值得关注的趋势

[Ports – Canada]

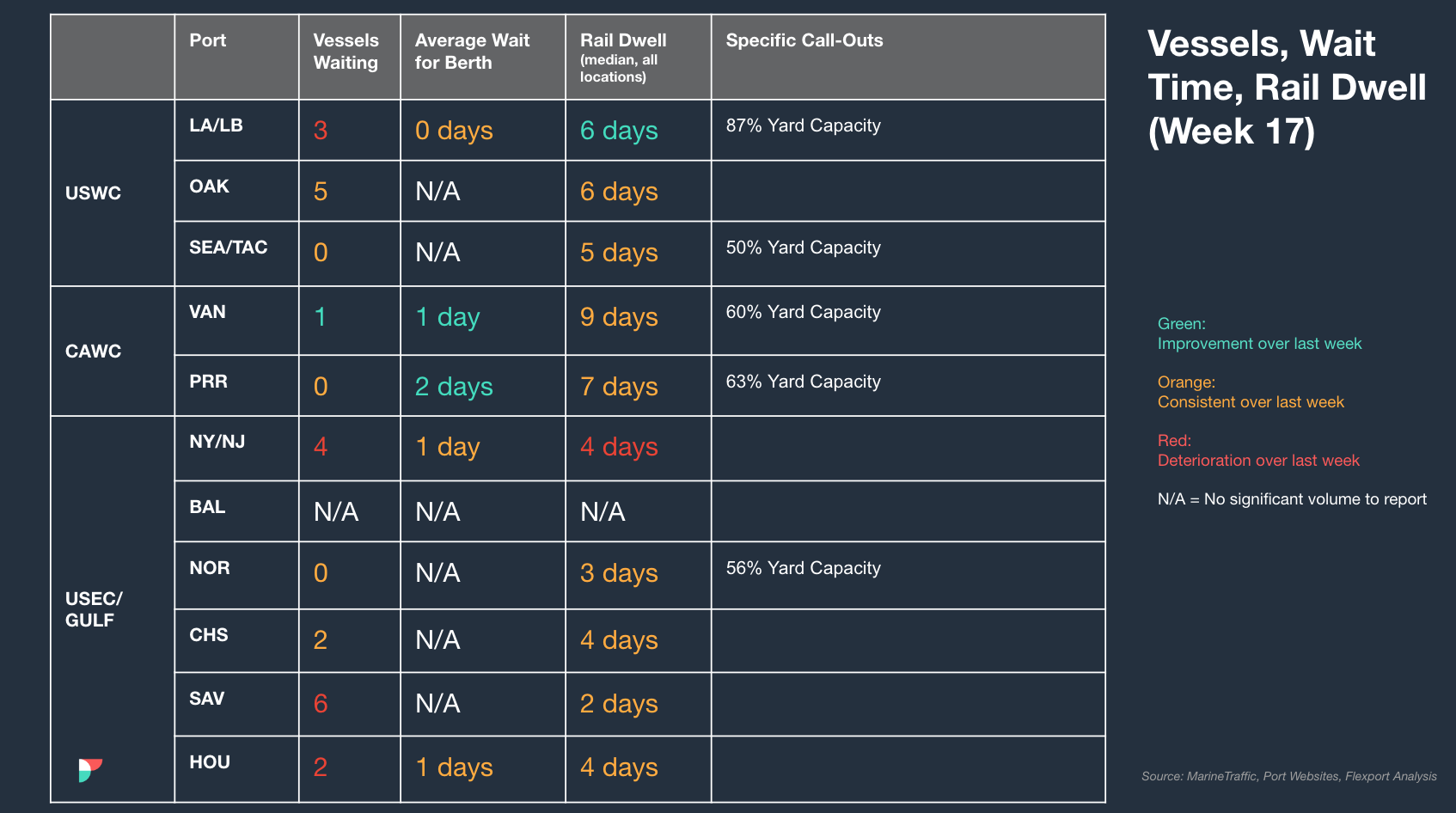

- Congestion and backlog at the Port of Vancouver is causing around seven days average dwell time. Similarly, the Port of Prince Rupert is experiencing four to five days of average dwell time.

[Ocean – TPEB]

- The ports in Shanghai, Ningbo and Busan experienced closures last week due to dense fog in the region. The closures have led to heavy berth congestion and delays.

- Carriers have announced a May 1 GRI (General Rate Increase). This will increase the rate spread between Fixed and Floating, and could push more fixed volume upcoming in May.

- Space is getting tight and we expect to see more cargo being rolled, especially for the Pacific Southwest gateway, and some tightness for the East Coast and Pacific Northwest.

[Ocean - FEWB]

- GRIs announced on FEWB (Far East Westbound) are expected to stick due to reported high utilization from carriers. The high utilization is a result of three key factors: 1. Slight increase in demand due to the May Labor holiday in China and more importantly 2. Significantly reduced capacity due to blank sailing throughout May following the impact of the Red Sea situation and 3. Increased congestion in ports and equipment challenges from certain carriers.

[Ocean – FCL U.S. Exports]

- When booking to load at an inland rail point, shippers are encouraged to submit bookings 3-4 weeks in advance of CRD (cargo ready date).

[Air – Global] (Data Source: WorldACD/Accenture)

- Stability in Global Air Cargo Rates: Average global air cargo rates remained flat at US$2.52 per kilo in the second week of April, maintaining the level from the same week in 2023, which marked the first time since mid-2022 that rates stabilized at the previous year’s level. This follows six consecutive weeks of rate increases ranging from +2% to +3%.

- Impact of Eid on Tonnages: Tonnages declined by 3% globally in week 15 (April 8-14) with significant drops observed in predominantly Muslim countries such as Pakistan, Bangladesh, and the UAE due to the Eid holiday. Notably, export tonnages from these regions to worldwide destinations experienced steep week-on-week falls.

- High Spot Rates from MESA to Europe: Despite the overall drop in tonnages, spot rates from the Middle East & South Asia (MESA) to Europe remained exceptionally high. Rates from India and Bangladesh to Europe were significantly above the previous year’s levels, indicating a robust demand relative to supply.

- Regional Variations in Rates and Tonnages: While global tonnages decreased, certain intercontinental routes like Asia Pacific to Europe and Europe to Africa saw an increase in rates, despite a drop in demand. This suggests a complex interplay of regional supply and demand dynamics affecting prices.

请与您的客户代表联系,了解货运所受影响的详情。

北美地区船舶停留时间

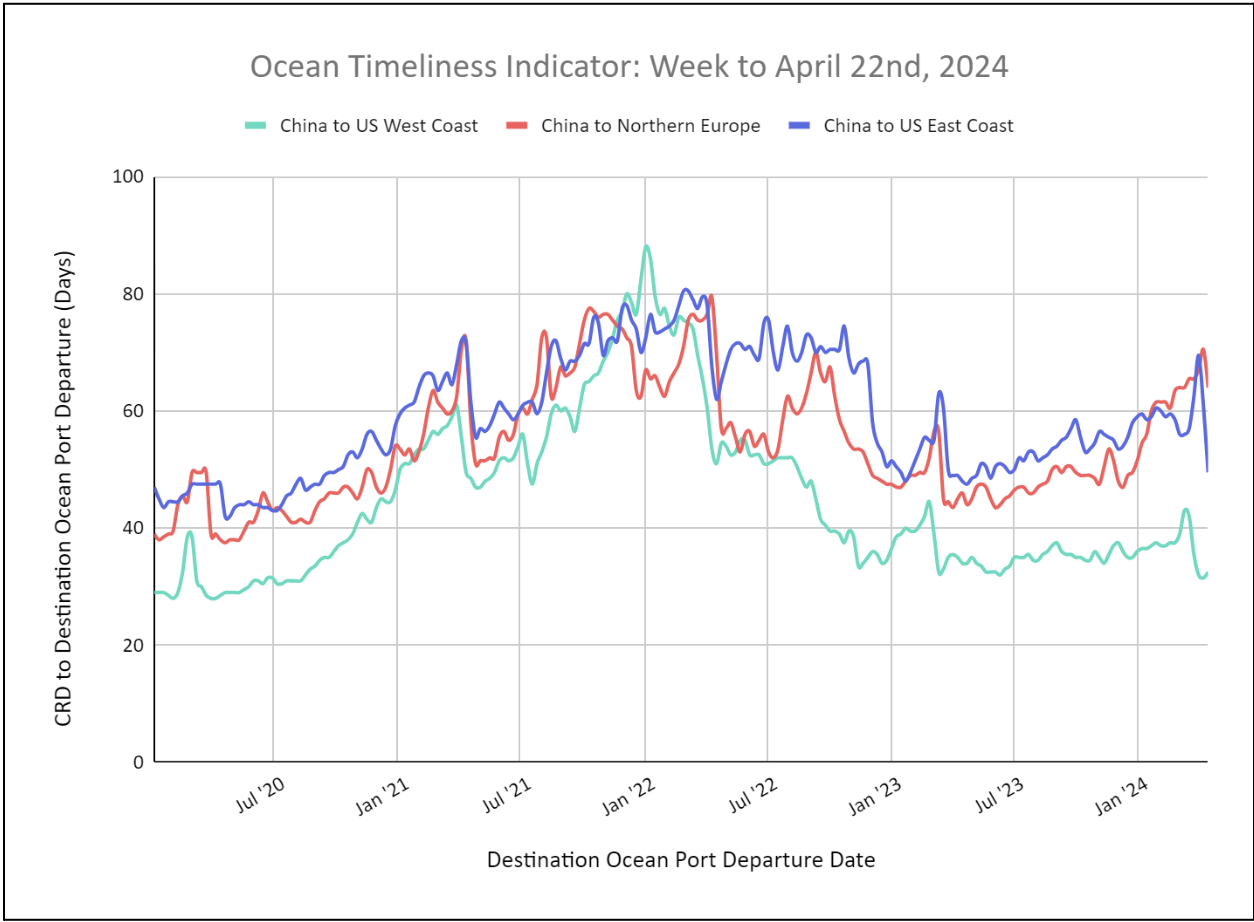

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators Decrease Across Major Trade Lanes

Week to April 22, 2024

This week, the OTI for China to Northern Europe decreased to 64 days, after weeks of increasing transit time. The OTI for China to the U.S. East Coast also decreased significantly to 50 days, the lowest in 2024. The OTI for China to the U.S. West Coast remained steady at 32 days.

来源于Flexport.com