值得关注的趋势

关税讨论

- 距离 2025 年 4 月 2 日--美国总统唐纳德-特朗普重申新的互惠关税生效的日期--只有不到两周的时间了。

- 据美国财政部长斯科特-贝森特(Scott Bessent)称,当天,特朗普将给每个贸易伙伴一个对等的关税 "数字",这个数字代表了他们的关税、非关税贸易壁垒、货币惯例和其他因素。

- 与此同时,加拿大和墨西哥的商品将继续有资格享受微量优惠待遇,直到 "充分、迅速地处理和征收关税收入的适当制度到位 "为止。

- 关注我们的实时博客,了解最新进展。

海洋:跨太平洋东行航线 (TPEB) 最新情况

- 产能与需求:三月份的需求一直停滞不前,自春节过后就没有增长。预测需求未达预期,或未如期实现。运力:航运运力保持健康,3 月下旬至 4 月的部署率一直保持在 80% 以上。

- 设备:大多数原产地网关都有充足的设备供应,预计不会出现重大短缺。

- 运费率:浮动市场运价:本周浮动市场运价有所放缓,运价稳定在当前水平。四月总运价上调和运价稳定:承运商已宣布 4 月份的总运价上调(GRI)。取消旺季附加费:大多数承运商已取消了 3 月份剩余时间的旺季附加费 (PSS)。

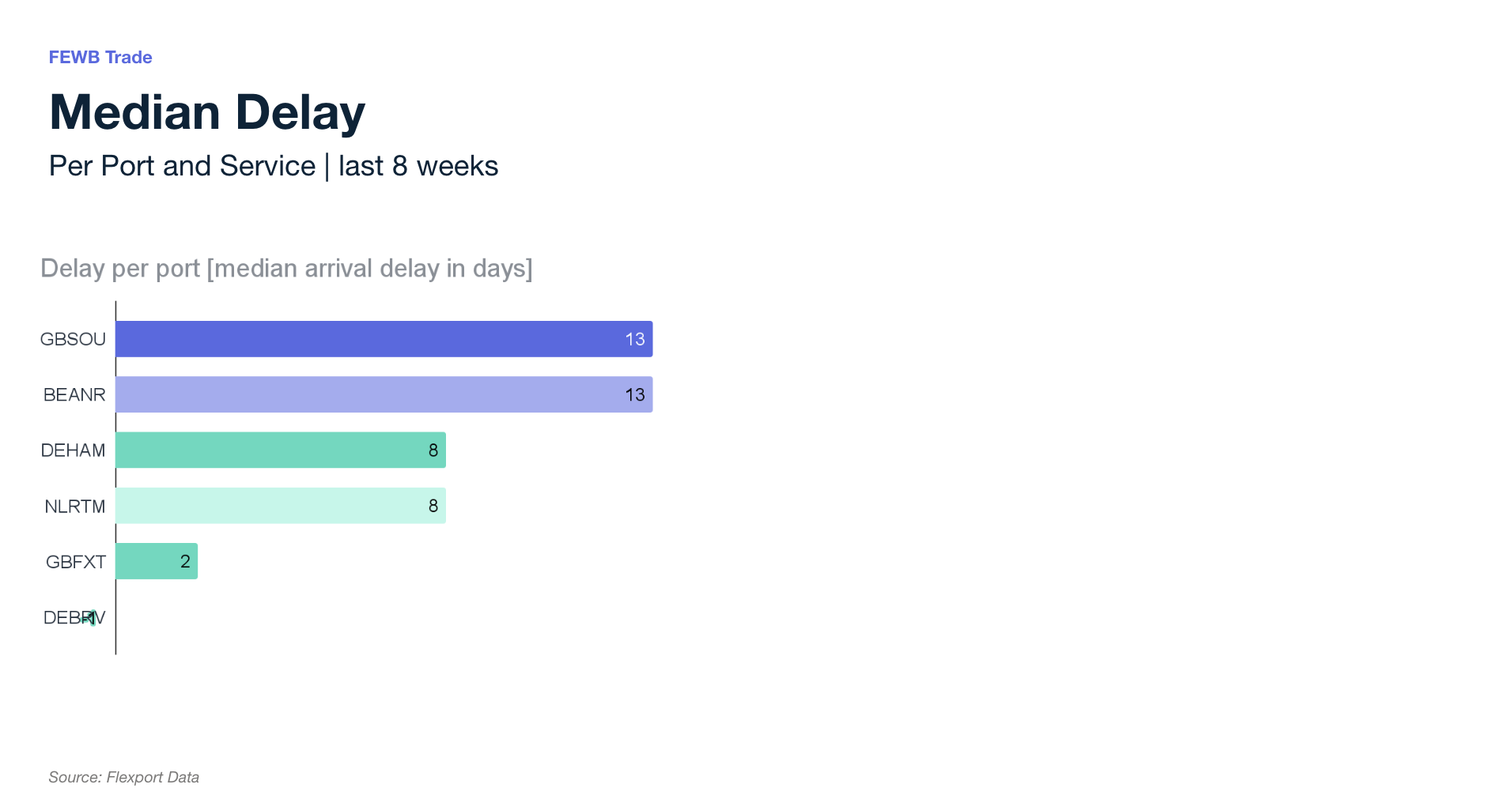

海洋:远东西行(FEWB)最新情况

- 运力和需求:3 月下半月的运力保持稳定,没有宣布 4 月份增加空白航次,但荷兰鹿特丹的持续拥堵造成了一些滚动情况。为减轻港口拥堵的影响,将在始发地管理转运安排。需求略有回升,随着抵达前服务船舶规模的缩小,市场正朝着供需更加平衡的方向发展。新的订舱空间总体上仍然可用,订舱放行流程运行顺利,但仍可能出现滚动问题。

- 设备:设备供应充足,但承运商偶尔会用 40 英尺集装箱代替 40 高立方集装箱,后者在鹿特丹卸货时受到限制。如果设备交换收据(EIR)上指定的是 40HW 集装箱,我们建议要求堆场将其换成一个空的 40 英尺或 40 高立方体集装箱,并准备好装载货物。

- 运费率:上海集装箱运价指数(SCFI)的下降是由于 3 月份 GRI 的回调导致运价稳定。目前,市场焦点已转向 4 月份的运价指数,主要承运商宣布上调运价,而其他承运商则在等待评估市场状况。4 月份 GRI 能否成功实施仍不确定,主要取决于 3 月下半月的市场交易量。Flexport 建议在可能的涨价之前转移货物,因为承运商的目标是维持定价底线。

海洋:跨大西洋西行航线 (TAWB) 最新情况

- 运力和需求:空白航班已经减少,我们预计三月份的运力将更加稳定。这些空白航次主要集中在南欧航线。比雷埃夫斯港、梅尔辛港和巴伦西亚港出现拥堵,导致航班延误。

- 设备:中欧部分地区,特别是奥地利、斯洛伐克、瑞士、匈牙利和德国南部/东部地区,设备仍然短缺。建议这些产地使用承运人运输。在南欧,港口目前尚未遇到任何设备问题。

- 运费率:大多数承运商取消了北欧 PSS 的实施,因为他们预计 4 月份的需求将与南欧持平。在地中海,一些承运商正在推动 4 月份实施 PSS,重点是西地中海。由于需求持续高涨和超额使用,每个 40 英尺集装箱的附加费在 700-1000 美元之间。

空运最新情况(2025 年 3 月 3 日至 3 月 9 日,第 10 周):

- 市场总体稳定,但同比有所增长:全球航空货运需求保持稳定,但在第 10 周同比增长了 2%。在第 9 周和第 10 周,总吨位同比增长了 4%,其中亚太地区的货运量增长了 8%,部分原因是受到农历新年时间的影响。

- 亚太地区的复苏推动了区域趋势:亚太地区计费重量环比反弹 +5%,恢复到 1 月中旬的水平。从亚太地区运往欧洲的吨位环比增长了 4%,其中中国(+5%)、香港(+6%)、日本(+7%)、台湾(+7%)、泰国(+9%)和新加坡(+9%)增长强劲。亚太地区至欧洲的现货运价环比下降-3%,但由于主要市场的强劲增长(如中国+14%、香港+22%、泰国+38%),同比仍增长+20%。

- 运价呈环比上升趋势,但短期内涨跌不一:第 9 周和第 10 周,全球平均空运费率环比增长 5%,同比增长 1%,达到每公斤 2.33 美元。在全球范围内,现货运价稳定在每公斤 2.55 美元,但环比上涨了 8%(亚太地区现货运价环比上涨了 11%)。从中国和香港到美国的现货价格保持稳定,为 3.78 美元/公斤(湿重)。

- 中东和南亚(MESA)以及迪拜的需求下降:中东和南亚(MESA)至欧洲的运价稳定在 2.42 美元/千克,但需求环比下降了-4%,这可能与斋月有关。迪拜至欧洲的货运量下降了 -15%,而前一周则下降了 -17%。因此,第 10 周的现货价格下跌了 -12%,为 1.88 美元/千克。

来源: Worldacd.com

请与您的客户代表联系,了解货运所受影响的详情。

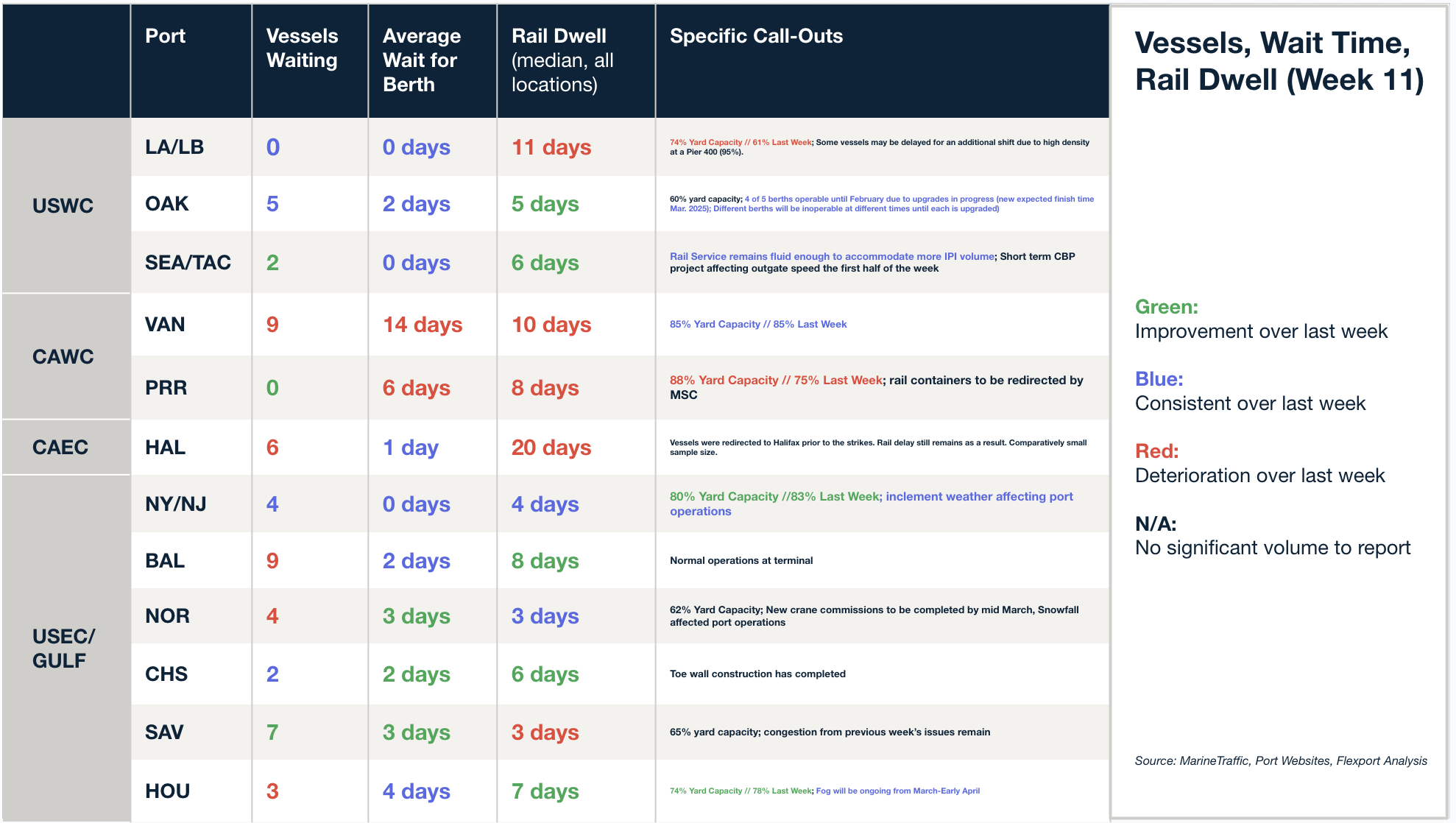

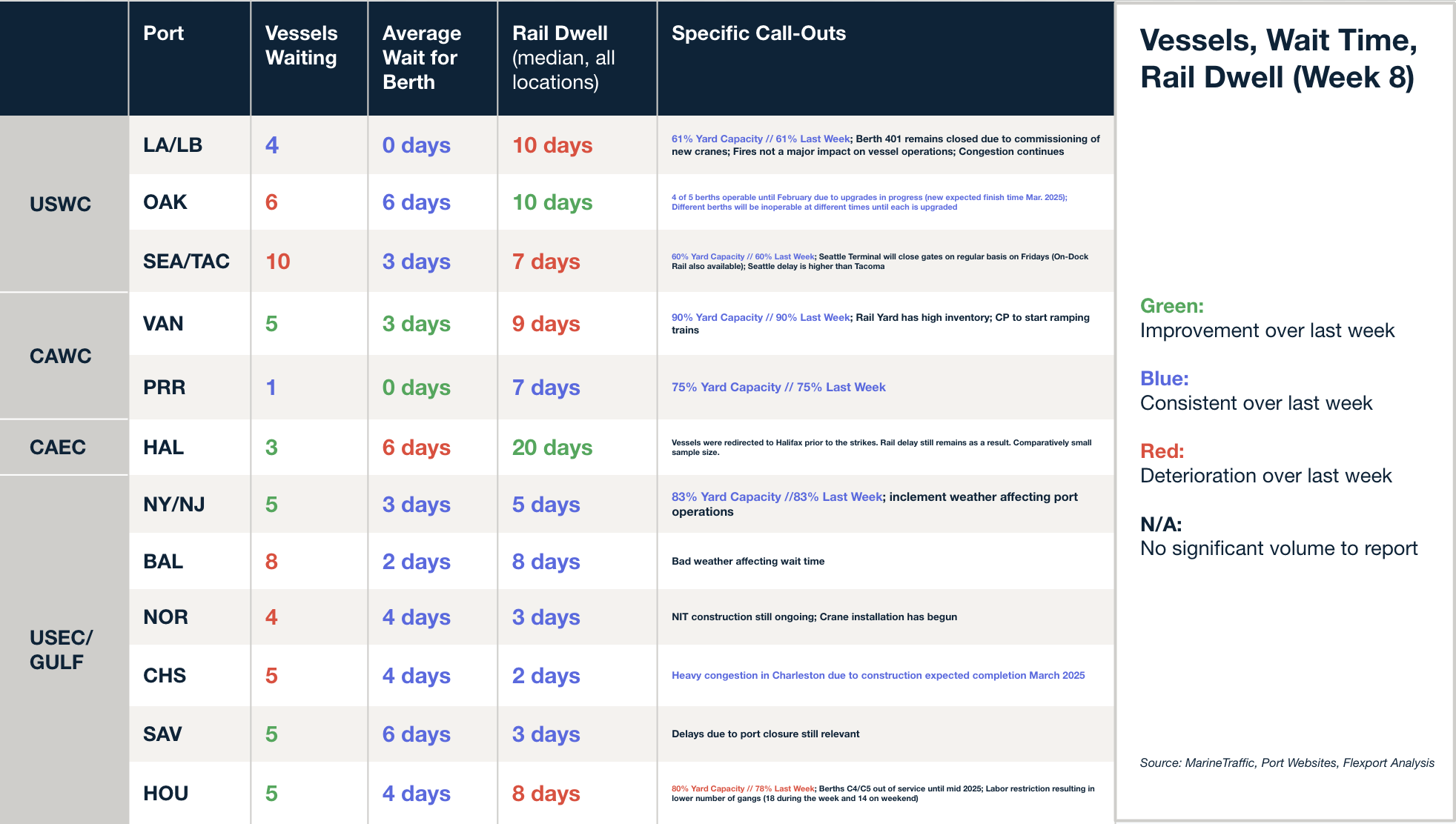

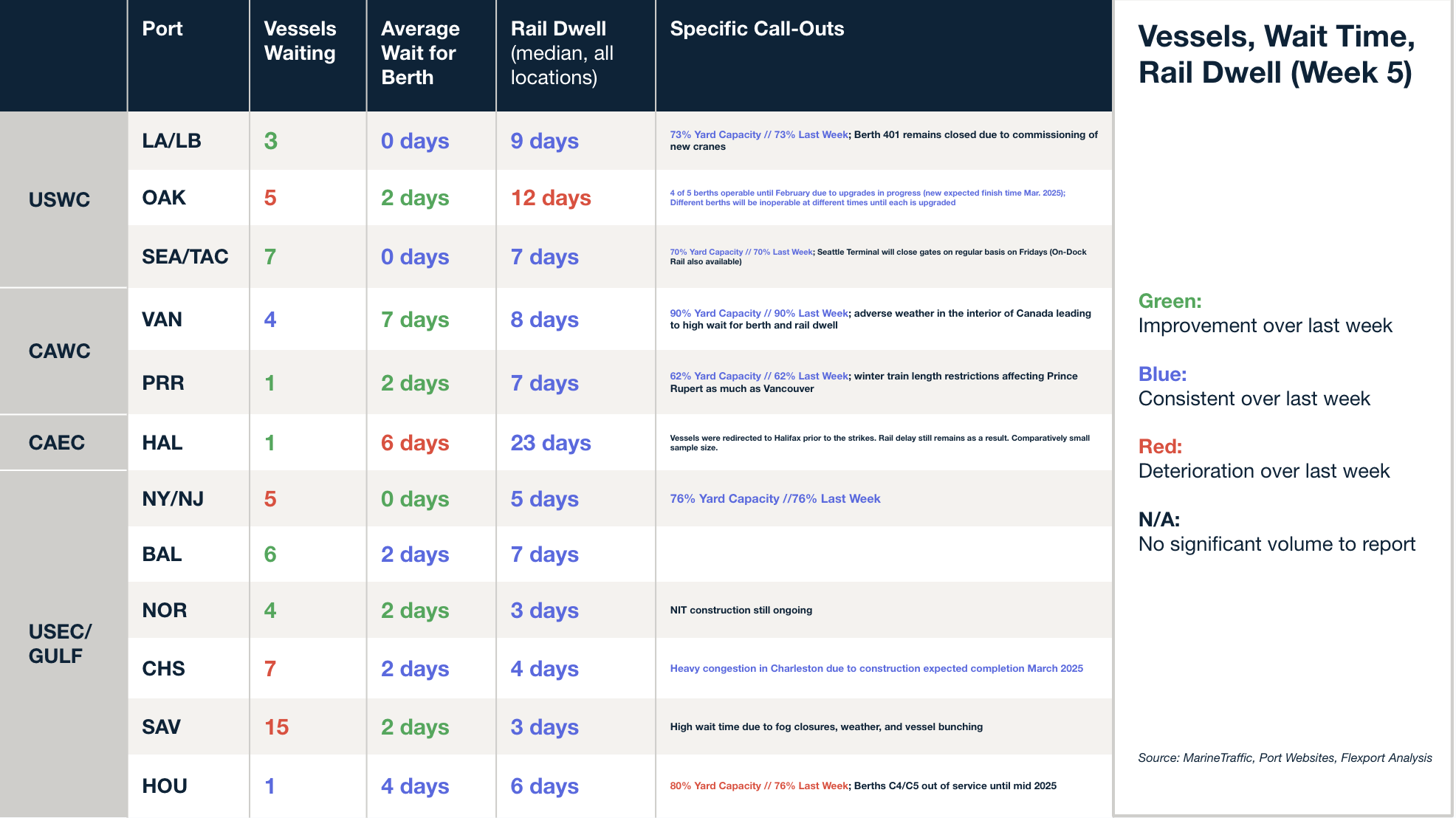

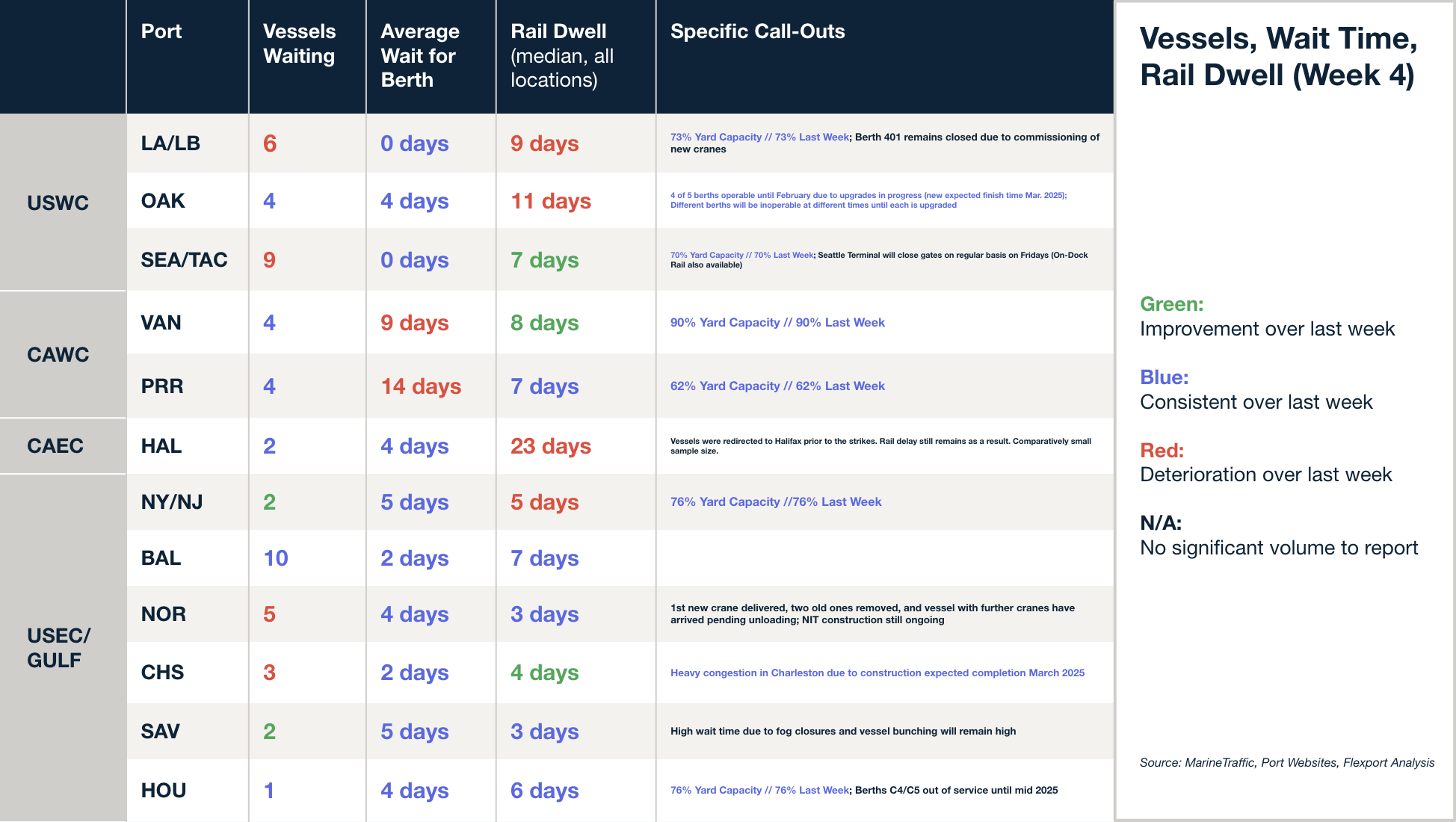

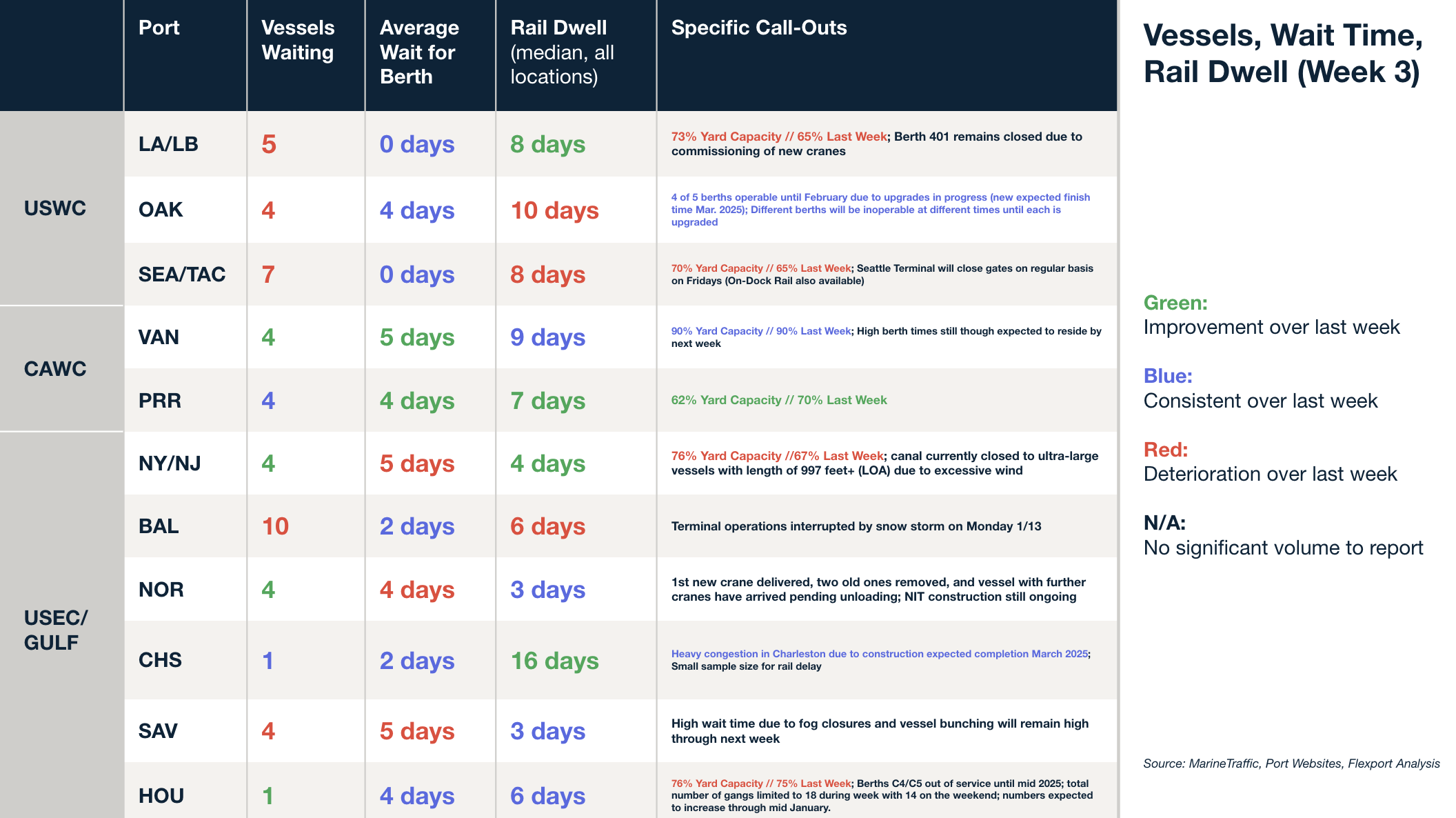

北美船舶停留时间

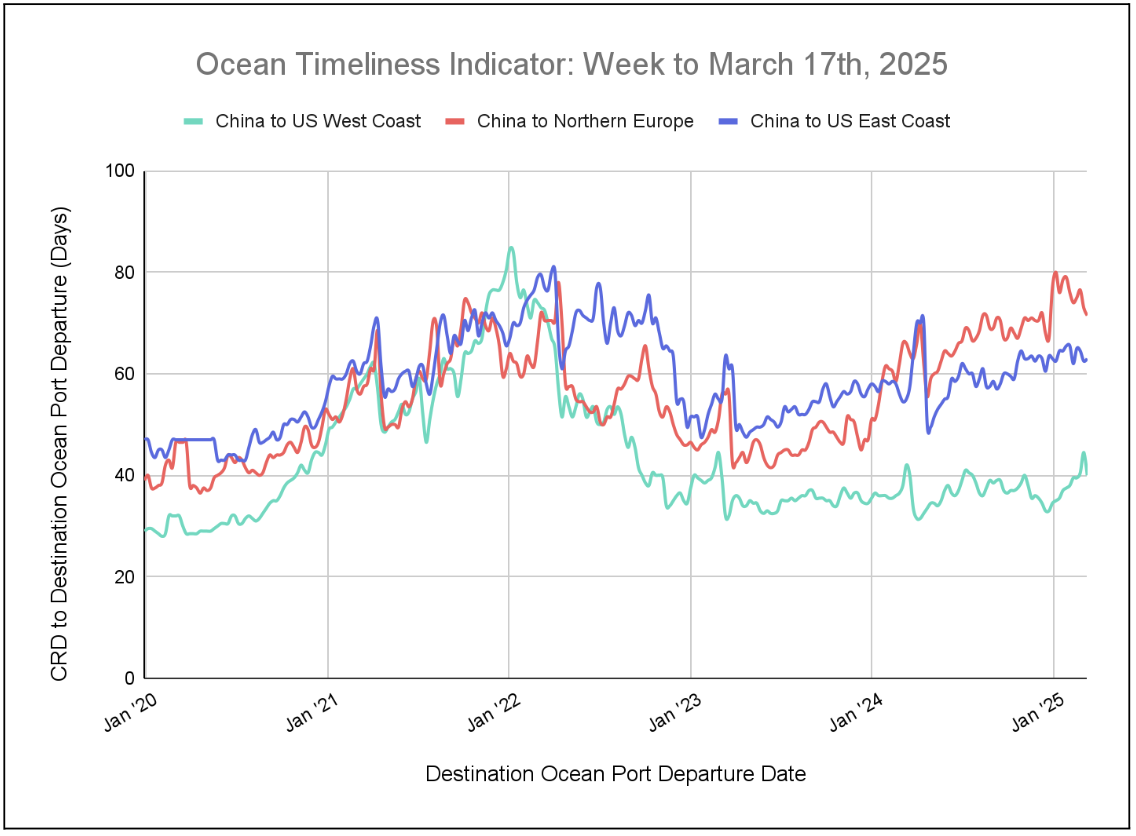

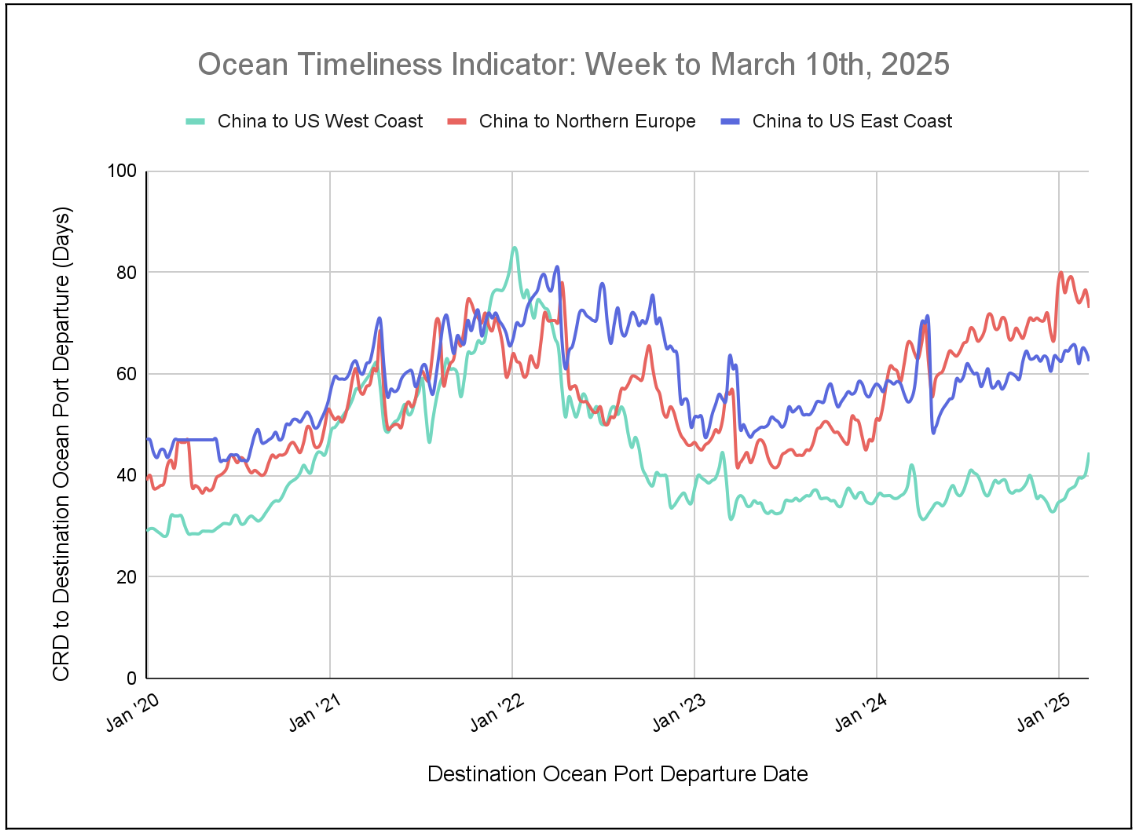

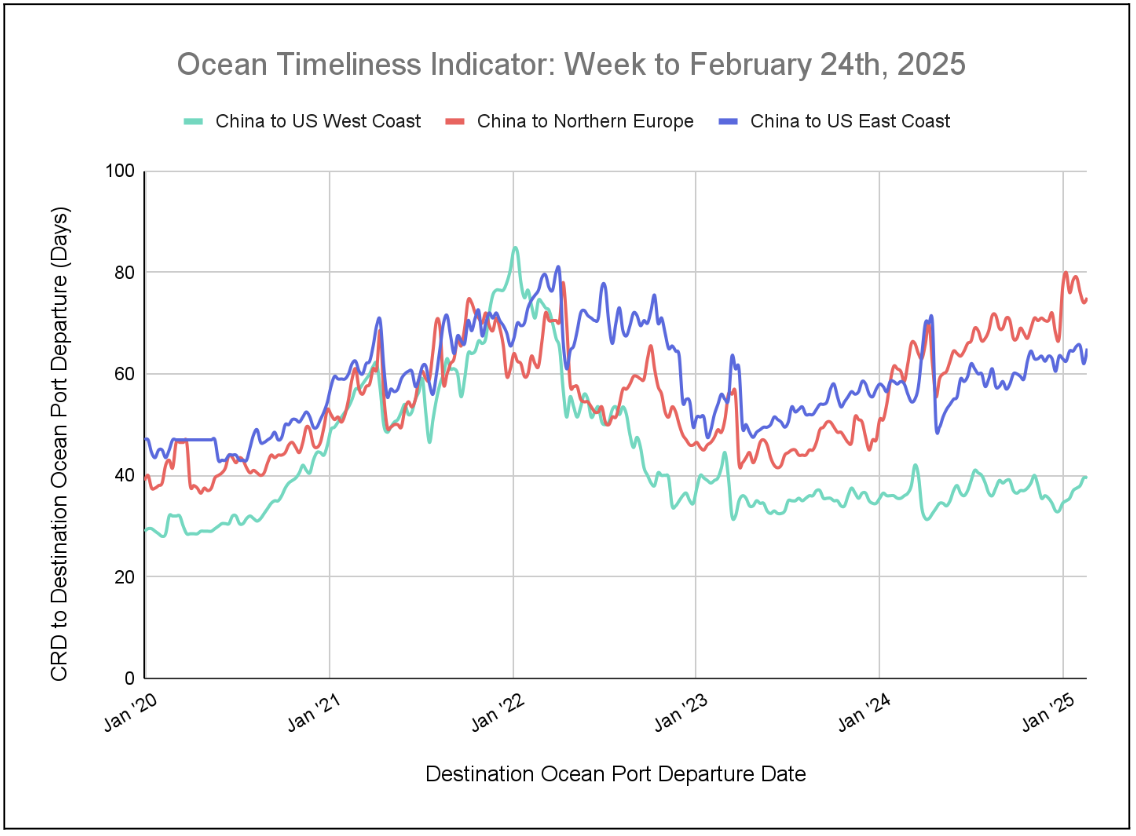

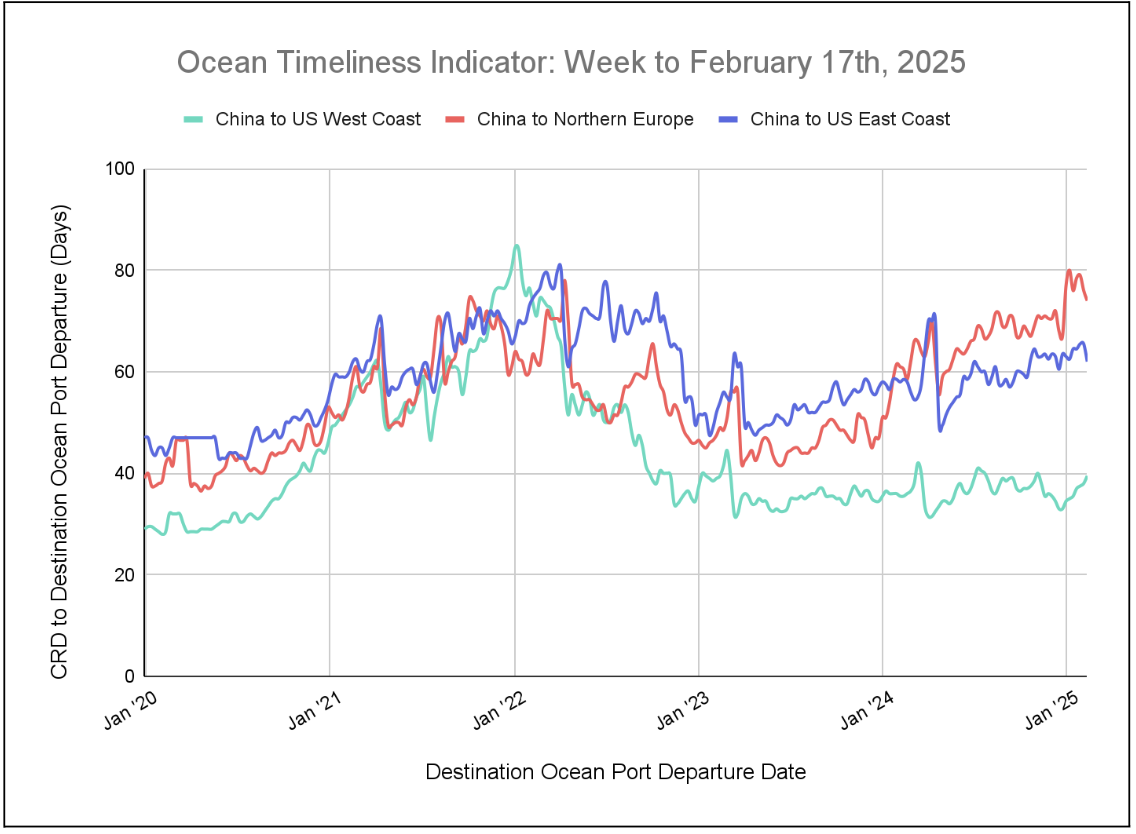

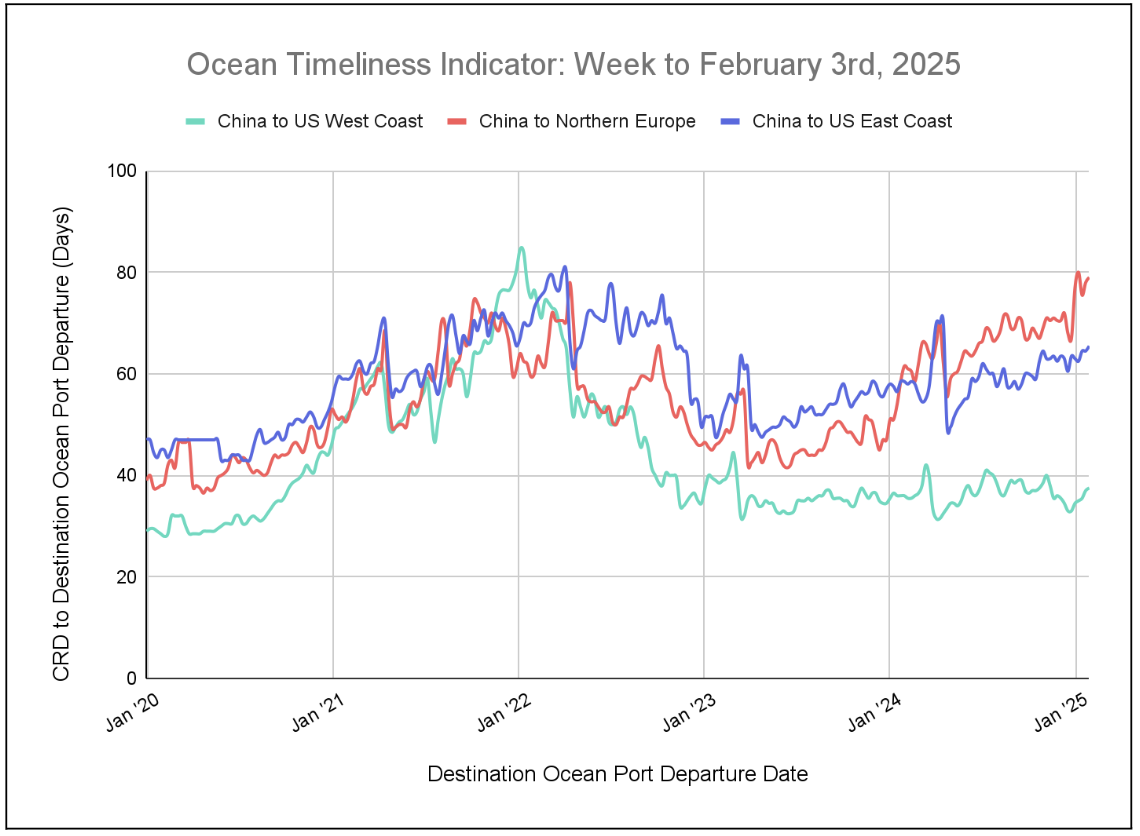

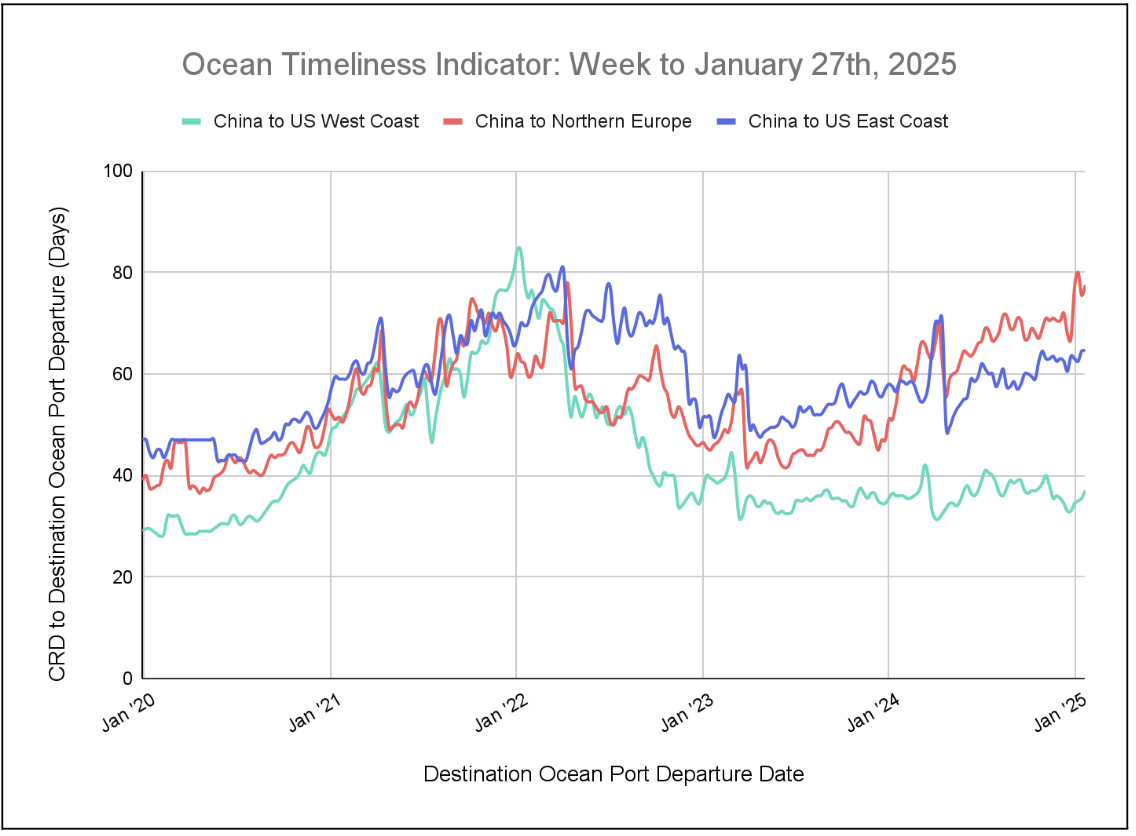

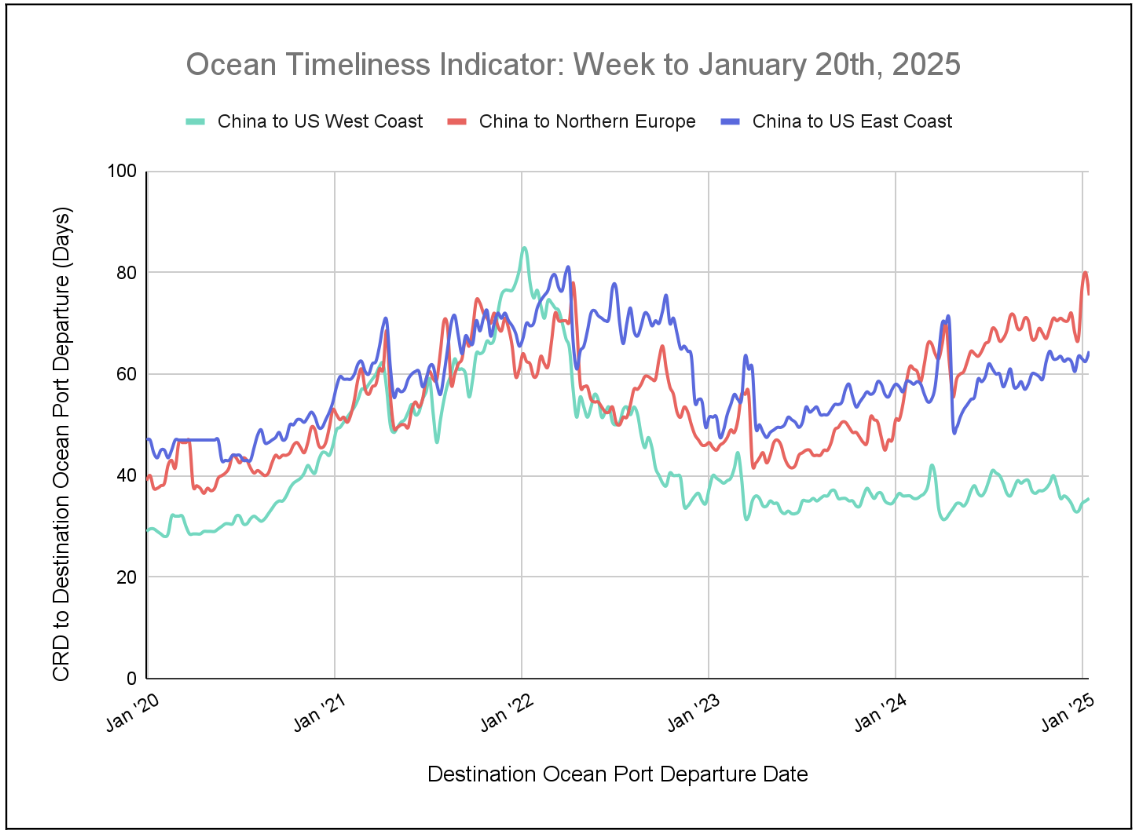

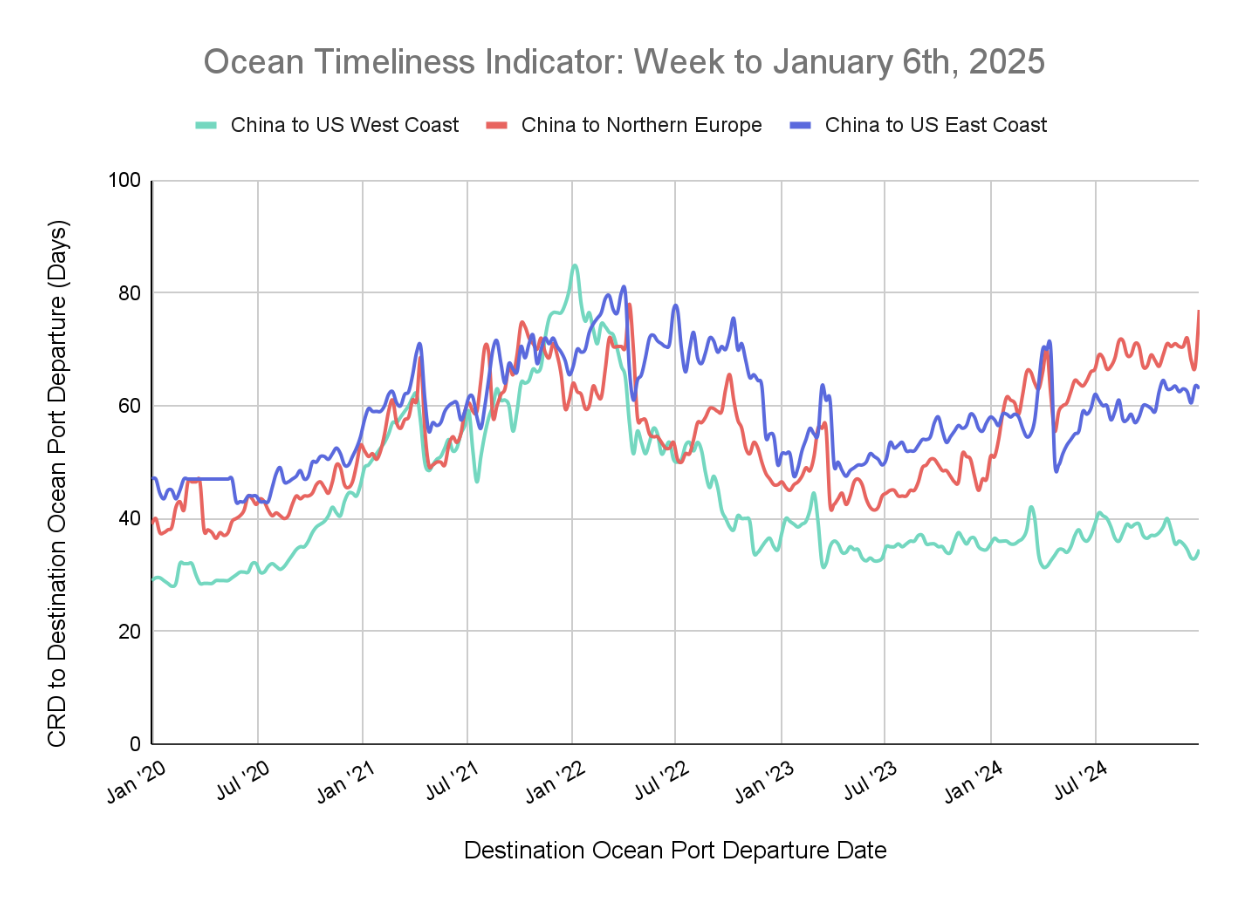

柔性海运及时性指标

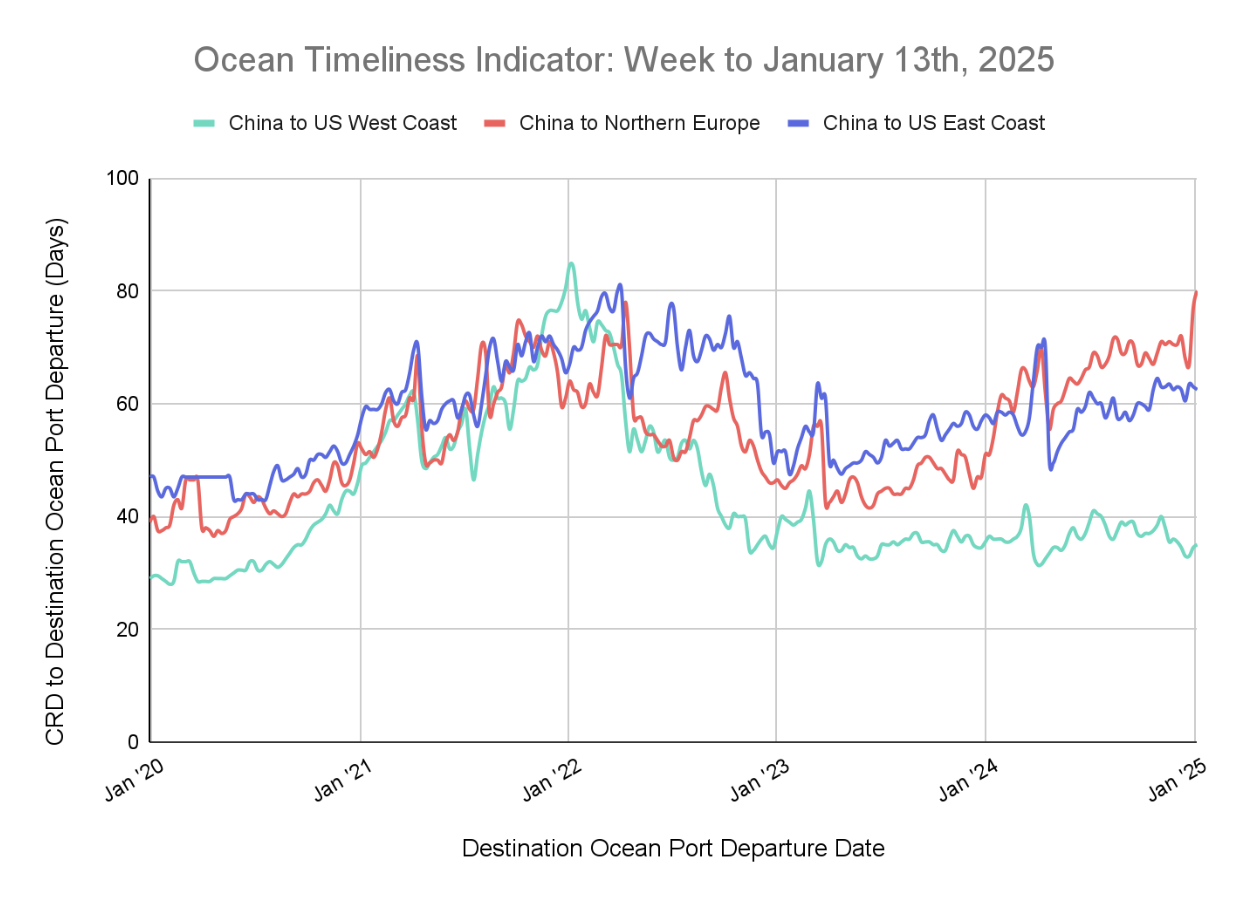

本周,中国至美国东海岸的 Flexport OTI 上升,中国至美国西海岸和中国至北欧的 Flexport OTI 下降。

至 2025 年 3 月 17 日的一周

本周,中国至美国西海岸的海洋适时指数(OTI)从44.5天降至40天。中国至北欧也出现下降,从 73 天降至 71.5 天。与此同时,中国至美国东海岸从 62.5 天增加到 63 天。