值得关注的趋势

[海关]

- On September 13, the U.S. Trade Representative (USTR) outlined final modifications to Section 301 tariffs imposed on certain products originating from China.

- We have compiled a list of items subject to the new tariffs—some of which go into effect tomorrow (September 27, 2024). For a detailed breakdown of tariff updates, read our blog.

- Learn more about what’s changing, why it matters, and how these new rules could affect your holiday shipments and supply chain. Don’t miss our webinar for further insights.

- On September 13, the Biden administration issued an executive action introducing significant changes to the de minimis exemption for low-value shipments under $800. This shift could greatly impact U.S. businesses that rely on the $800 de minimis threshold for duty-free goods, particularly those benefiting from exemptions under Section 301, 201, and 232 tariffs.

- Businesses may see additional duty costs and increased documentation requirements for de minimis shipments before year-end.

- In the short term, businesses may be required to start providing HTS classifications down to the 10-digit level for all products. Check out our detailed guide to the de minimis executive action on our blog, where you’ll also find live updates.

- Reach out to our team of trade advisors at CustomsBD@flexport.com to understand how you can mitigate the risks.

[国际劳联停工观察]

- More U.S. East and Gulf Coast ports are extending their operating hours in anticipation of a potential ILA work stoppage on October 1 as part of their contingency plans.

- To help their customers navigate this looming supply chain disruptions caused by the impending work stoppage, more shipping companies have been actively advising their customers to implement contingency measures. For example, multiple carriers, including ONE, Hapag-Lloyd, and others have announced port omissions and cargo discharges at alternate ports along the U.S. East and Gulf coast. Additionally, bookings for export of Dangerous goods (DG) and Reefer cargo have also been restricted.

- Follow our live blog for real-time updates. Flexport will continue to provide timely updates and work closely with our customers to take proactive action and plan ahead in the event of a potential ILA work stoppage.

[Ocean - TPEB]

- Demand remains flat and continues its downtrend leading into and following Golden Week. Ocean freight rates are being extended until October 14 with further rate mitigations, particularly for the U.S. Southwest, East Coast, and Gulf Coast.

- In anticipation of a potential ILA work stoppage, some BCOs are shifting volumes to or through the U.S. West Coast as a contingency plan. A few carriers are considering implementing surcharges for East Coast and Gulf Coast ports by mid- to late October if the stoppage occurs.

- Should the ILA work stoppage materialize, expect carrier-imposed surcharges, operational disruptions, port congestion, and vessel deployment issues affecting East Coast and Gulf Coast schedules. There may also be equipment shortages at origin, depending on how long the stoppage lasts.

- Fixed rates: Peak Season Surcharges (PSS) will remain unchanged through September, and are expected to extend into October, covering the Golden Week period.

[Ocean - FEWB]

- Demand is trending downward, with vessels now open for bookings. Carriers are preparing roll pools ahead of China’s Golden Week.

- Floating rates have continued to decline in the second half of September, as easing demand takes hold. However, rates remain higher compared to early 2024 levels. Carriers are being more proactive in adjusting rates to optimize vessel utilization. The SCFI dropped by $591/TEU in August, and has fallen an additional $1,808/TEU so far in September.

- While carriers are cautiously reopening long-term named account business negotiations, they remain conservative in their approach.

- Equipment shortages are improving overall, though some ports of loading (POLs) with less frequent direct calls still face occasional shortages due to rerouting via the Cape of Good Hope (COGH).

[Ocean - TAWB]

- Carriers have announced General Rate Increases (GRIs), Rate Restoration Initiatives (RRIs), and Peak Season Surcharges (PSSs), effective October 1st.

- In response to the potential work stoppage on the U.S. East Coast, nearly all carriers have introduced disruption surcharges to cover the additional operational costs associated with the work stoppage. The estimated impact of a potential work stoppage:

- A 1-day strike could take 6 days to clear the backlog.

- A 1-week strike could require 1.5 to 2 months for recovery.

- A 2-week strike could result in a 4-month recovery period.

- No equipment shortages are reported in Southeast Europe (SEU).

[Air – Global] Mon 09 Sep – Sun 15 Sep 2024 (Week 37):

- Worldwide tonnage increase (week on week): Air cargo tonnages increased by +4% in week 37 (Sept. 9-15), driven by +5% growth from the Asia-Pacific, +6% from Central and South America, and a +10% rebound from North America, following Labor Day disruptions.

- Average worldwide rate increase (year on year): Average worldwide rates increased to $2.58 per kilo, up +14% YoY, and more than +50% above pre-Covid levels (September 2019). The Asia-Pacific and MESA regions saw increases of +24% and +56%, respectively, while North America and Europe experienced a decline of -7% YoY.

- Bangladesh to USA spot rates (4 weeks on 4 weeks): Spot rates from Bangladesh to the U.S. have soared to $7.49 per kilo in week 37, more than three times higher than the same period last year (+219%). Rates have remained above $7 per kilo for the past four weeks.

- Dubai to USA tonnage surge (4 weeks on 4 weeks): Tonnages from Dubai to the U.S. surged by around +50% over the past four weeks, with volumes now more than three times their levels last year (+275% in week 37).

- Japan to U.S. spot rate spike (3-month comparison): Spot rates from Japan to the U.S. reached $8.33 per kilo in week 37—their highest level this year—marking a +50% increase since mid-June levels, driven by disruptions from typhoons.

来源: Worldacd.com

请与您的客户代表联系,了解货运所受影响的详情。

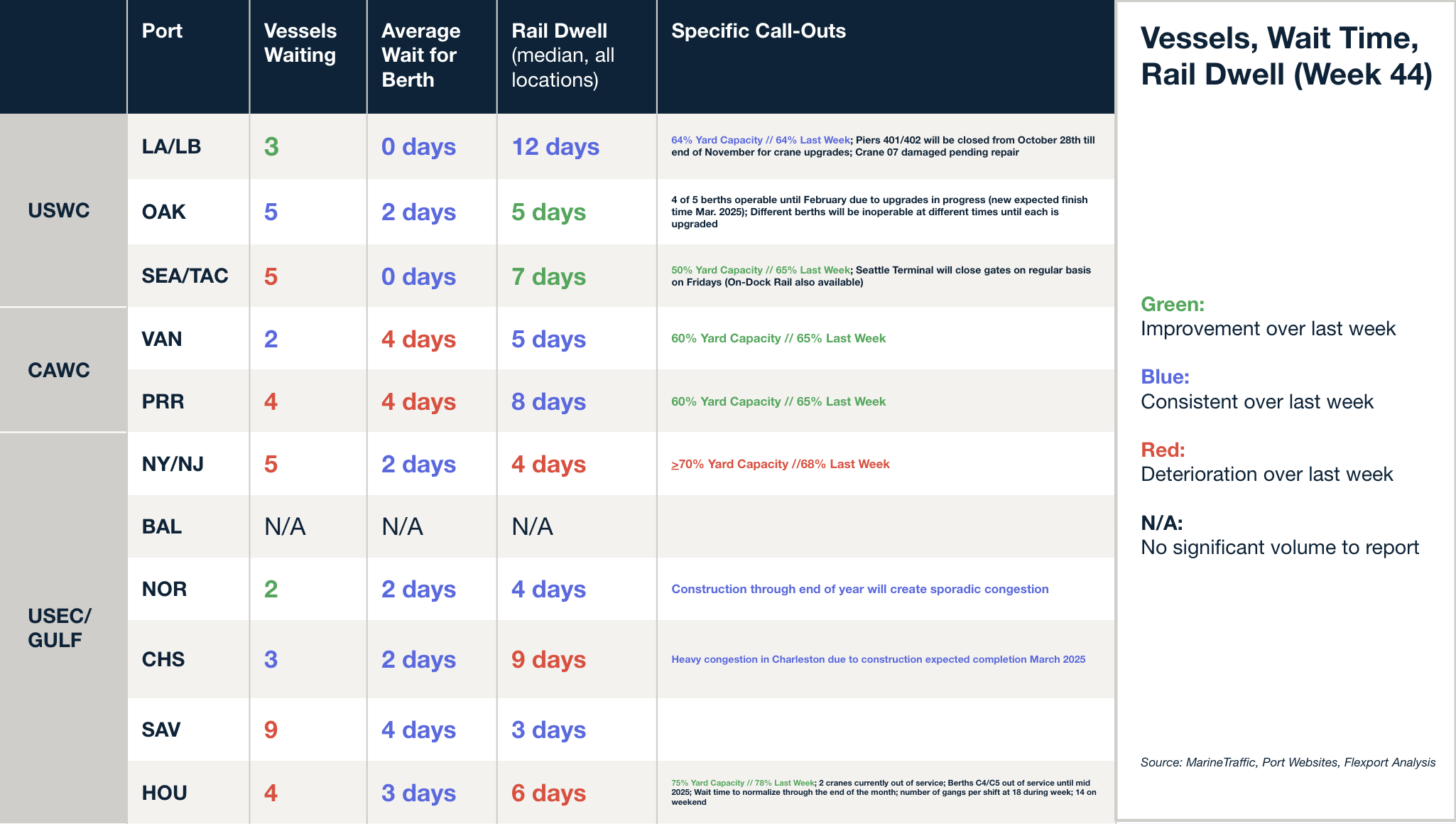

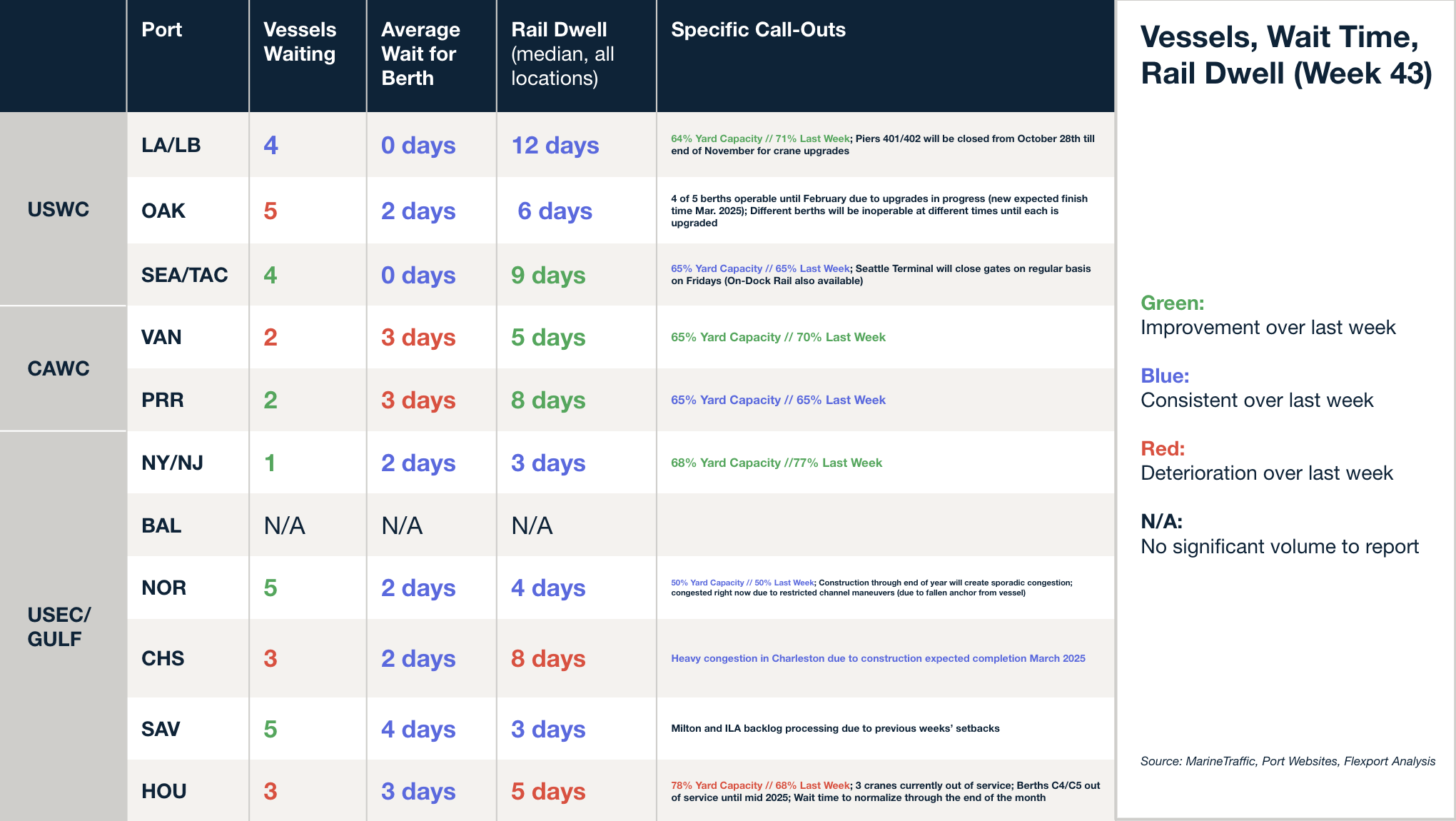

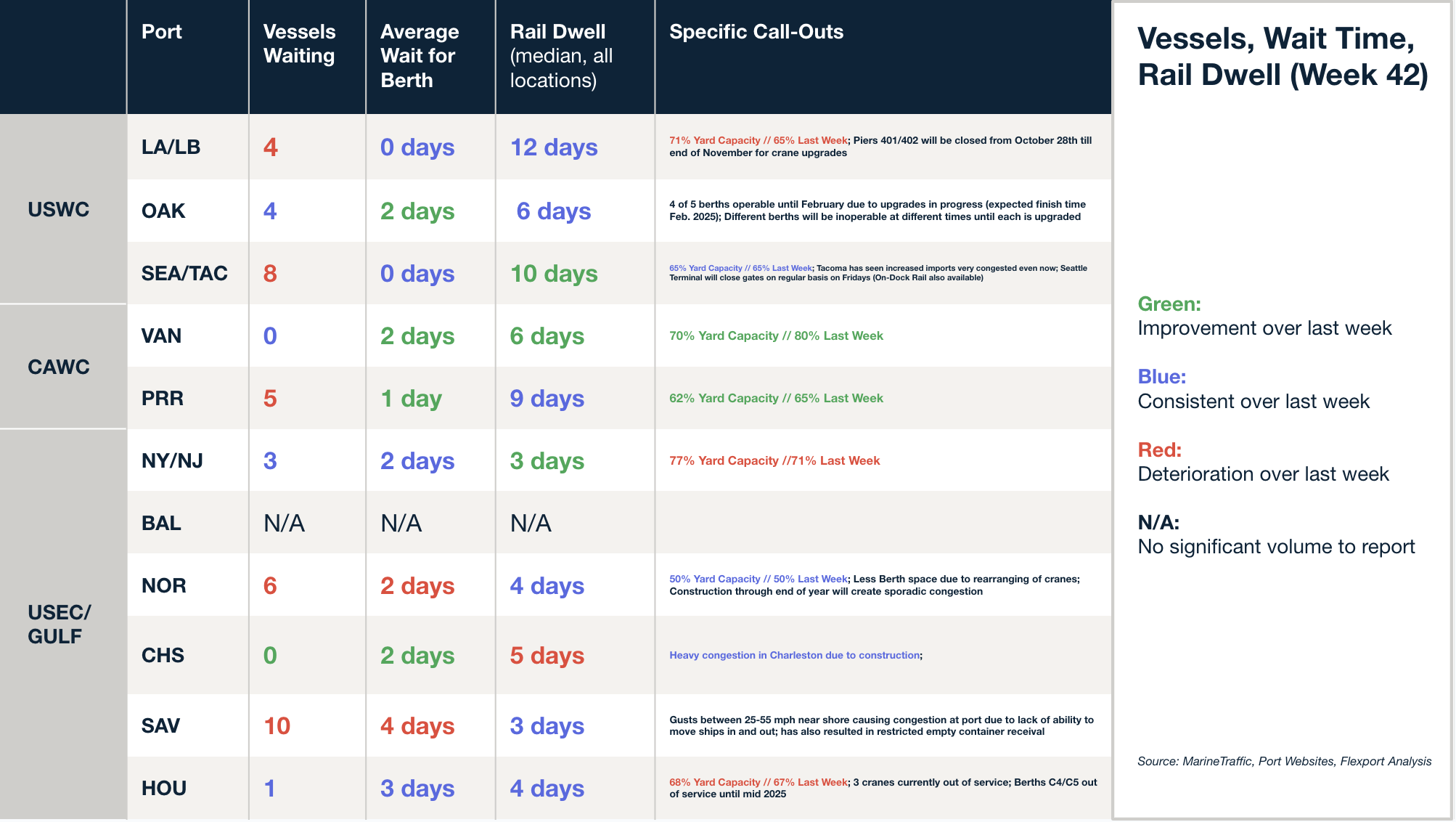

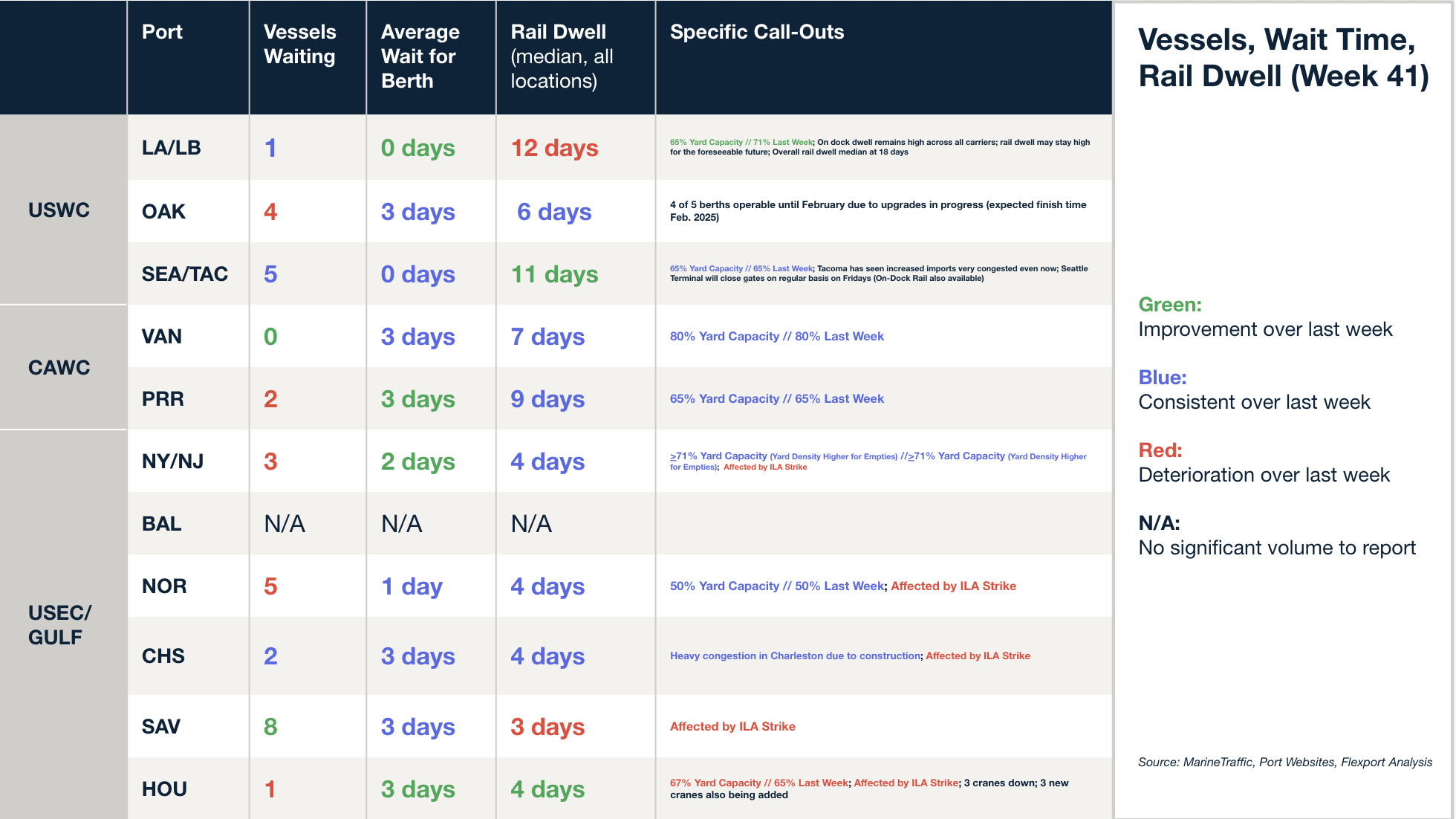

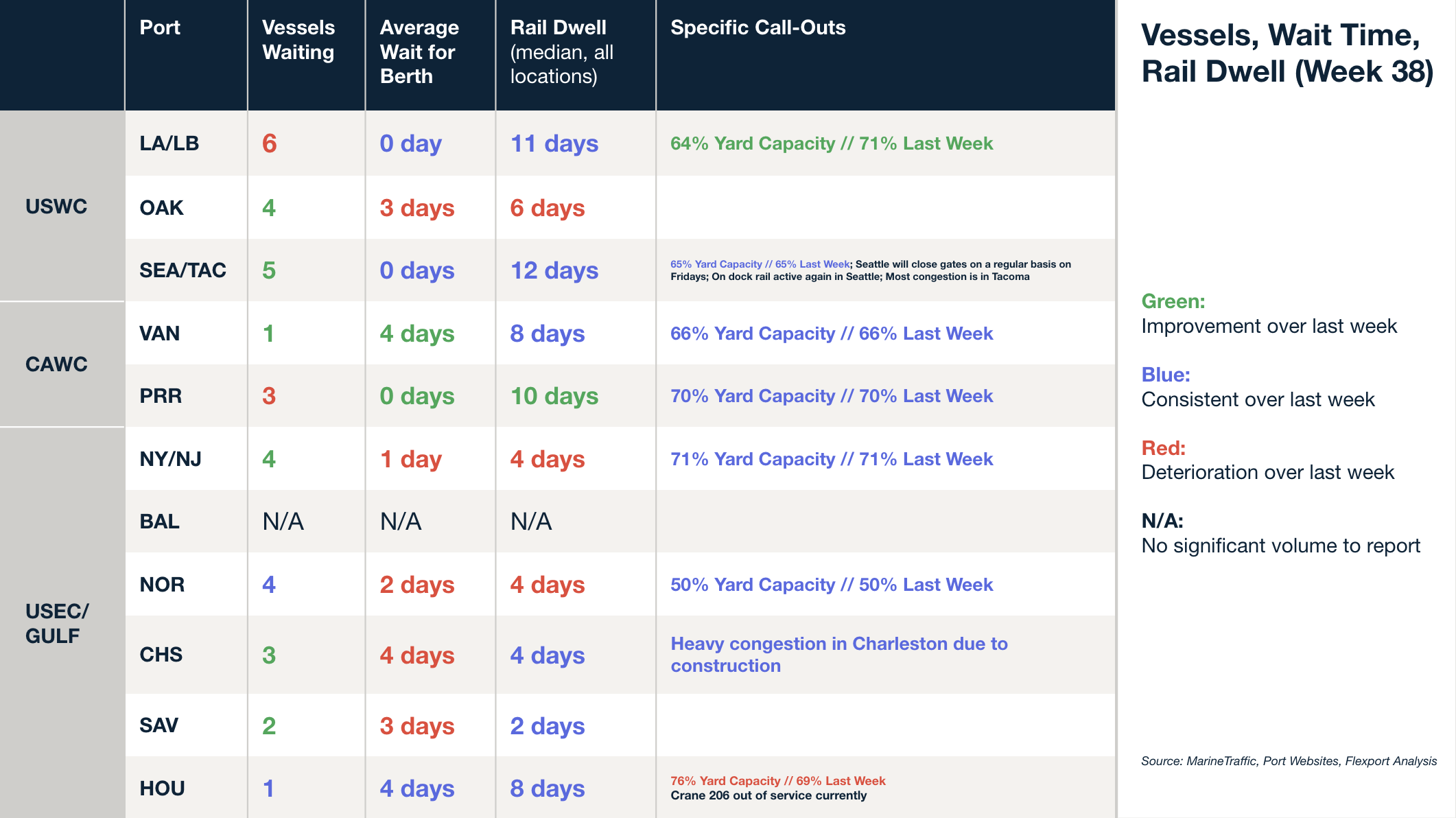

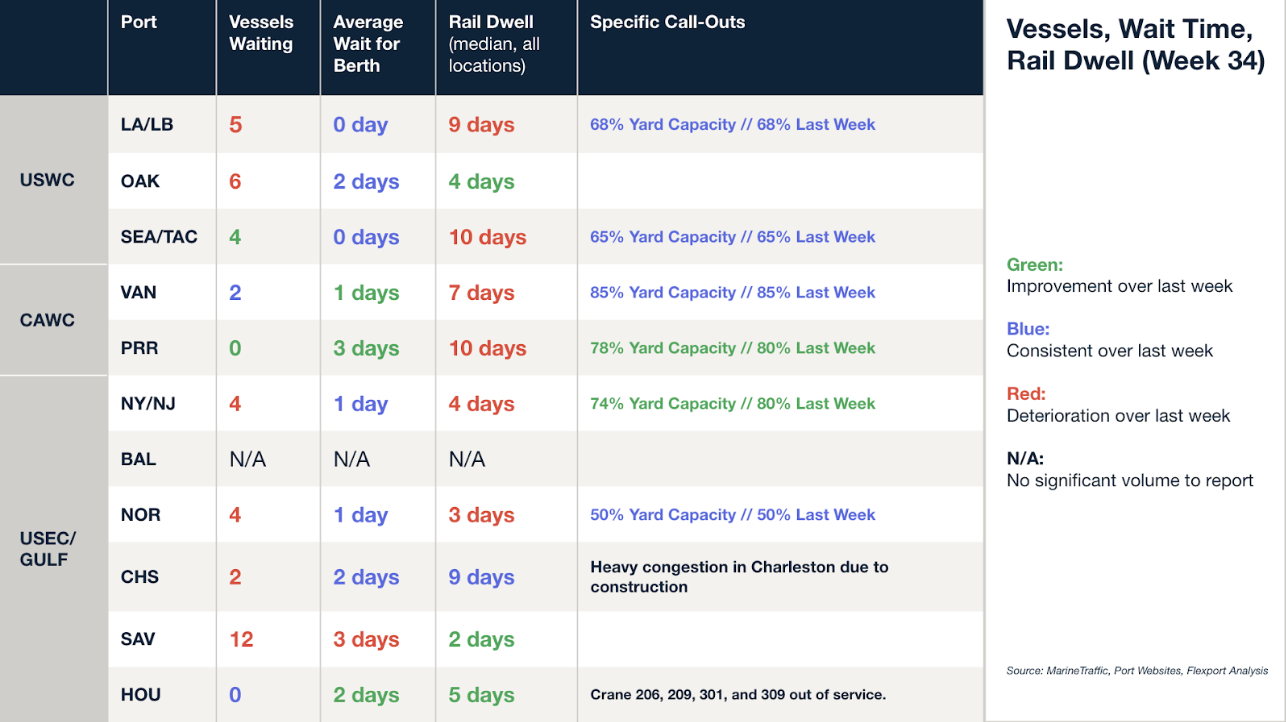

北美船舶停留时间

网络研讨会

Flexport Customs: Duty Optimization Through Tariff Engineering and HTS Classification

Thursday, October 3 @ 9:00 am PT / 12:00 pm ET

北美Freight Market Update Live

10 月 10 日星期四 @ 太平洋时间上午 9:00 / 美国东部时间下午 12:00

变革海运物流:Flexport 首席执行官 Ryan Petersen 与赫伯罗特首席执行官 Rolf Habben Jansen 的对话

Available On Demand

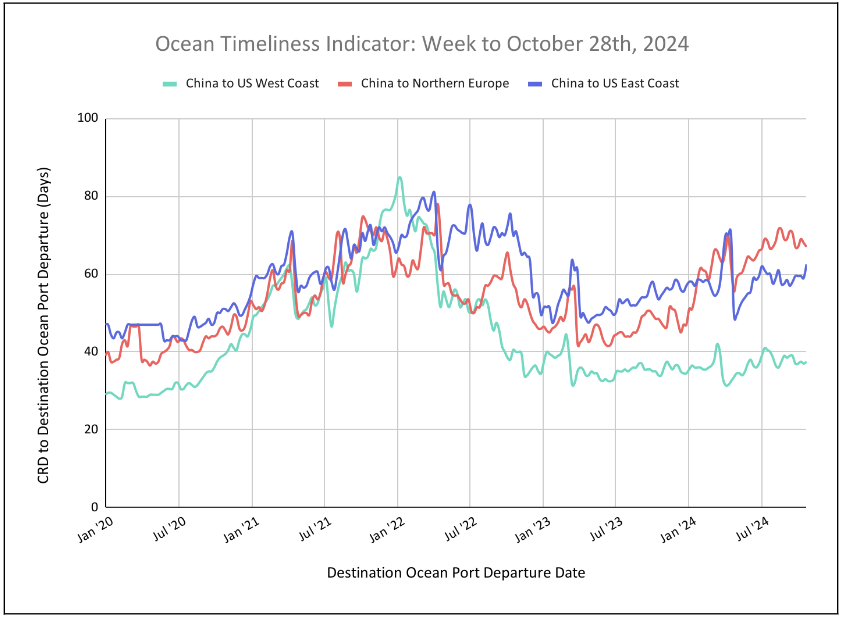

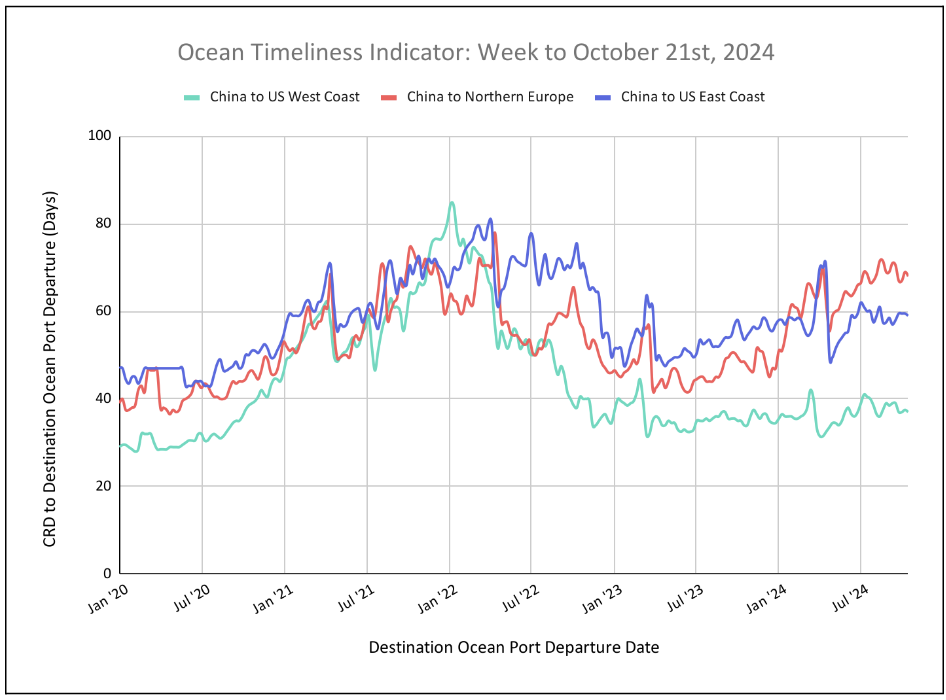

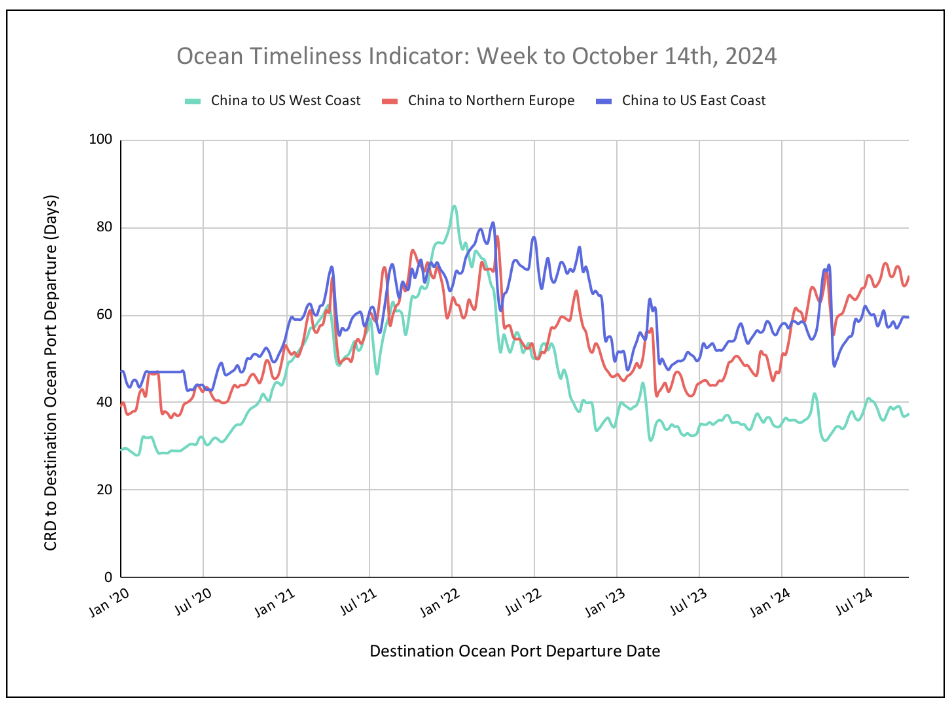

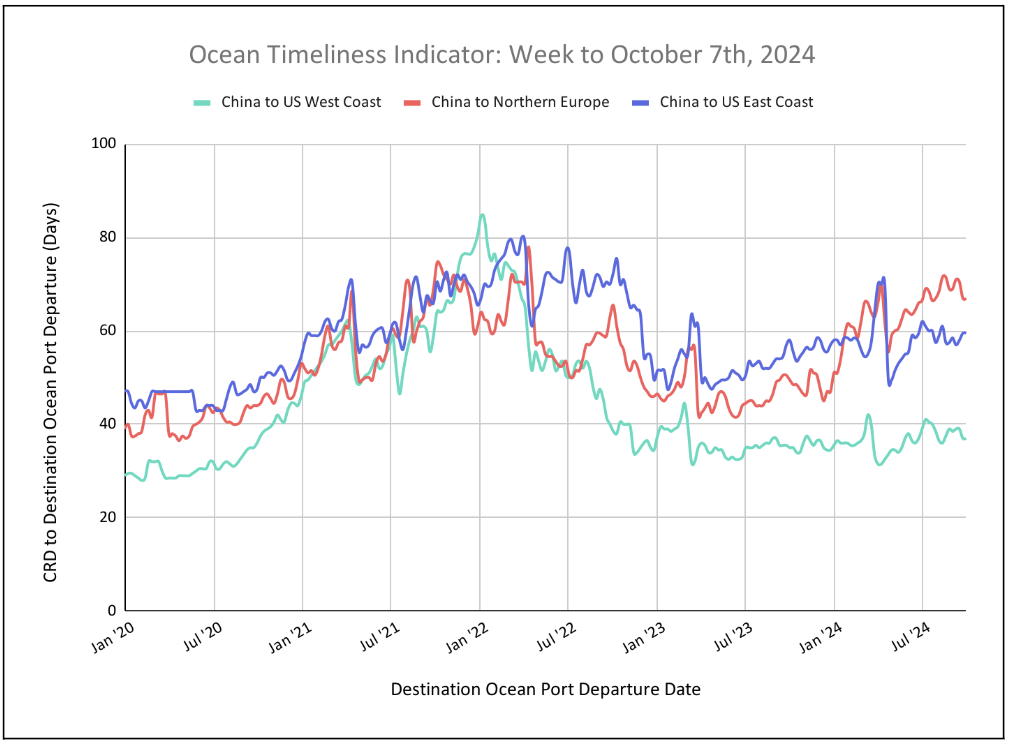

柔性海运及时性指标

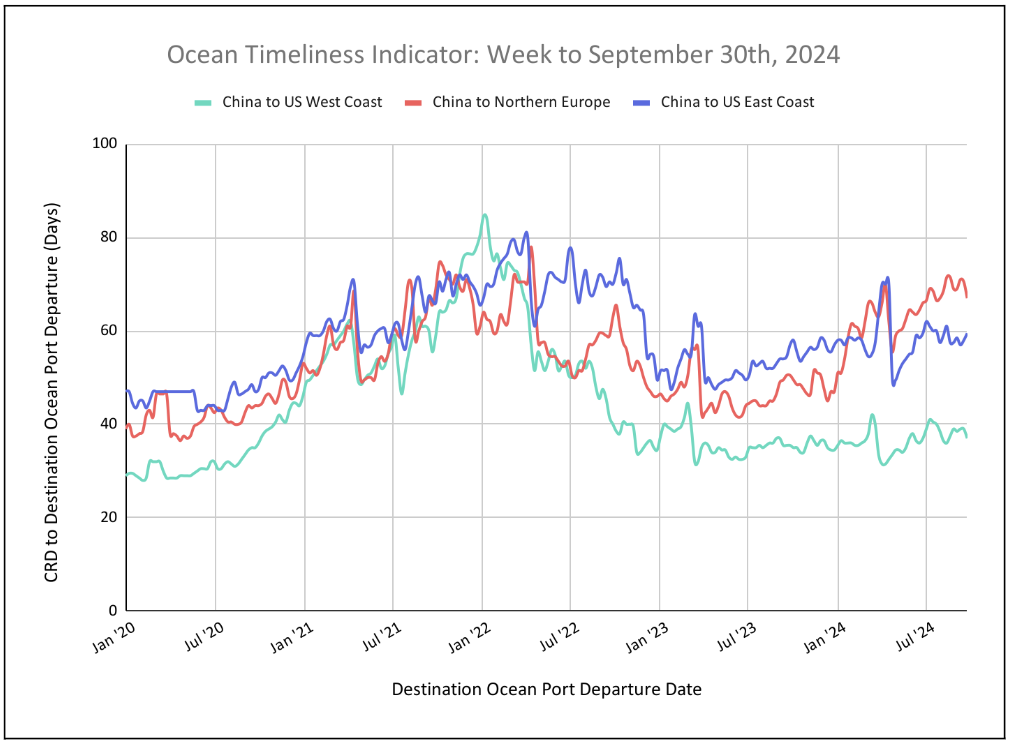

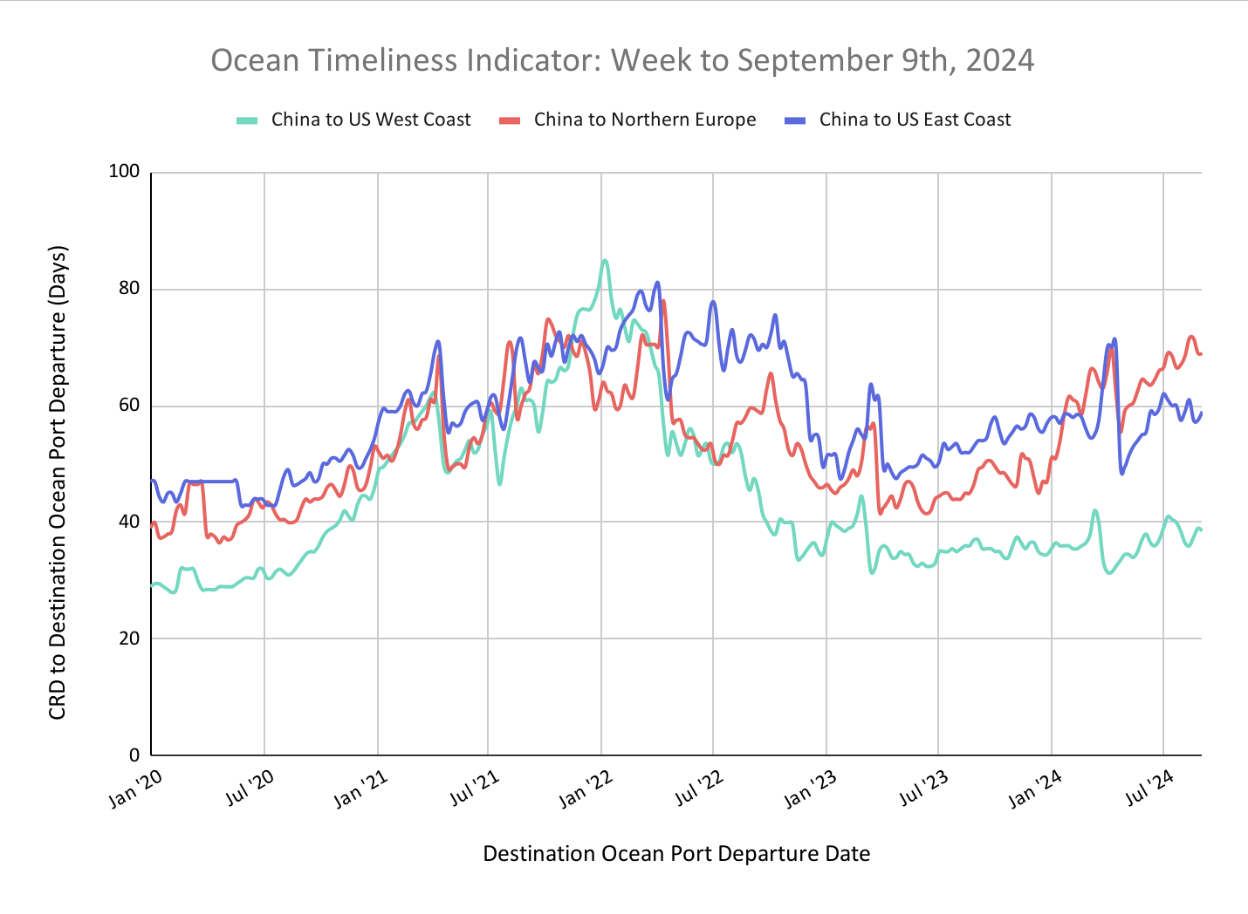

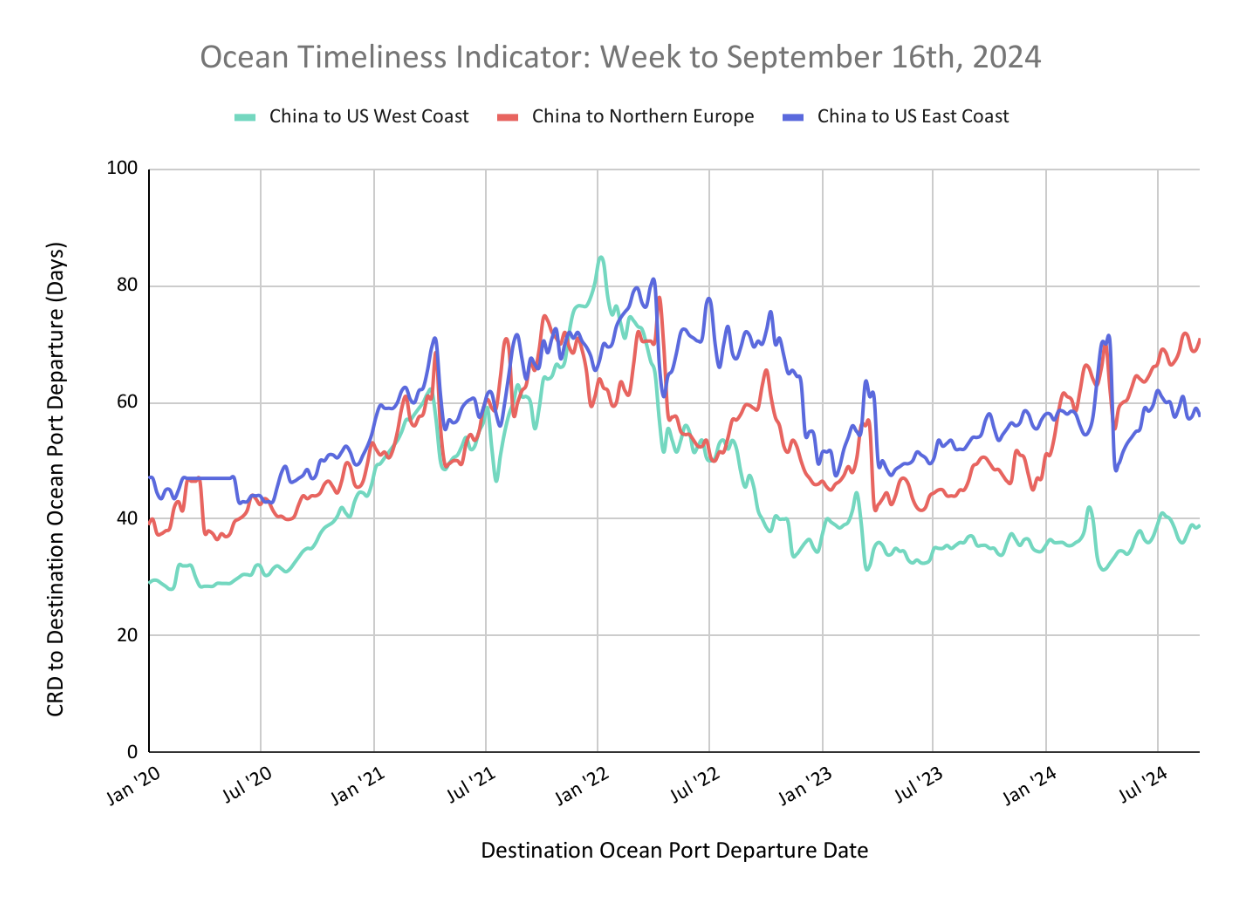

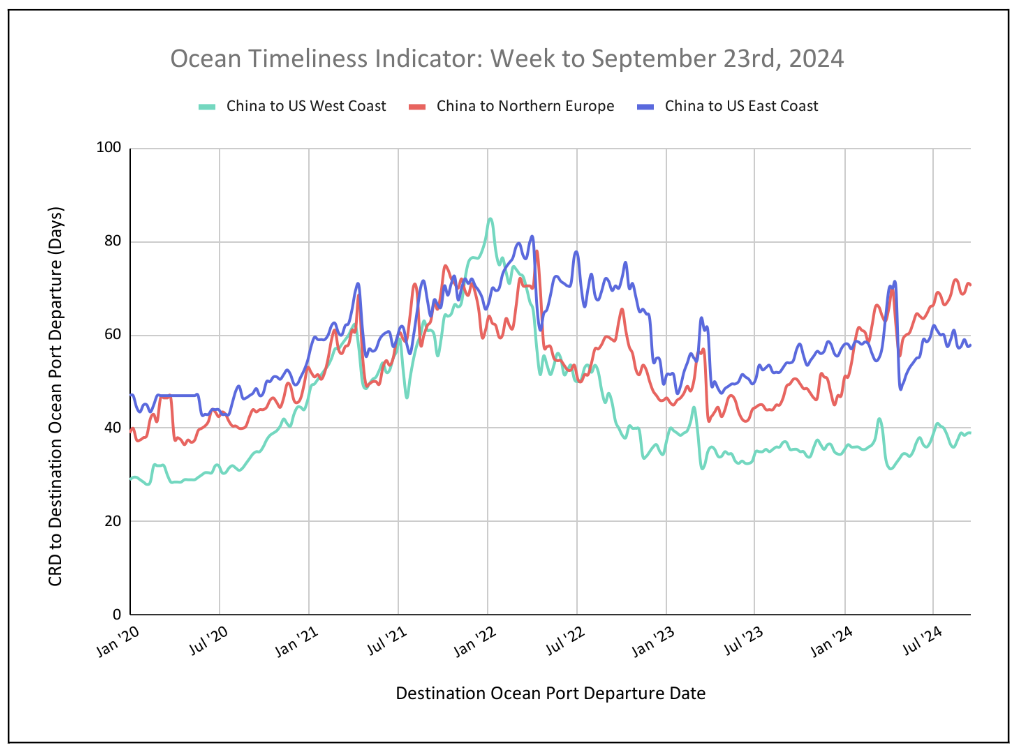

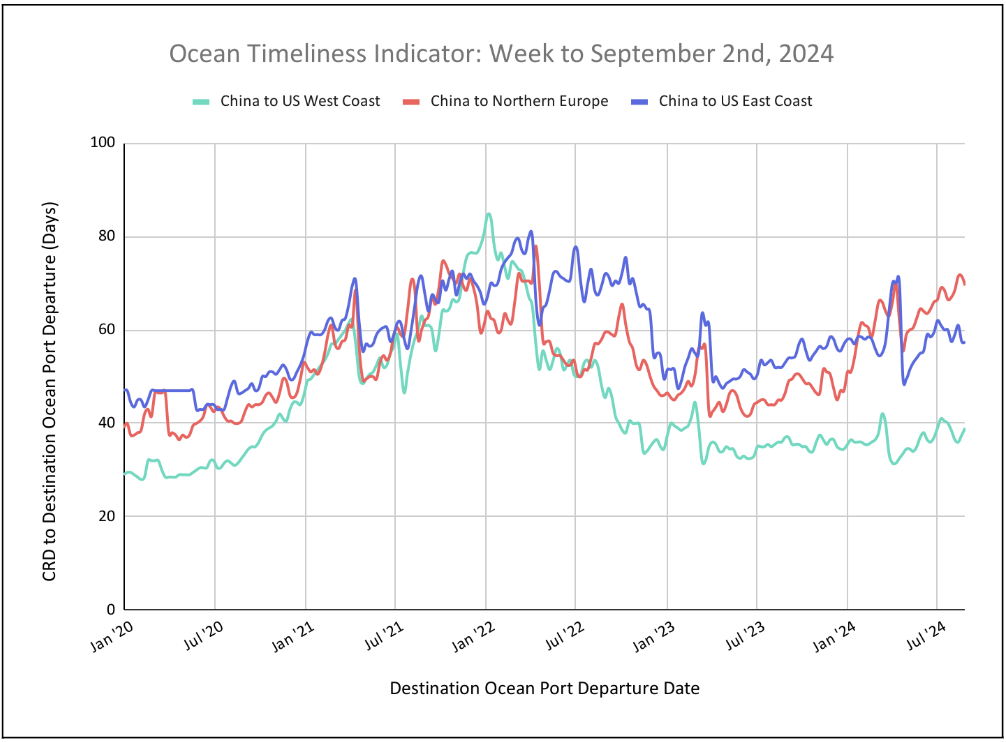

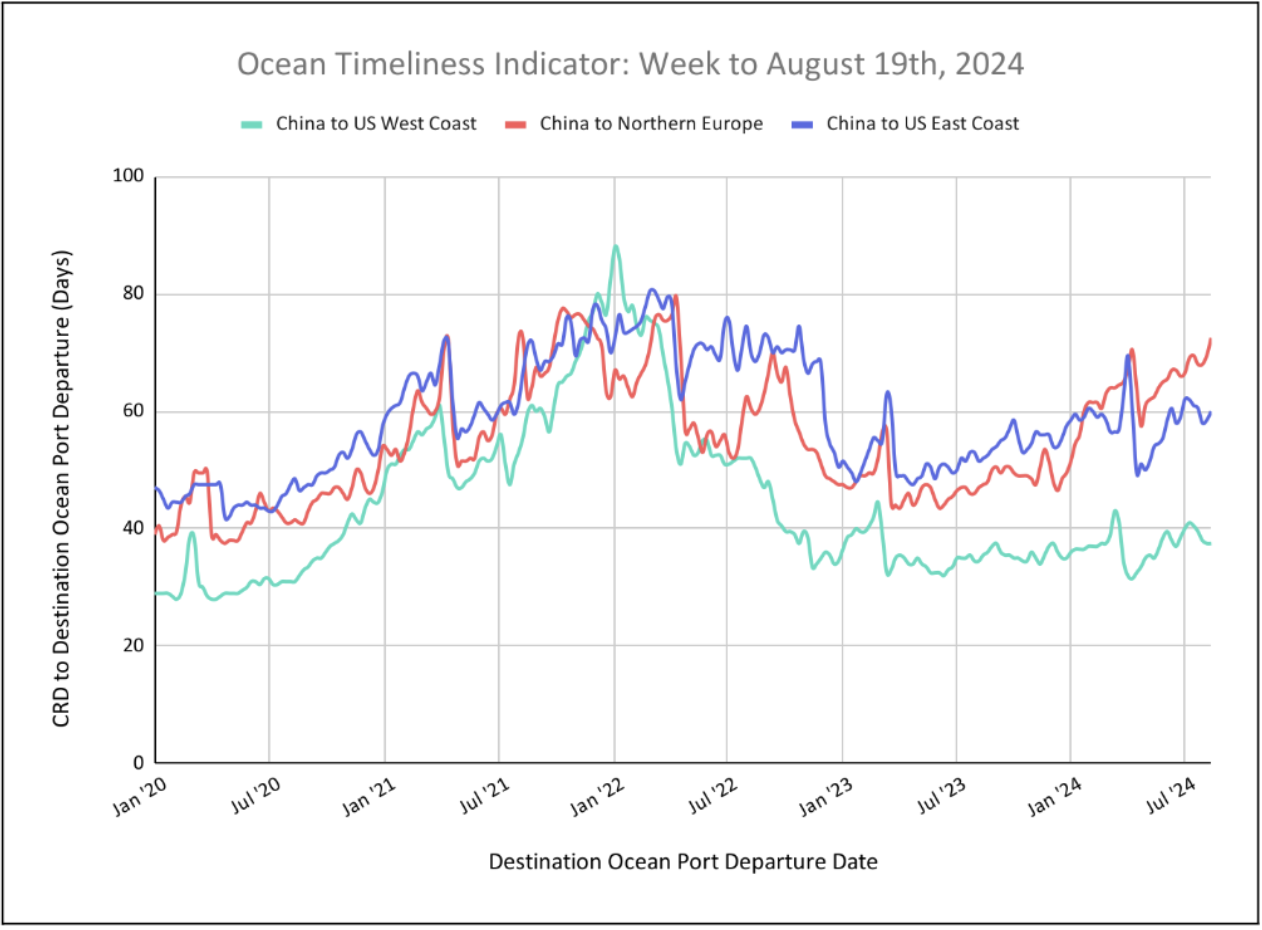

Stabilization has been the key word for the past few weeks’ Ocean Timeliness Indicator, with minor to no oscillations across the board.

Week to September 23, 2024

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast has plateaued at 39 days. Meanwhile, China to North Europe showed a slight decrease, falling from 71 to 70.5 days. China to the U.S. East Coast also demonstrated a slight shift, rising from 57.5 to 58 days.

有关 Flexport OTI 的问题,请直接发送电子邮件至press@flexport.com。

点击此处查看报告全文并了解我们的方法。

本报告内容仅供参考。Flexport 不对本报告中的任何内容作出保证、陈述或担保,因为这些内容是基于我们当前的信念、预期和假设,而由于可能发生的各种预期和非预期事件,我们无法对这些内容作出保证。Flexport 及其顾问或附属机构均不对因依赖本报告所载内容而以任何方式造成的任何损失承担责任。

来源于 Flexport.com