Trends To Watch

- [U.S. Exports – Ocean] Routing changes are happening related to the bypassing of the Panama Canal for some key services from USEC/U.S. Gulf to Asia.

- [TAWB – Ocean] The pandemic introduced a level shift in favor of MED-USEC when it comes to the total port-pair connections, while not having any negative impact on the total distinct connections. New Orleans, for example, is completely cut off from direct Europe services, while Saint John is heavily introduced as a direct port call. Spot rates continue to be under pressure and are now heavily below the 2019 levels. Weak demand and over-capacity continue to impact the sustainability of this trade. From now until the end of the year, there will be more blank sailings introduced in the market; average capacity will decrease on average by 25-40% between WK52 and WK2 2024. The expectation is for some rate action to be taken by carriers to alleviate the pressure. In other news, the Panama Canal situation will have an impact on Transatlantic routes to West Coast ports but at a much smaller scale compared to Trans-Pacific. At the moment only two shipping lines have announced a Panama Canal surcharge even though the current vessel delay is only 1-2 days on top of published proforma transit time.

- [FEWB – Ocean] GRI Implementation: With freight costs remaining on the lower side, liners are implementing General Rate Increases (GRI) to push up the rate even when there’s no significant cargo rush or general capacity issue; For the first half of December, liners are trying to push up the rate by $300-500/FEU, and another $400-600/FEU for the second half of December; Prior to Christmas and the New Year holidays, we’re expecting there might be a slight cargo rush for some specific commodities, and it’s also the last chance for Liners to hold the rate into 2024. Capacity/Deployment adjustment: With the THEA FE5 services suspension, the carrier CMA-CGM in Ocean Alliance also adjusted their FAL1/FAL3, taking out Cai Mep and some port rotation aiming to expedite the first calling port ETA as well as maximizing capacity via other POL; 16-18% capacity was cut as a result. With all the changes, for South East Asia (especially Vietnam and Thailand), capacity is getting tight, but compared to the export volume in 2023, the impact is limited. We foresee it will cease soon in a couple of weeks and eventually get back to normal. If there is no significant demand increase, we may see more last-minute blank sailings announced, especially prior to/post-Lunar New Year.

- [Air Freight – Global] In week 47 of 2023, worldwide air cargo experienced a 3% decrease in tonnages and a 2% increase in global average rates compared to the previous week, with a less severe Thanksgiving-related decline in North America than last year. Tonnages and rates varied regionally, with notable decreases from North America to Europe and Asia Pacific, and increases from ex-Africa to Europe and ex-Europe to Central and South America. Year-over-year, global volumes are 2% higher, with significant increases in capacity from several regions (particularly Asia Pacific) and decreases in tonnages from North America and Europe. Despite current average rates being 21% lower than last year, they remain 42% above pre-COVID levels.

Please reach out to your account representative for details on any impacts to your shipments.

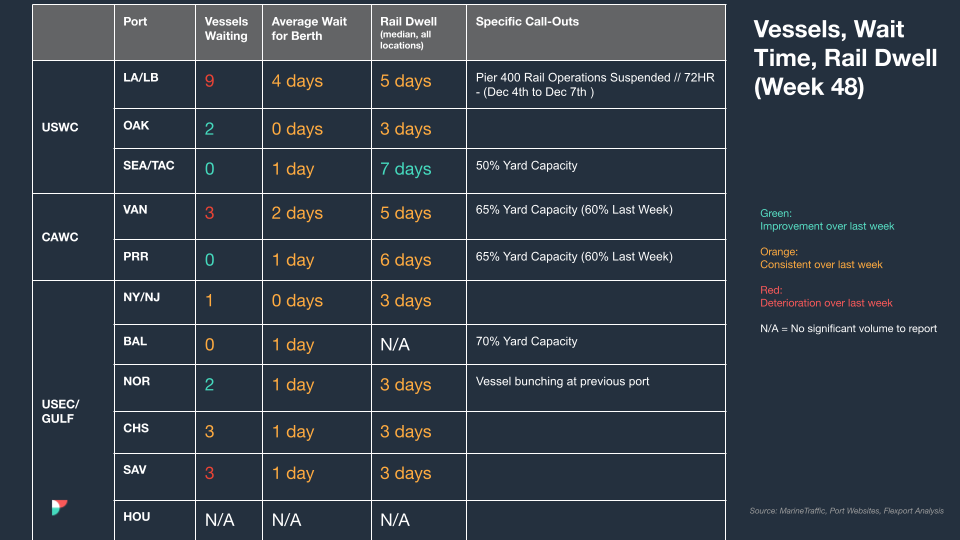

North America Vessel Dwell Times

The Week In News

Atlanta Becomes Casualty of Imports Returning to West Coast

Over the past year, Atlanta’s share of the total U.S. freight market volume has decreased by more than 11%, while the Ontario, California, market has seen a recovery of over 14% in its outbound trucking market share. Supply chain shifts and a cost-effective transportation market are key factors driving this trend. During the pandemic, overwhelmed West Coast port and rail infrastructure led importers to divert shipments to Eastern ports. However, recent challenges, including drought affecting the Panama Canal and Middle East conflicts disrupting the Suez Canal, are prompting importers to return to the Los Angeles and Long Beach port complex.

OOCL Box Ship in Red Sea Hit by Rocket Fired From a Drone

Container vessels in the Red Sea region face increased risks following an attack on an OOCL ship by a Houthi drone. The 4,250 TEU Number 9 issued a distress call after being hit by a rocket near the Yemen coast, resulting in engine damage and water ingress. Houthi rebels ordered the vessel to dock at the port of Hodeidah, where another captured ship is reportedly held, but the damaged engine prevented a change of course. The vessel, part of the Ocean Alliance’s Asia-Mediterranean service, continues its schedule despite the incident.

Manufacturing Down Again in November Amid Low Orders: PMI

Manufacturing orders in the U.S. remained soft in November, according to the Institute for Supply Management’s Purchasing Managers’ Index (ISM), which held steady at 46.7%, indicating economic contraction. The ISM Manufacturing Business Survey Committee noted that the industry is in a “low-end” trough with depleted inventories and expects it to remain subdued, especially in terms of new orders. S&P Global’s PMI index was slightly more positive at 49.4, down from October’s 50.0, attributing the decline to weak demand and low stock levels.

Source from Flexport.com