Trends To Watch

- [Ocean – FEWB] EUR trade: In the last week, the market remains flat and rates continue at the $800 level. However, the spot price is down to $700. As expected, carriers are planning another General Rate Increase (GRI) starting on November 1st in order to cover operational costs. The first round of price increases has been announced between $1700 and $1800. Due to the GRI increases, there are expected to be more void plans (canceling sailings) if cargo recovery doesn’t improve in the coming weeks; For instance, after Ocean Alliance announced 5 more void plans for November, 2M Alliance followed suit, and announced 7 sailings to be voided in November during their Winter Program. MED trade: Following North European markets, a GRI has been announced for WMED pushing back up to $2000 levels. However, they are still seeing oversupply. Ocean Alliance has announced 6 more MED void plans to support the GRI in November, and there is an expectation that 2M & THE Alliance may follow.

- [Ocean – TAEB] As capacity is starting to decrease, carriers are planning their first-rate restorations. We have seen announcements for rates to increase as soon as November 15th, 2023. Overall the on-time performance (OTP) is getting better and back to pre-pandemic levels around 70-75% of the time.

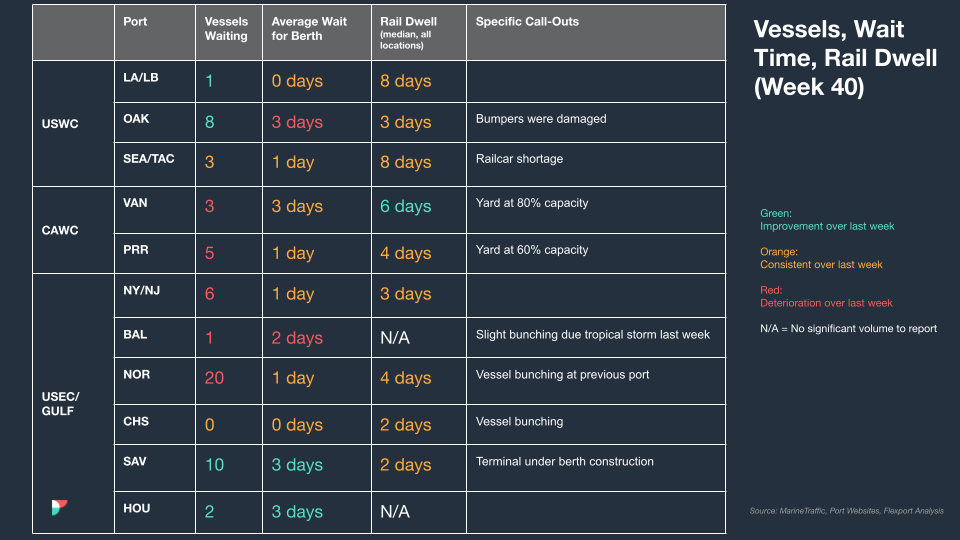

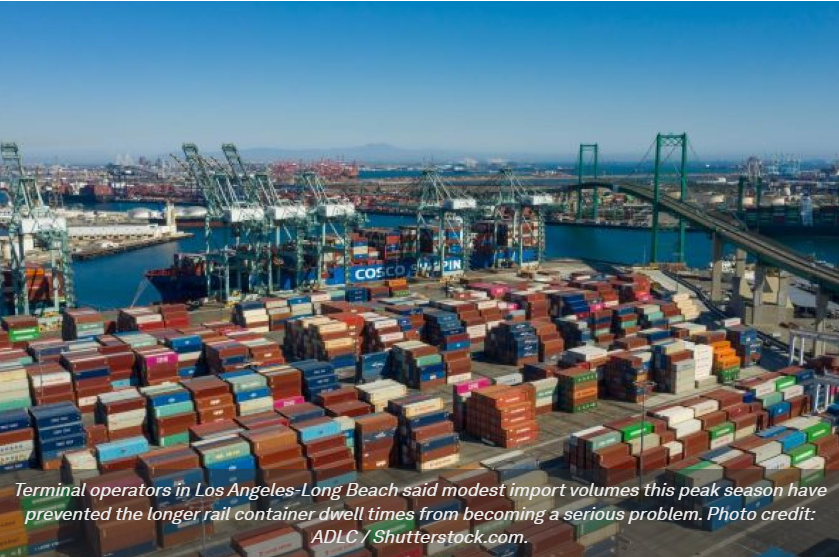

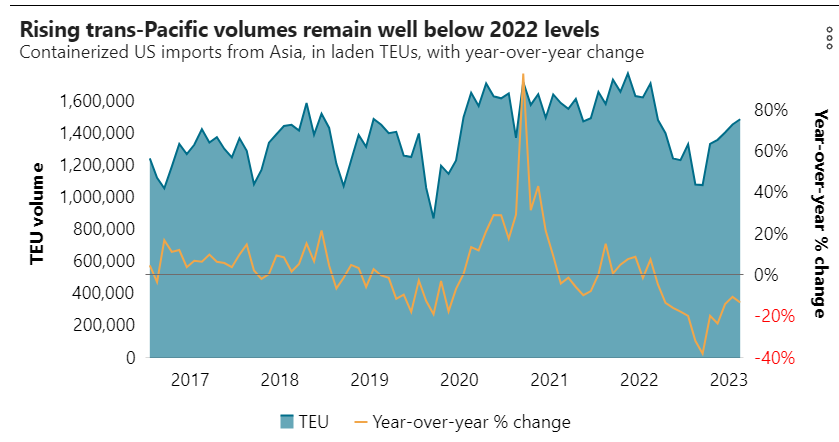

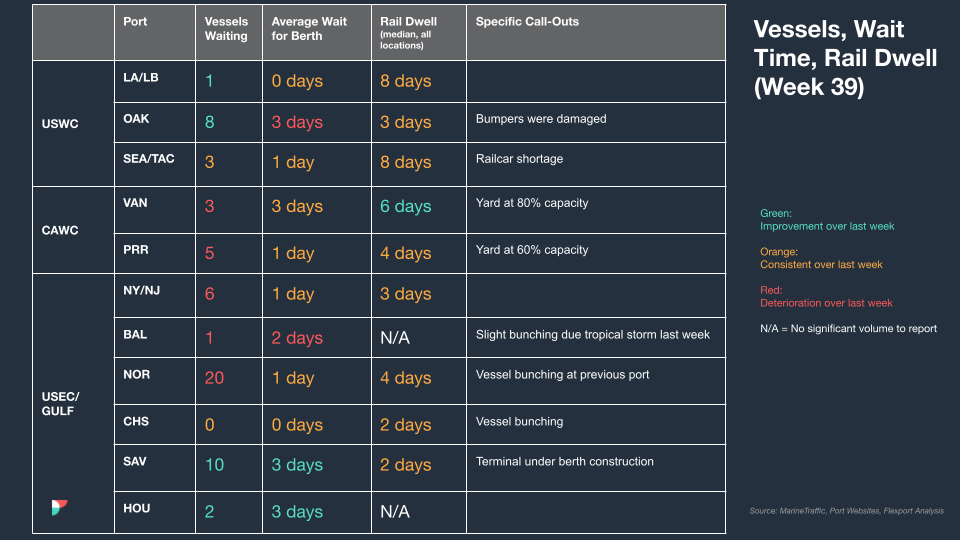

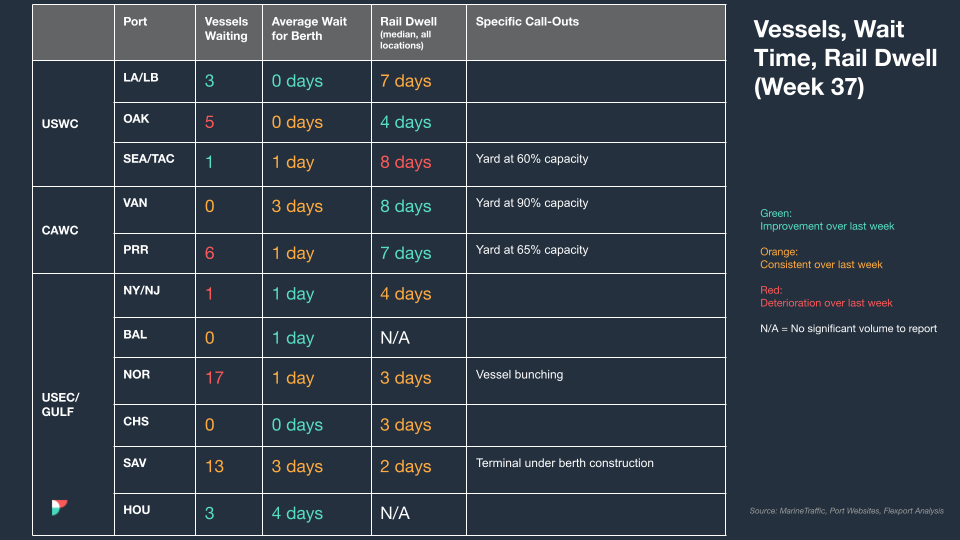

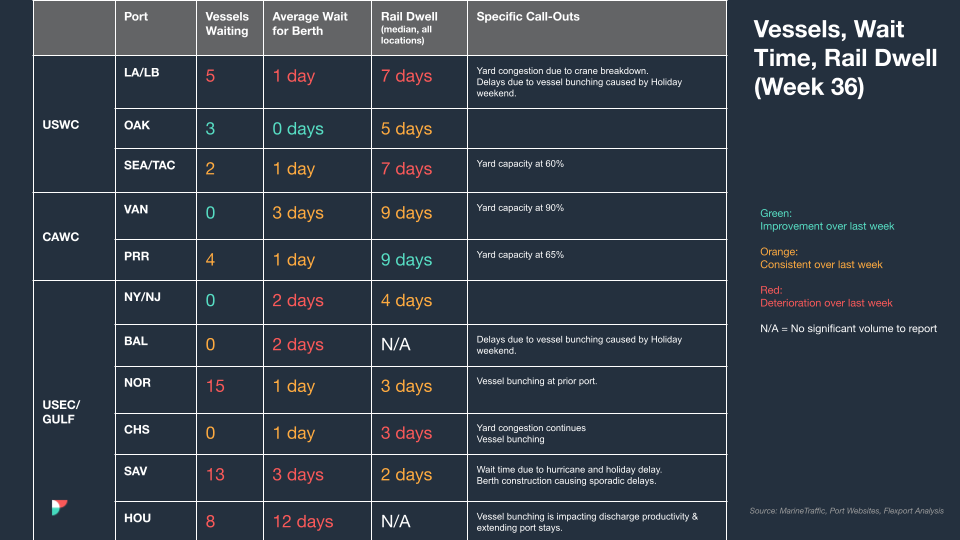

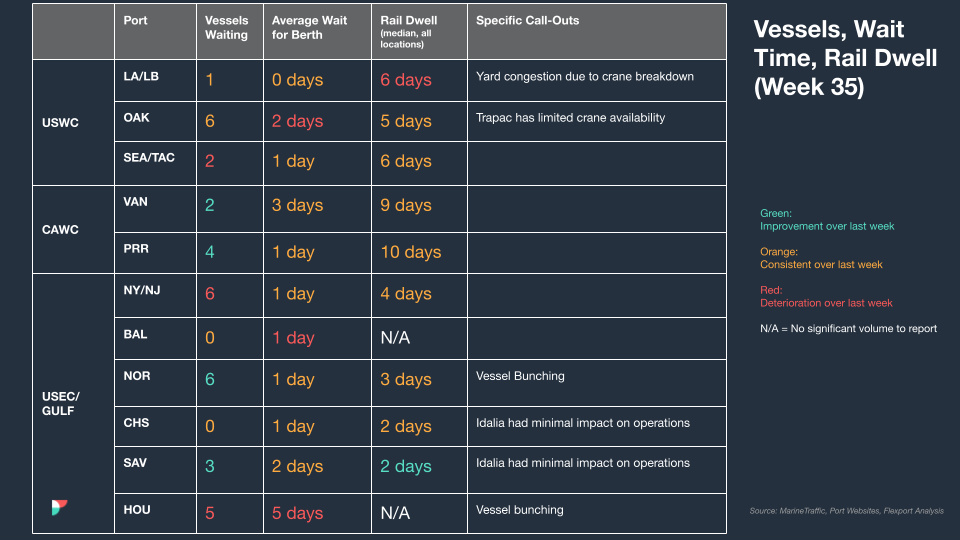

- [Ocean – TPEB] October capacity has decreased as expected, however it is not as big a drop as was seen during CNY earlier this year. November’s outlook, on the otherhand, is still very healthy, but that has the possibility of changing. Demand ex-China has started to come online this week, bookings over the next 1-2 weeks will determine capacity for November. PN3 was discontinued from THE Alliance services for the foreseeable future. Expect healthy blanks, but overall capacity to be comparable to Q2/Q3.

- [Air – Global] In September, global air cargo tonnage and rates increased compared to August. According to WorldACD Market Data, global air cargo had a rise of nearly +3% in tonnages and a +5% increase in rates. However, in week 39 (September 25 to October 1), there was a slight -1% drop in tonnages and a +2% increase in regional rates, the most notable increases were observed between the Americas, Europe, and Asia. Overall cargo capacity increased by 10% compared to the same period last year. Rates are now at $2.37 per kilo, which is 31% lower than last year but 38% higher than pre-COVID rates in September 2019.

- [US Exports] TAEB: Transatlantic Eastbound (TAEB) capacity is decreasing due to canceled sailings and capacity cuts to transatlantic services. TPWB: Capacity is available from US Coastal Base Ports to China Base Ports and South East Asia’s Port of Delivery, but subject to continued canceled sailings. Inland Rail Ramps are reporting lower Excepted Quantity (EQ) levels due to reduced imports into the Midwest. If you’re booking a US export from a Rail Ramp, it’s advisable to book at least two weeks before the Cargo Receipt Date (CRD) to ensure EQ availability.

Source from Flexport.com