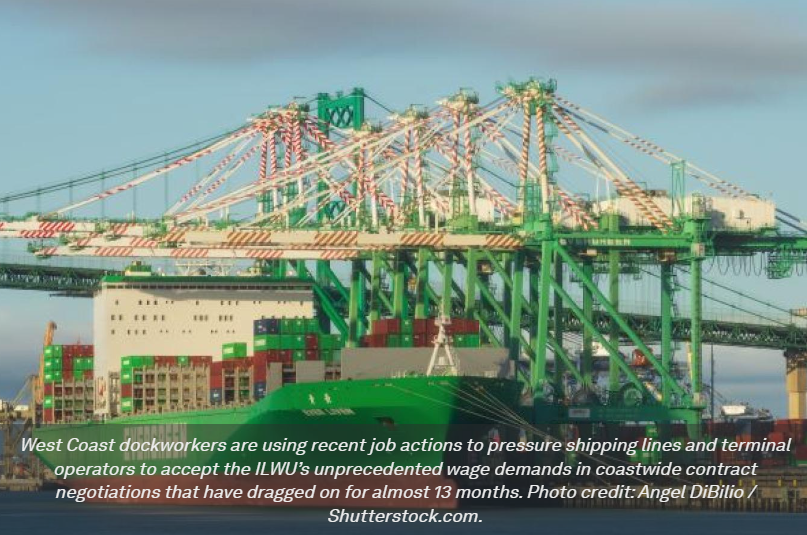

消息人士周一称,美国西海岸码头工人正竭力争取大幅提高工资,并改变人员配置,以便在一些港口设备上安排两名工人,而不是一名工人。

据消息人士称,周一西雅图、长滩和洛杉矶的几个集装箱码头都发生了罢工事件。据四位接近谈判的消息人士称,虽然周一港口中断的严重程度低于周五,当时码头工人关闭了从长滩到西雅图沿岸的多个码头,但国际码头与仓库工会(ILWU)和太平洋海运协会(PMA)在工资和人员配备水平上仍存在很大分歧。

洛杉矶一个海运码头的一名操作员说,他周一没有收到任何他向国际劳工联合会招聘大厅申请的劳动力,并补充说:"我们今天可能会让船闲置。

SSA Marine 的一位发言人说,由于起重机生产率低,在西雅图四艘船上工作的劳工帮派已于周一被解雇。在长滩经营三个码头的 SSA 说,那里的两个码头自周六以来就没有为一艘国际船舶工作过。

上周末,国际工人工会继续采取零星的工作行动,包括将船岸起重机的生产率从正常的每小时 25 至 26 台降至每小时约 20 台,甚至更低。

PMA 周一在一份声明中抨击 ILWU 继续采取 "协调一致的破坏性工作行动"。

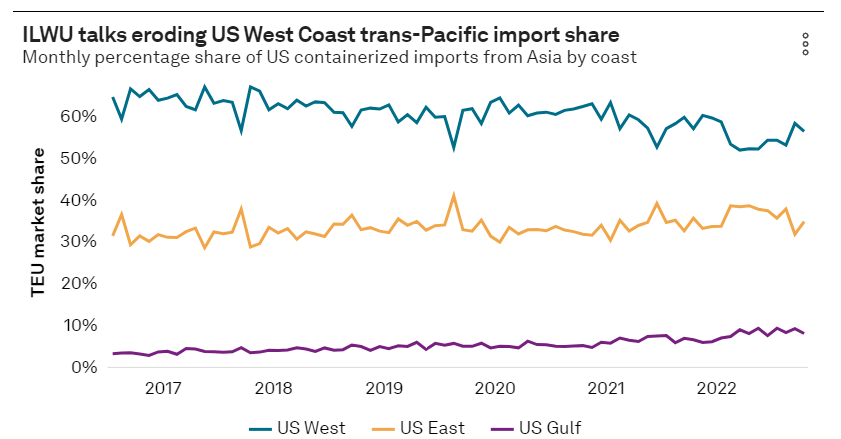

"工会领导人正在实施他们工作行动手册中许多熟悉的破坏策略,包括拒绝向海运码头派遣工人、放慢运营速度以及提出毫无根据的健康和安全主张,"PMA 说。"ILWU 自 6 月 2 日以来在全海岸范围内采取的工作行动正迫使零售商、制造商和其他托运人将货物从西海岸转移到大西洋和墨西哥湾沿岸的港口。大部分被转移的货物可能永远不会返回西海岸"。

国际码头工人工会拒绝发表评论。但国际码头工人协会(ILA)发表声明称,它 "声援 "国际码头工人工会,并声称该工会 "受到了 PMA 的诋毁,PMA 精心策划了一场媒体宣传活动,旨在以牺牲西海岸码头工人的利益为代价,提高其合同影响力"。

港务局发言人说,周五和周末受影响的大部分码头都收到了周一白班的全额劳动力分配。

白宫监测局势

在周一的一次简报会上,白宫新闻秘书卡琳-让-皮埃尔(Karine Jean-Pierre)说,拜登政府正在密切关注合同谈判,并指出双方就未公开的 "某些关键问题 "达成了初步协议。让-皮埃尔说,白宫 "将继续鼓励各方本着诚意,努力达成互惠互利的解决方案,确保工人获得公平的福利、平等的生活和应得的工资"。

自 2022 年 5 月全海岸合同谈判开始以来,最近几天在西海岸发生的就业行动促使美国全国零售联合会(NRF)于周一第三次致函拜登政府,敦促联邦政府干预国际劳工联合会(ILWU)与代表航运公司和码头运营商的 PMA 之间的谈判。

"NRF 负责政府关系的高级副总裁 David French 在致拜登政府的一封信中说:"随着我们进入节假日航运旺季,这些额外的干扰将迫使零售商和其他重要的航运合作伙伴继续将货物从西海岸港口转移,直到新的劳动合同签订为止。"当务之急是双方回到谈判桌前。我们敦促政府进行调解,以确保双方在不造成额外干扰的情况下迅速敲定新合同。

工会寻求大幅加薪

据说,谈判因国际码头工人工会史无前例地要求在拟议的六年期合同中每年增加每小时 7.50 美元的工资而陷入僵局,这将使码头工人的工资在合同期内增加近 100%。两位接近谈判的消息人士证实了工会的工资要求。

相比之下,根据 PMA 的年度报告,在过去 20 年里,合同期内每年的工资增长幅度在每小时 50 美分到 1.50 美元之间。

2021 年和 2022 年,全球供应链因大流行病而中断,来自亚洲的进口量达到历史最高水平,消费者的消费支出庞大,承运商因此获得了创纪录的利润。但随着远洋运输市场恢复正常,消费者减少了在商品上的可支配收入,这些利润也随之减少。

据报道,ILWU 还要求将某些货物装卸设备(如堆场拖拉机)分配给两名码头工人。长期以来,这一直是船岸起重机的惯例,因为这种起重机需要较高的技术水平。根据 ILWU 的要求,每辆堆场拖拉机将分配给两名司机,这意味着一名码头工人将工作 4 个小时,领取 8 个小时的工资,而第二名码头工人将工作当班剩余的 4 个小时,领取 8 个小时的工资。

消息人士称,谈判中的另一个重要问题涉及追溯工资。一位消息人士告诉《商报》,在每次合同谈判中,PMA 和 ILWU 之间都有一个心照不宣的协议,即无论新合同中商定的工资涨幅是多少,都将追溯到上一份合同到期时。这意味着,PMA 和 ILWU 一直在假定新合同中讨论的工资增长将追溯到 2022 年 7 月 1 日,即之前合同到期之时。

但据消息人士称,随着谈判已过一年期限,PMA 已告知 ILWU,如果届时仍未达成临时合同,则自 7 月 1 日起将取消追溯工资。消息人士称,PMA 的这一策略旨在提供一种紧迫感,以便 ILWU 尽快达成协议,而不是进一步拖延谈判。

码头运营商告诉《商业日报》,如果国际劳工联合会停止工作行动,货物装卸在周一顺利进行,工会与 PMA 之间的全海岸谈判将在周二恢复。但现在还不能确定是否会这样。