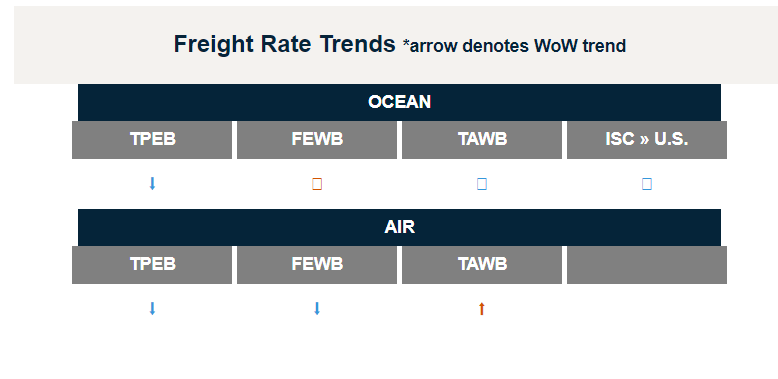

值得关注的趋势

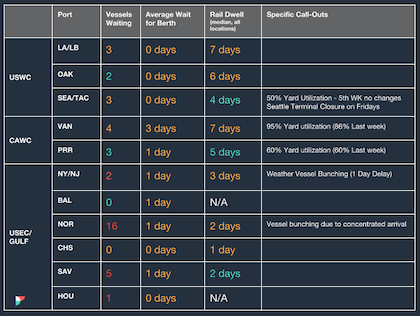

- [地区 - 不列颠哥伦比亚省] 不列颠哥伦比亚省码头工人罢工已进入第二周,请联系您的客户代表,了解罢工对您的货物影响的最新信息。

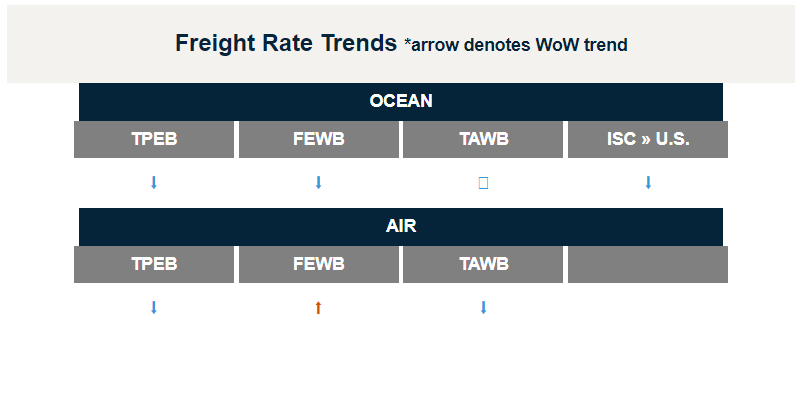

- [Ocean-TPEB]利用目前浮动市场的软条件(低费率和开放空间)。考虑利用优质服务,因为它们已经恢复到出色的运输时间性能。

- [大洋洲 - 拉丁美洲和加勒比海地区]美洲内部货运量全面疲软。原因包括库存过剩、季节性淡季、运力增加以及巴西、智利和哥伦比亚等主要国家的高通胀率。

- [Ocean-FEWB]由于通货膨胀、库存和能源成本居高不下,再加上地缘政治不稳定影响了欧洲方面的需求,需求和订舱情况依然平平。传统上从7月开始的长达4-6周的暑假进一步影响了该航线的贸易。

- [航空-欧洲]跨大西洋航线的双向市场继续疲软。由于美国和欧洲航空公司为夏季航班增加了大量运力,因此需求疲软。5月中旬跌至谷底的运价出现企稳迹象。

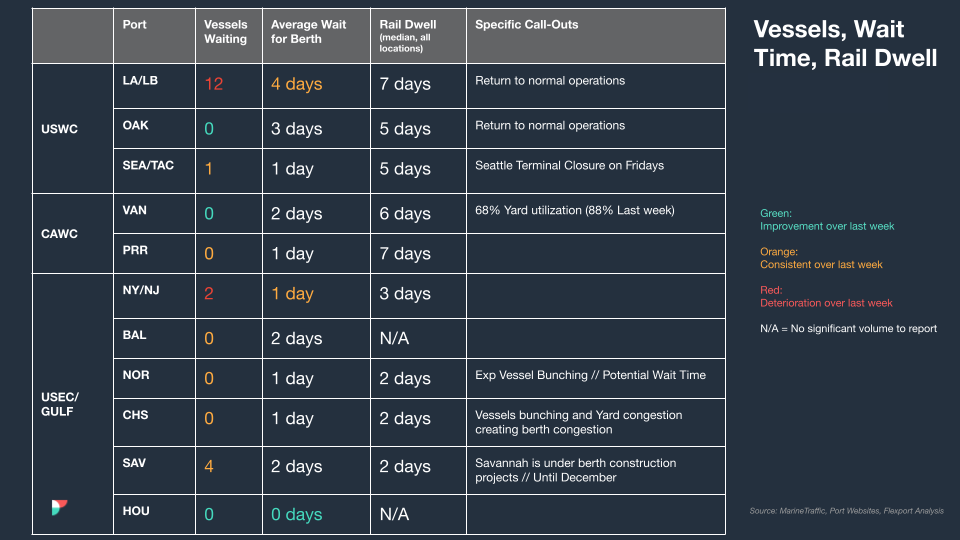

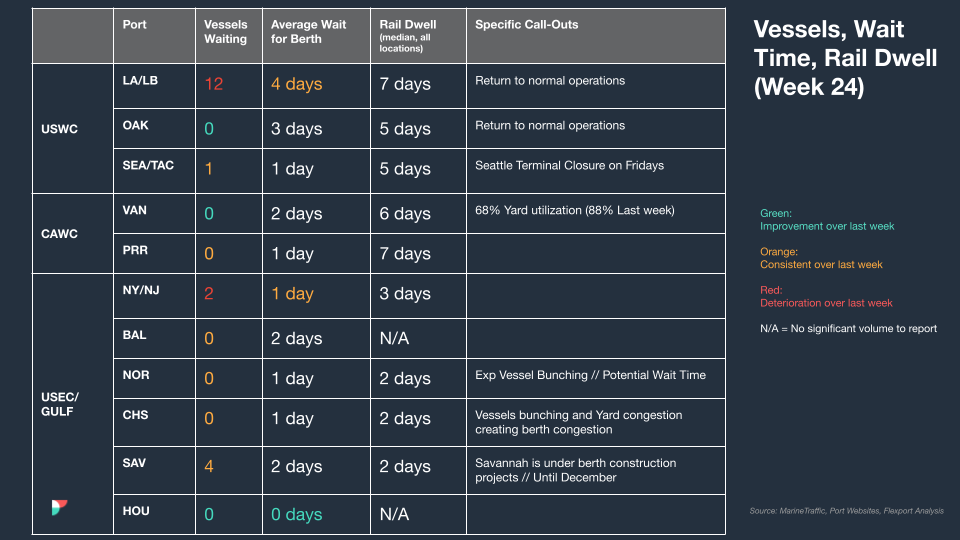

北美船舶停留时间

来源于 Flexport.com