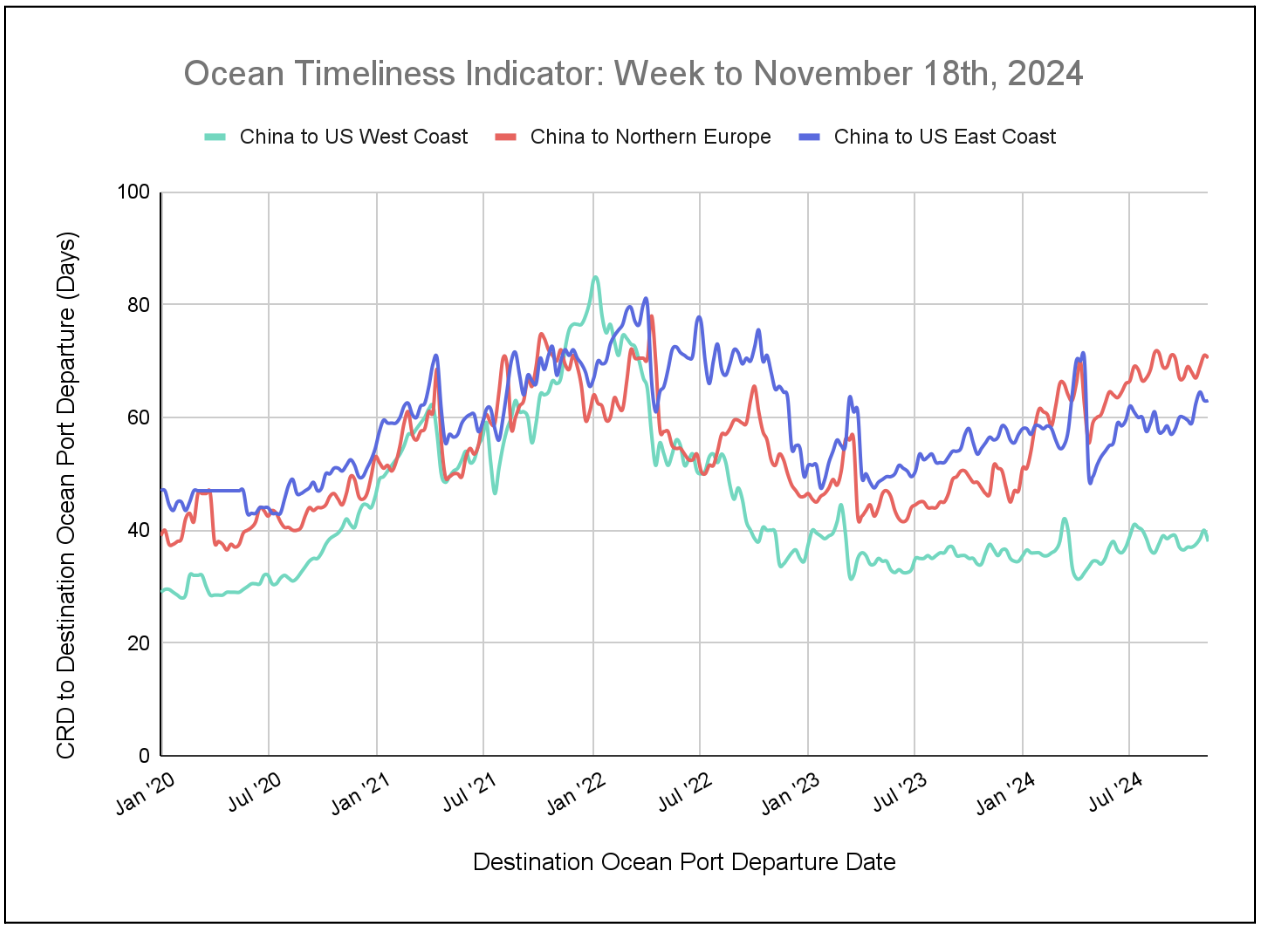

This week, the Flexport OTI showed potentially meaningful fluctuations as out-of-pattern moves emerged for both China to North Europe and China to the U.S. West Coast. Meanwhile, China to the U.S. East Coast exhibited a slight drop.

Week to December 16, 2024

This week, the Ocean Timeliness Indicator (OTI) has dropped for China to the U.S. West Coast, falling from 35.5 to 34.5 days. China to the U.S. East Coast has shown a minor drop, moving from 63 to 62.5 days. Meanwhile, China to Northern Europe jumped from 70.5 to 72 days.

来源于 Flexport.com