Trends to Watch

- [Air – Global] Air cargo volumes are rebounding in early 2024, surpassing previous years’ trends. Global air cargo tonnages witnessed a strong recovery in the second week of January 2024, rising by 24% compared to the previous week, countering the typical end-of-year slowdown. This rebound is notably more pronounced than the same period in the previous year, with a marked increase in cargo from Asia Pacific and Middle East & South Asia to Europe, potentially influenced by shipping disruptions in the Red Sea. Despite an overall 7% decrease in global tonnages compared to the preceding two weeks, Middle East & South Asia saw a 2% rise, while major intercontinental lanes experienced significant declines. Year-on-year data shows a global increase in demand by 2%, with a notable 6% surge ex-Asia Pacific, despite lower rates that remain 24% below the levels from the same time last year but 31% above pre-COVID levels. The increase in tonnages to Europe from Asia Pacific and Middle East & South Asia did not lead to higher average prices, indicating a complex interplay between demand, capacity, and pricing in the global air cargo market.

- [FEWB – Ocean] Asia-North Europe: The Red Sea Crisis continuously impacts freight market developments. Rates remain on the higher side. Over the past few weeks, demand has been strong and with Lunar New Year approaching, a slowdown in demand in Asia has ocean carriers reducing freight rates. Two more void plans announced by carriers led WK08/09 capacity to be cut by more than 25% on average. As a result of vessels rerouting via the Cape of Good Hope, vessels and containers face longer transit times. Expect a shortage of empty containers in Asia in the coming weeks, especially outports. To mitigate the disruption of operational challenges (sailing schedule adjustment, vessel downsized, equipment shortages, rollover, etc.), shippers can explore premium services offered by liners with higher cost to get guaranteed space and equipment and to shorten delays. German Rail Strike: There’s another strike on the German railway infrastructure of DB InfraGO AG. From January 23, 2024 6:00 PM CET to January 29, 2024, the entire traffic on the German infrastructure will be affected. The end of the strike is announced for January 29, 2024, at 6:00 PM CET. Please stay close to the situation and plan delivery if any. Asia-Med: Following North Europe, MED floating rates remained on the higher side. Rates started trending slightly lower in WK04 in a push to get more cargo to fill up ships before Lunar New Year and also rollpool preparation for WK07 onwards due to the weak demand and holidays in Asia.

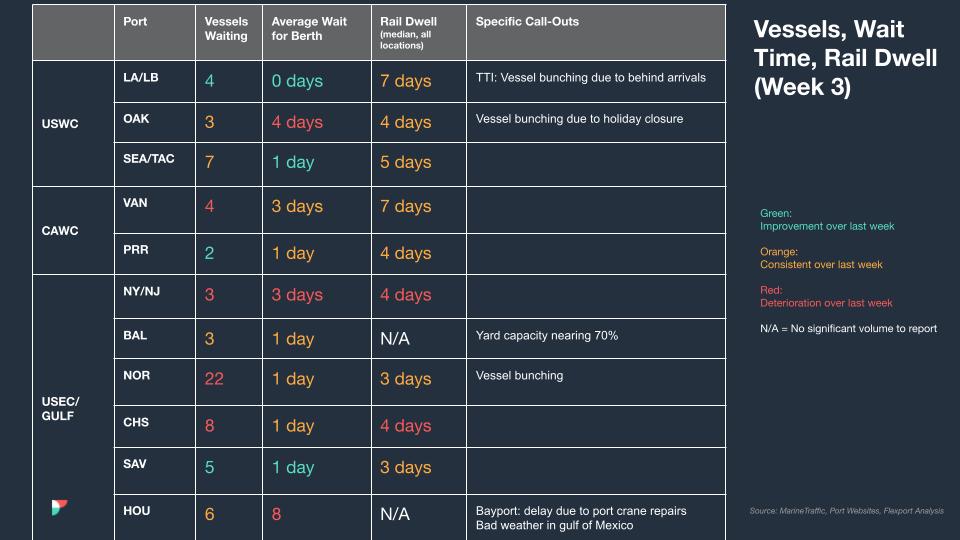

North America Vessel Dwell Times

This Week In News

West Coast To Experience Increased Transpacific Volumes

The ITS Logistics US Port/Rail Ramp Freight Index reports increased transpacific volumes on the U.S. West Coast due to the seasonal Lunar New Year restock and the potential for congestion at East Coast ports. As more freight is routed to the West Coast, congestion is expected at rail ramps across the U.S., affecting long-term contracted rates and capacity during the ocean carrier contract season.

U.S.-bound Imports Are Up In December And Down For All Of 2023, Reports S&P Global

Containerized freight imports to the United States experienced growth in December 2023 for the fourth consecutive month, with a 9% increase reaching 2.2 million TEU (Twenty-Foot Equivalent Units). This marks a recovery after 14 months of annual declines. S&P Global Intelligence noted widespread growth in various sectors in December.

Cargo Theft Spiked Over 57% In 2023 Vs. 2022, New Data Shows

Cargo theft incidents in 2023 increased by more than 57% compared to the previous year, reaching an unprecedented level, according to CargoNet. The total reported cargo theft amounted to nearly $130 million, but the actual figure is likely higher due to the non-mandatory nature of reporting.