Trends to Watch

[Ocean – FEWB]

- For Asia-Europe trade, re-routing via Cape of Good Hope continues. Over the weekend, a Chinese-owned oil tanker called Huang Pu was attacked. Carriers are investigating the Indian Ocean status as well to determine if it’s safe for transport.

- Ocean Alliance (CMA CGM Group, COSCO Shipping, Evergreen, and OOCL) Day 8 Product Update effective April 2024:

- Restructure of all Asia to North Europe loops via Good Hope.

- Offering 6 loops from Asia to North Europe with the widest coverage and largest capacity on the trade.

- Suspension of FAL7 loop and Pusan call on FAL1. Pusan, Nansha, Hong Kong, and Ho Chi Minh will continue to be served with a dedicated mainliner/feeder to connect with our 6 loops sailing to North Europe with improved frequency and reliability.

- The Tangier call will be switched from FAL3 to FAL1. Dunkirk will become the first call on FAL3, offering the French customers best-in-class service with two direct fast services: FAL1 into Le Havre and FAL3 into Dunkirk.

- New FAL1 rotation: Ningbo, Shanghai, Yantian, Singapore, Tangier, Le Havre, Hamburg, Gdansk, Rotterdam, Port Kelang, Ningbo.

- New FAL3 rotation: Qingdao, Shanghai, Ningbo, Yantian, Singapore, Dunkirk, Rotterdam, Southampton, Antwerp, Le Havre, Algeciras, Singapore, Qingdao.

- Carriers are preparing to implement General Rate Increases (GRI) for April by $400-600 per FEU. While demand remains flat at the moment, more discussion is ongoing about current offerings and long-term deal finalizations, especially if the current Red Sea surcharges are upheld by carriers.

- For historical updates on the Red Sea situation, read more in Global Ocean Carriers Halt Red Sea Transits – What to Expect.

[Ocean – FEWB]

- Receiving for laden Exports at POL USBAL is closed until further notice.

- Contingency options for U.S. Exporters who would traditionally use USBAL:

- If moving cargo to North Europe, use POLs NYC, PHL, and Norfolk.

- If moving to the MED, Middle East, ISC, or Africa, use POLs NYC and Norfolk.

- If moving to Asia and you want to route all water service, use POLs NYC and Norfolk.

- If moving to Asia and you want to avoid USEC altogether, FTL and transload to a USWC port or CHI.

Please reach out to your account representative for details on any impacts to your shipments.

Francis Scott Key Bridge Collision and Collapse – What to Expect

At about 1:30 am ET on Tuesday, March 26, the Francis Scott Key Bridge in Baltimore, MD collapsed after being struck by a container ship. The ship, named DALI, is about 300-meters long and 94,000 tonnes. The vessel is operated on charter by Maersk on the 2M Alliance service between Asia and the US East Coast.

The DALI was traveling from Baltimore to Colombo, Sri Lanka when, according to local reports and videos, the ship lost power prior to hitting a structural pillar of the bridge. The bridge collapsed instantaneously. Local authorities are treating the situation as a mass casualty incident; our thoughts are with those impacted.

While it’s still early, we anticipate considerable downstream impacts to the Port of Baltimore, US East Coast ports, and regional rail and trucking networks.

Immediate Impact of Bridge Collision and Collapse

As of March 26, there were more than 40 ships, including cargo ships, currently inside the Port of Baltimore or on the Patapsco River west of the Francis Scott Key Bridge that were unable to leave the area. The impact to cargo depends on exactly where it is and the approach the Port of Baltimore takes in the evolving situation. Cargo already discharged from vessels should be able to be picked up from port. Cargo not yet discharged from vessels will likely experience discharge delays based on port operations. And cargo on trapped vessels that are planned to be unloaded at other East Coast ports will be subject to the direction taken by the vessel operator. There’s potential to redistribute the cargo to other ports via truck or rail, but this would require a coordinated effort from the vessel operators and the Port of Baltimore.

Container vessels with Baltimore in their rotation – 107, as of the incident – will likely head to surrounding ports like Norfolk or New York/New Jersey and discharge cargo there. Norfolk and New York/New Jersey are typical port calls for vessels that head to Baltimore, so while the direct vessel schedules should be able to adapt to the situation, the positioning of cargo on the vessels will likely cause discharge delays and importers will have to navigate different options such as long distance drayage or transloading to deliver the cargo to the final destination.

The collapse of the bridge implies that water access to the container terminals, along with various other terminals at the port in Baltimore, will be temporarily blocked.

Downstream Effects to Neighboring Ports

While the Port of Baltimore is one of the smaller ports by containerized freight volume on the US East Coast, handling roughly 800k TEUs in 2023, compared to neighboring ports like the Port of New York and New Jersey at 5.1 million TEUs in 2023 and the Port of Norfolk at 2.4 million TEUs in 2023, it’s an essential port with specialized infrastructure to handle bulk commodities in a major manufacturing corridor.

To put it into context, if the cargo originally destined for the Port of Baltimore is redistributed exclusively among the Ports of NY/NJ and Norfolk, throughput at these ports would increase by just under 10%. The moderate volume increase is less of a concern, as the bigger question is whether the truck and rail systems can quickly adapt to handle this sudden 10% surge in cargo volume.

A major unknown as of now is how long it will take for the waterway to be cleared and Port of Baltimore operations to return to normal. The resolution timeline will determine the magnitude of downstream impacts to port and inland operations on the East Coast.

The Takeaway

This is an evolving situation. It’s too early to tell how rates to the US East Coast could be impacted, if ocean carriers will establish temporary booking stops to Baltimore, or if shippers will elect to re-route to alternate US East Coast ports or even the US West Coast as point of entry. Flexport is in contact with all ocean carriers that call Baltimore and will continue to provide updates.

Before making changes to your shipments, such as electing to re-route cargo, reach out to your dedicated Flexport account manager to discuss all your options. Flexport can help you design a routing to balance cost and speed, based on the current advice for your trade lane.

North America Vessel Dwell Times

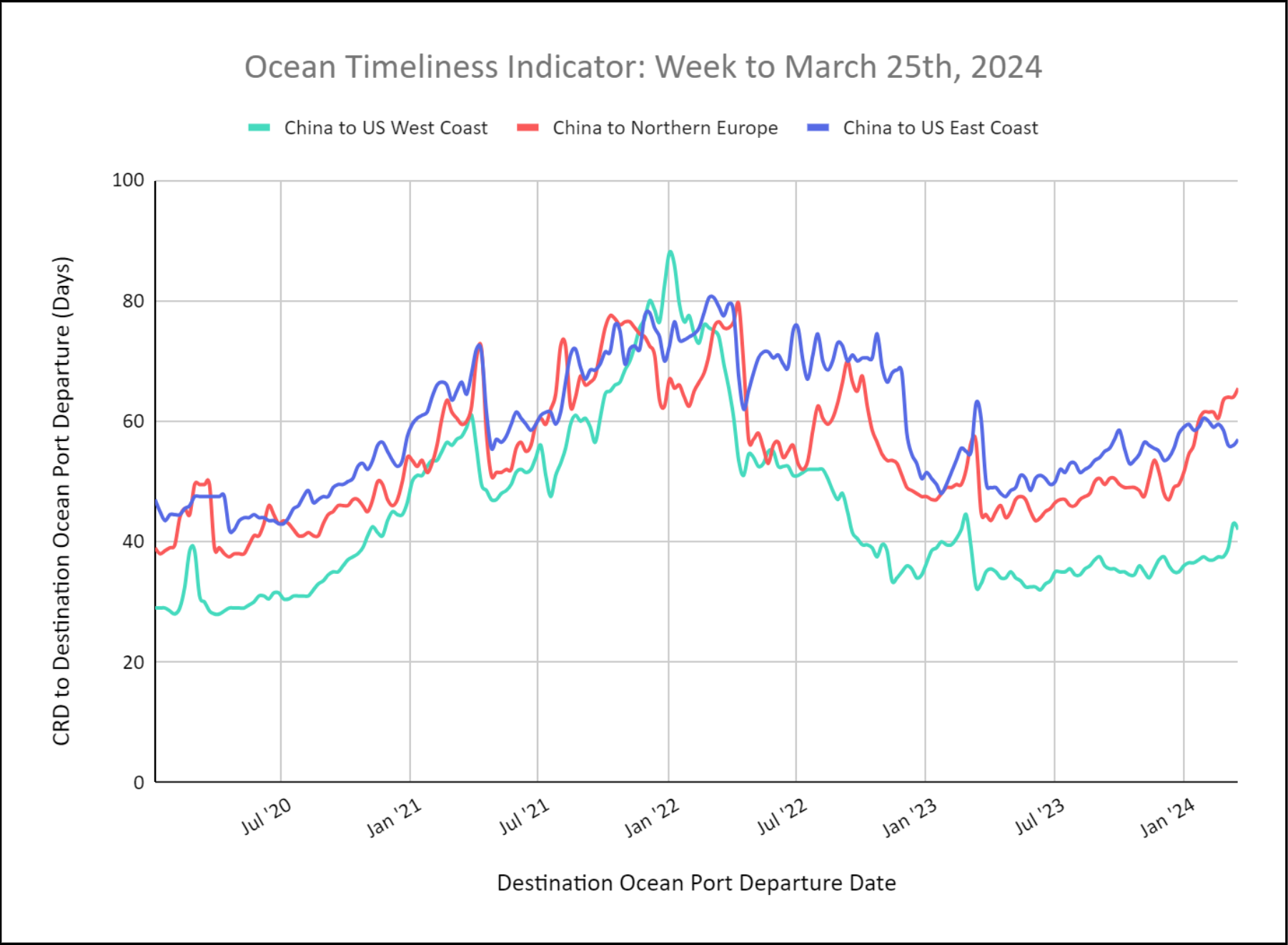

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators for China to Northern Europe and China to the U.S. East Coast Increase. Indicators for China to the U.S. West Coast Decrease.

Week to March 25, 2024

This week, the OTI for China to Northern Europe increased to 65 days due to carrier re-routings from the Suez Canal around the Cape of Good Hope. The OTI for China to the US East Coast also remains increased to 57 days as some carriers route westward around Cape of Good Hope while most have decided to use the Panama Canal despite continued slot restrictions. The OTI for China to the US West Coast decreased slightly to 42 days.

Source from Flexport.com