Trends to Watch

[Operations – Canada]

- Border-Agent Union Negotiations: The Canada Border Services Agency (CBSA) will be in a legal strike position as of June 6. The majority of the members are considered essential and can not legally perform “work to rule action” or intentionally slow down trade. A simple 5-10 min delay off the normal average crossing time could have a large cumulative effect. Importers should expect to experience delays with their imports if a strike is called.

- Canadian Rail Negotiations: The Canada Industrial Relations Board (CIRB) has directed the Teamsters National Rail Conference (TCRC), the Canadian National (CN) and Canadian Pacific Kansas City (CPKC) to provide final replies by June 14, which could mean a CIRB decision and possibly a strike, by the end of the month.The Teamsters National Rail Conference (TCRC) union has vowed to strike at the earliest opportunity after the CIRB ruling, and there have been no negotiations in the meantime. The CN, CPKC and the Canadian International Forwarders Association (CIFA) have requested a longer period than 72 hours from decision for strike to be able to occur.

[Ocean – TPEB]

- The early peak conditions for Transpacific Eastbound Ocean freight that we entered in the month of May continue through the first part of June with volumes expected to be +10% higher YoY.

- Floating rates: All general rate increases for the month of May have stuck with further rounds to be implemented on all Transpacific Eastbound gateways based on the peak conditions we are seeing in June. Carriers expect these rate hikes to stick and accelerate in the short term since vessels leaving Asia are expected to be full through June – Pacific Southwest is full, Pacific Northwest is close to full into the end of month and into June. Particularly Vietnam + South/East China (Yantian/Shanghai/Ningbo) into the Pacific Southwest is especially tight.

- Fixed rates: Carriers implemented a Peak Season Surcharge (PSS) on June 1, and it is likely that the PSS will be increased again on June 15. More updates to come shortly as plans are finalized.

[Ocean – FEWB]

- The market continues to tighten and space is constrained at least up until the end of June, trending to July. Multiple factors are at play including port congestion, equipment shortages, and the continued delays on vessels rerouting via Cape of Good Hope resulting in low reliability and blank sailings reported out of Asia intensifying the situation.

- Port congestion in Asia remains severe mainly due to high yard utilization, unexpected bad weather and vessel bunching, leading to low terminal operation efficiency and long waiting times, causing last-minute port omission by carriers to catch up with the transit time.

- Demand continues to be stronger than usual and rates rose again for the first half of June followed by another increase for the second half of June ($1,000 – $2,000 increase per 40-foot container). We expect the increase in demand to be driven not only by consumer demand but also by companies building stock due to the longer than anticipated lead times and companies trying to secure space.

- Carriers are increasing the Peak Season Surcharge (PSS) quantum to $1000-1500/TEU aiming for existing long term fixed deals.

- Shippers continue to push cargo for earlier departure to avoid further freight cost increases. Unless space has already been secured, all vessels are full. To push cargo on sooner ETD (estimated time of departure) and avoid delays, more carriers are open to Premium options to get cargo loaded on the first available departure date with higher equipment priority.

- Flexport continues to monitor the situation and we advise to book early, place bookings in smaller lots, and pick up empty containers as soon as possible. For urgent cargo with a target delivery date, it is recommended to move on the Premium option as early as possible.

- Read more about the situation in Why Ocean Freight Rates are Surging: A Look at the Supply Shock after the Red Sea Disruptions.

[Ocean – U.S. Exports]

- Container availability for inland U.S. exporters has become much more challenging. This is a result of the global disruptions in container shipping and their subsequent impact to the flow of laden and empty containers.

- The extended transit times seen due to routing around Cape of Good Hope, growing port congestion at key ports, further devolves the container equipment situation for U.S. exporters, especially shippers loading at inland rail points.

- Congestion at key destination transhipment hubs for U.S. exporters include Asia Base Ports and Strait of Gibraltar ports Tanger-Med and Algeciras.

- To ensure the smoothest loading experience, Flexport recommends booking 3-4 weeks in advance for bookings loading at a coastal port, and 4+ weeks in advance for bookings loading at an inland rail point.

[Air – Global] (Data Source: WorldACD)

- Rates: Global air cargo rates have surpassed 2023 levels for the first time this year, with an average increase of 4%. However, this is partly due to strong demand from Asia Pacific with higher rates. Notably, rates are significantly higher than pre-pandemic levels, sitting at 41% above May 2019.

- Tonnages: Global tonnages are up 9% YoY, primarily driven by Asia Pacific (+16%) and Middle East & South Asia (+14%). However, there was a slight decrease of 2% last week.

- Capacity: Capacity remains stable globally but has grown 7% compared to the same period last year. Central & South America saw a substantial decrease (-17%) due to airlines removing capacity used for Mother’s Day flower shipments.

- Regional Highlights: Dubai to Europe shows significant YoY tonnage growth (+26%) driven by sea-air cargo demand. Both Asia Pacific and Middle East & South Asia continue double-digit YoY growth (+16% and +14% respectively).

- Post-holiday impact: The recent tonnages reflect a recovery from China’s Labor Day and Golden Week holidays. While Asia Pacific shows an 8% increase, half can be attributed to Golden Week.

Please reach out to your account representative for details on any impacts to your shipments.

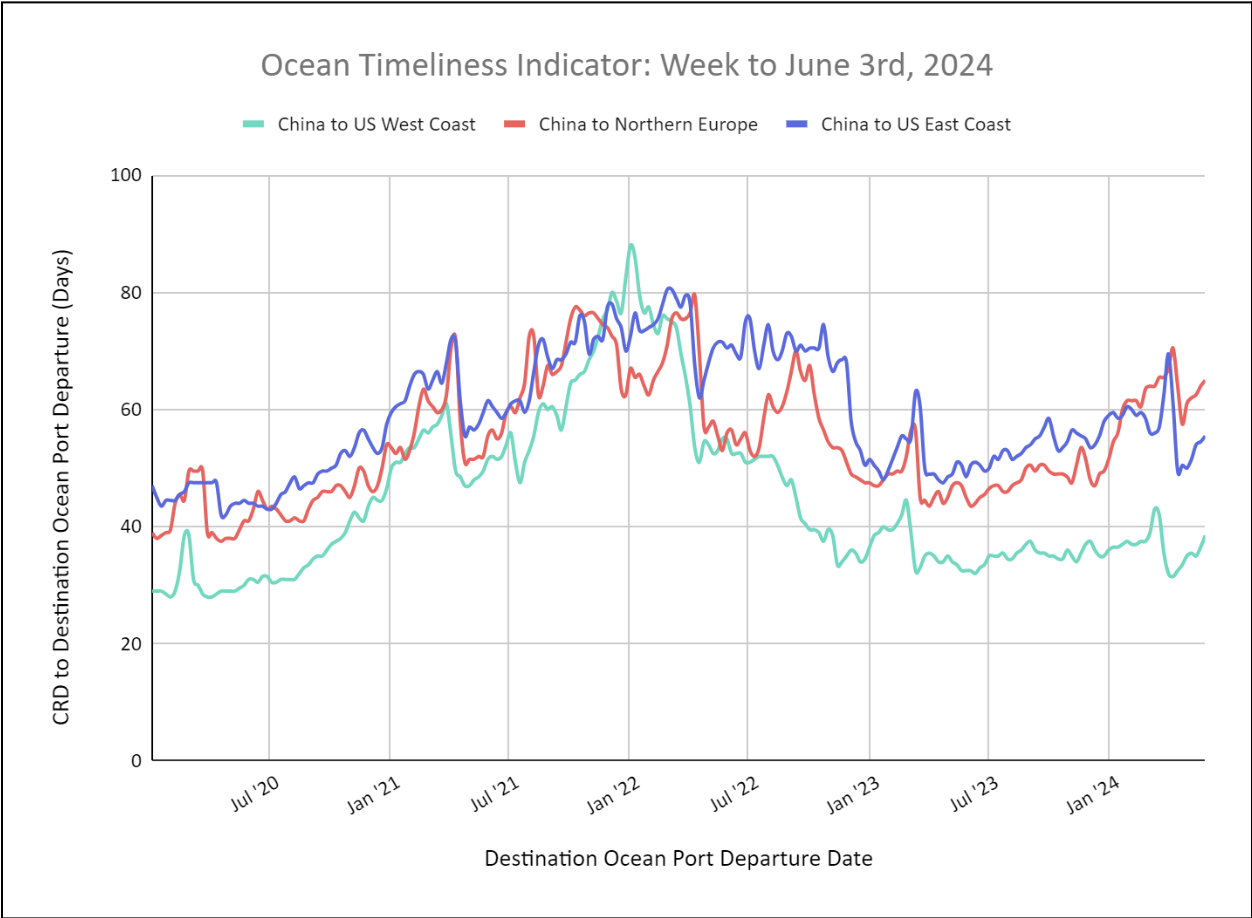

North America Vessel Dwell Times

Source from Flexport.com