泛太平洋集装箱航运公司正试图通过 4 月 15 日的普遍运价上调(GRI)来推高低迷的即期运价,这引发了美国进口商为避免运价上涨而进行的货物运输高峰,并促使他们签订年度服务合同。

承运商能否成功获得 GRI(每 FEU 600 美元至 1,200 美元不等),取决于所谓的需求绿芽是否健康,以及增加运力空白的效果。一般费率的增长值得关注,但最近船舶利用率的上升提高了承运商的希望,由于本月承运商取消了近 50 个航次,预计航运模式将有所恢复,承运商将能在本轮费率增长中获得一些牵引力。

根据客户通知,地中海航运公司、达飞轮船公司和 HMM 已分别就一个标准 40 英尺集装箱提交了自 4 月 15 日起生效的 600 美元 GRI 的通知。对于内陆铁路运输,地中海航运公司和达飞轮船公司都在 GRI 的基础上加收 200 美元。小型承运商 Wan Hai Lines 和 ZIM Integrated Shipping 已分别提交了 1000 美元和 1200 美元 GRI 的通知,也在同一天生效。

海运分析公司 Linerlytica 的数据显示,最近几周,亚洲至美国西海岸航线的利用率已升至 85% 以上,超过了两年前 4 月 15 日全球航运指数发布前的类似峰值,但仍低于 2022 年同期的 80% 高位。

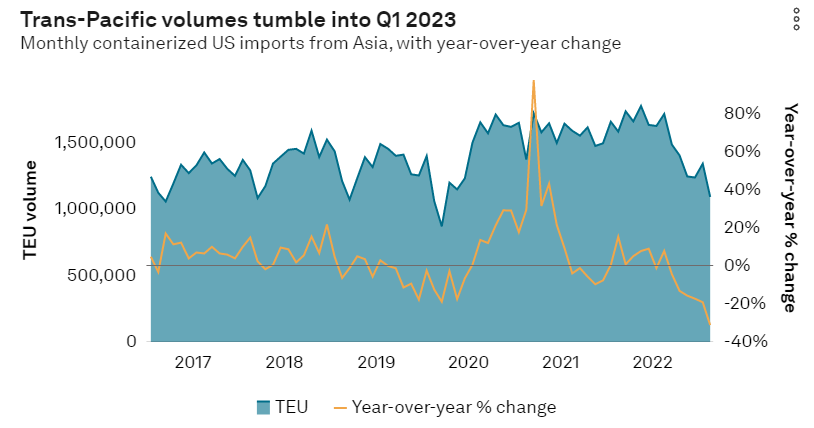

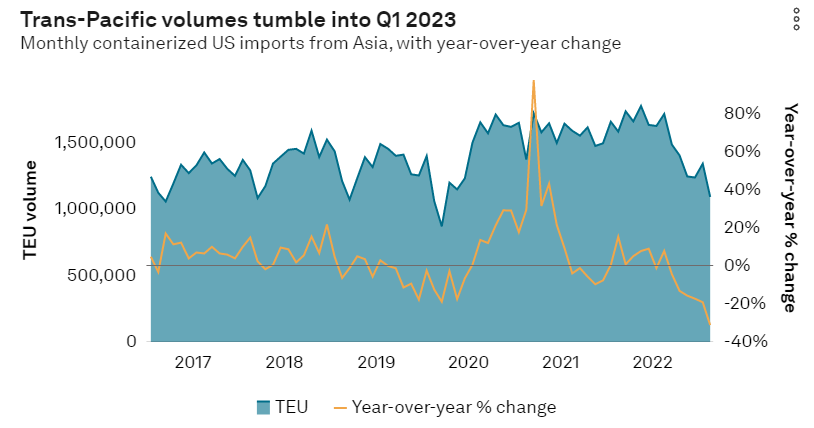

4 月 15 日全球货运报告公布前的利用率峰值在 2022 年和 2021 年的随后几周有所下降。根据标普全球旗下《商报》的姊妹公司PIERS的数据,2月份亚洲进口需求同比下降了31.1%。PIERS 3 月份的进口量数据将于本周晚些时候公布。

根据Hackett Associations 代表美国零售联合会周五发布的《全球港口跟踪》报告,美国零售商预测,至少在 8 月份之前,美国进口将比去年下降。

由于服务合同的签订权已从承运人手中转移到托运人手中,许多进口商暂缓签订跨太平洋服务合同,希望利用低迷的即期费率市场,并了解美国最大的大型零售商是在哪个费率区间签订合同的。承运商和托运人通常会在 4 月底之前完成服务合同,因为大多数交易的生命周期始于 5 月 1 日。

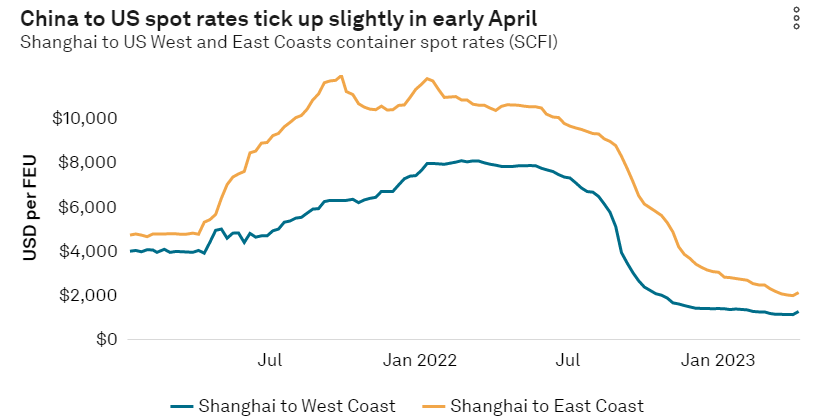

即期汇率下降使托运人更加大胆

货运代理 Freight Right 的创始人兼首席执行官 Robert Khachatryan 说,3 月下旬,他公司的一些大型 BCO 客户(拥有 5,000 个标准箱以上的客户)收到了到西海岸的 1,600 美元至 1,700 美元的折扣价,但托运人很容易就拒绝了,因为当时大多数货运代理的现货价约为 1,100 美元至 1,300 美元。

在某种程度上,费率下降使托运人更有胆量寻求更具竞争力的合同费率。

"卡恰特良在《商业杂志》的一篇评论文章中写道:"考虑到最近的预测,即期市场费率已接近底部,并应在今年年中趋于平稳,我们有理由预计,中型货代公司和中大型BCO的合同费率最终将分别落在西海岸和东海岸的1500美元至1600美元和2500美元至2700美元左右。

OEC 集团首席执行官 Marc Bibeau 告诉《商业日报》,相对于 4 月份发布的从 300 美元到 500 美元不等的 GRI,目前的 GRI 是 "激进的",但只是一个开局,目的是让托运人以介于即期汇率和即期汇率加 GRI 之间的汇率签订合同。

鉴于西海岸进口量的急剧下降,Bibeau 表示,目前还不清楚承运商在托运人投标集装箱时能否获得全部 GRI。但他表示,他理解承运商需要将费率恢复到能够维持可靠班期并为市场提供足够运力的水平。

"目前的市场条件不利于成本上升,"Bibeau 说。"但承运商现在的 FAK(全货运)费率又回到了亏损状态,他们需要获得一个不影响服务的盈亏平衡费率"。

M + R Forwarding 公司副总裁詹姆斯-卡拉多纳(James Caradonna)告诉《商报》,目前与海运承运人进行合同谈判的小型托运人更注重即期费率,因为他们可以更容易地在长期合同和货代即期费率之间转换货物。

"Caradonna说:"提高短期费率有助于承运商加快BCO(受益货主)的合同谈判,尤其是对那些不确定眼前提案的BCO而言。

发生货物滚动

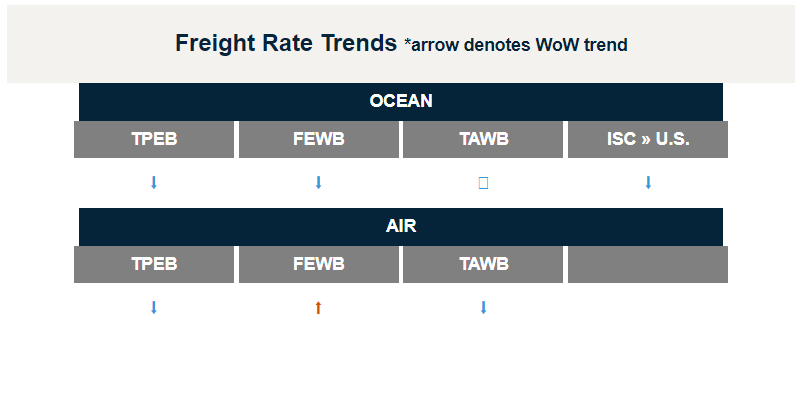

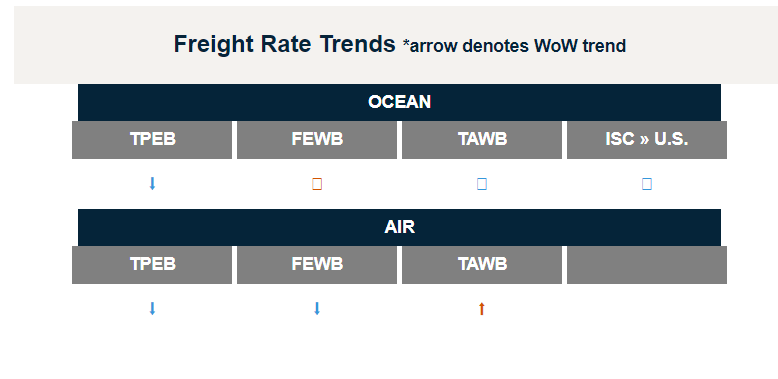

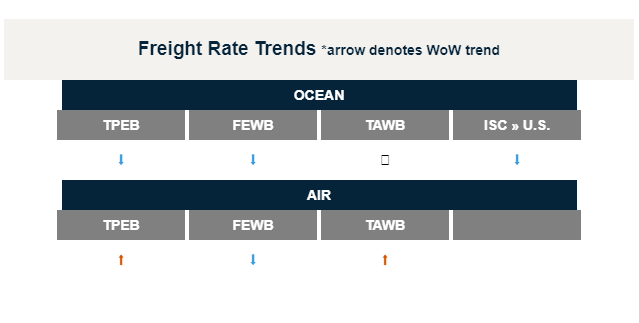

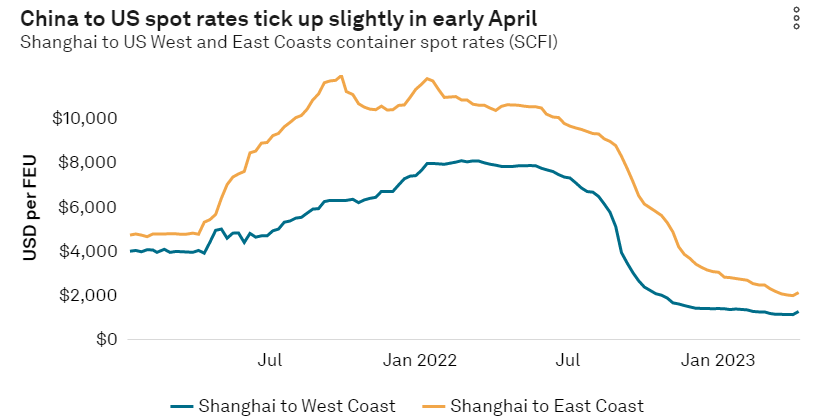

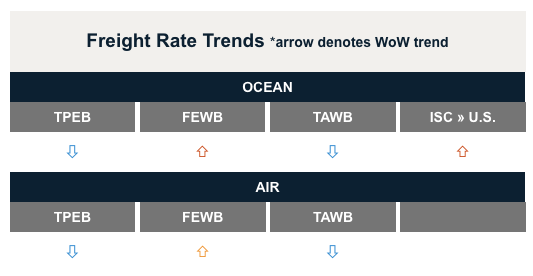

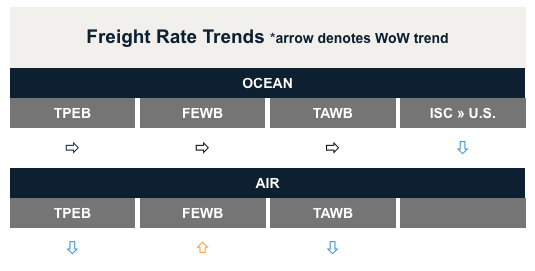

根据德鲁里(Drewry)、普氏(Platts)、Xeneta 和上海航运交易所(Shanghai Shipping Exchange)对运价的分析,东行跨太平洋即期运价略有下降或持平。根据上海航运交易所的数据,截至 4 月 7 日,上海至美国西海岸的运价为 1292 美元/FEU,高于 3 月 31 日创下的 2023 年最低点 1148 美元/FEU。

根据 Caradonna 的估计,自 1 月底以来,每周约有 7 万个标准箱的海运运力被削减,占美国西南太平洋港口运力的 25%。 同期,远洋承运商削减了约 3 万个标准集装箱的航次,占亚洲运力的 30%。运量下降导致西北太平洋海运码头缩短了运营时间。

"Caradonna 说:"这是承运商将货物运往西海岸的一个重要原因。"船舶满载,但这在很大程度上是由于空白航次造成的。"

到美国东海岸的跨太平洋航线每周减少约 45,000 个标准箱,相当于运力的 20%。

卡拉多纳说,在上海、宁波、盐田和厦门,"不同程度 "地出现了货物滚装现象,即装载高价现货而不是低价货物。

资料来源:《商业杂志