Trends to Watch

[Ocean – FEWB]

- Asia-Europe: The Red Sea situation continues to impact freight market development. Vessels continue to reroute via the Cape of Good Hope and vessel schedules continue to fluctuate, impacting on-time performance & reliability.

- After the Day 8 product reshuffle of Ocean Alliance and THE Alliance blank sailings, market capacity dropped by 10-13% and spaces are getting tight for 2H April. Vessel utilization is good and claimed at more than 95%, with roll pool being built up for the Labor Day Holiday.

- Carriers are still implementing GRIs (General Rate Increases) to keep rates from dropping further. Some carriers recently announced rates at a $4000/40’ level for 2H April. Per the current market, demand is not overwhelming and vessels are mostly full due to blank sailings, so GRIs may not hold.

- For historical updates on the Red Sea situation, read more in Global Ocean Carriers Halt Red Sea Transits – What to Expect.

[Air – Global] (Data Source: WorldACD/Accenture)

- Global air cargo rates increased throughout March, reaching within -7% of the previous year’s levels and recovering to Q4 peak levels, driven by strong demand from Asia and the Middle East.

- Average global rates rose to $2.48 per kilo in week 13, following consistent weekly increases, with the gap from the previous year narrowing from -19% in early 2023 to -7% by the end of March.

- The recovery to Q4 peak levels is attributed to rate increases from Asia Pacific and Middle East & South Asia (MESA), fueled by cross-border e-commerce demand and disruptions in container shipping.

- Global air cargo tonnages in March were up +6% year on year, with a slowdown in growth compared to the January-February period, and tonnages for weeks 12 and 13 were down -3% compared to the preceding two weeks.

- Tonnages from key Asia-Europe sea-air hubs like Dubai and Colombo remain elevated due to disruptions in container shipping, with Dubai-Europe and Colombo-Europe tonnages up significantly year on year.

Please reach out to your account representative for details on any impacts to your shipments.

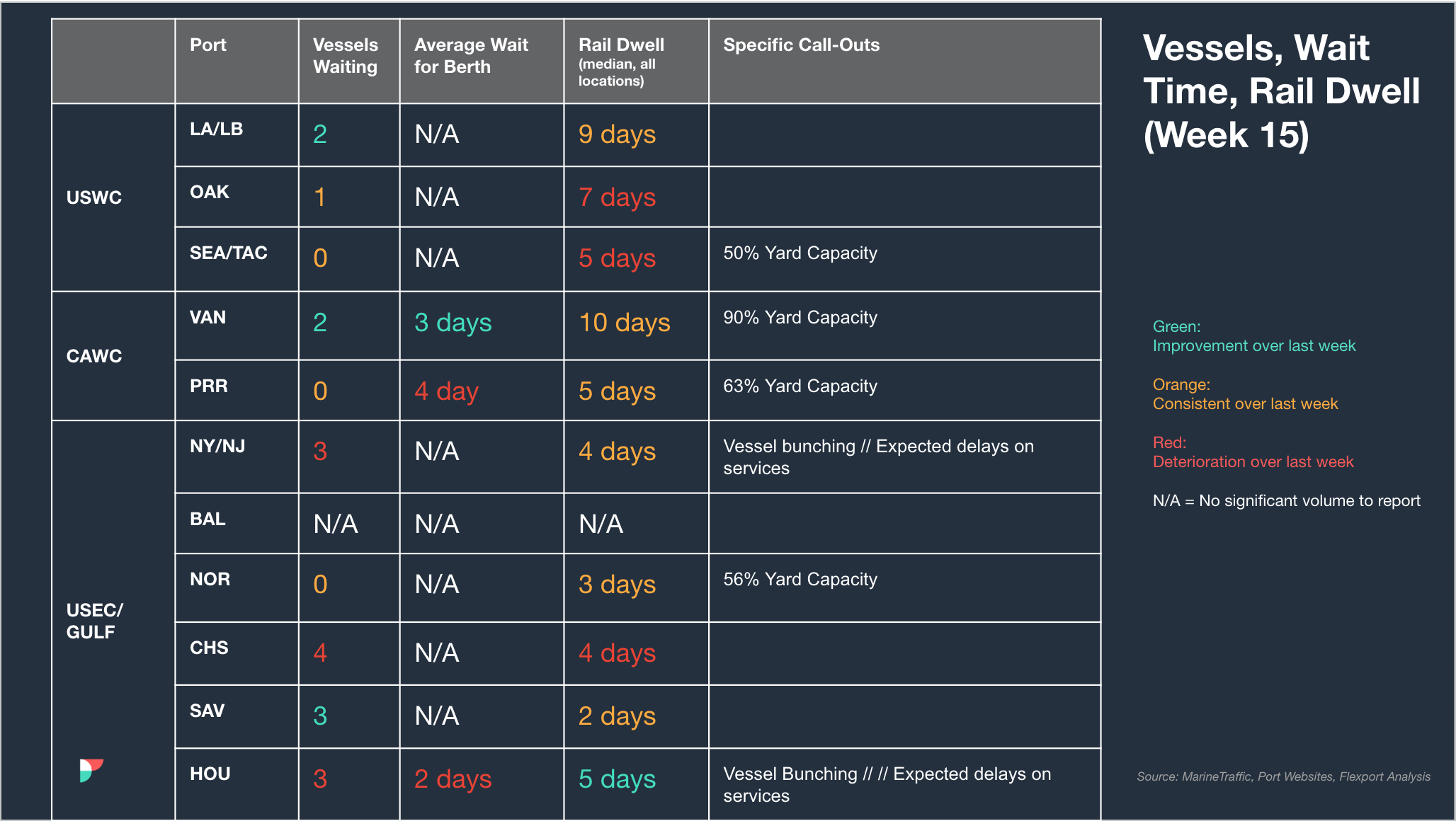

North America Vessel Dwell Times

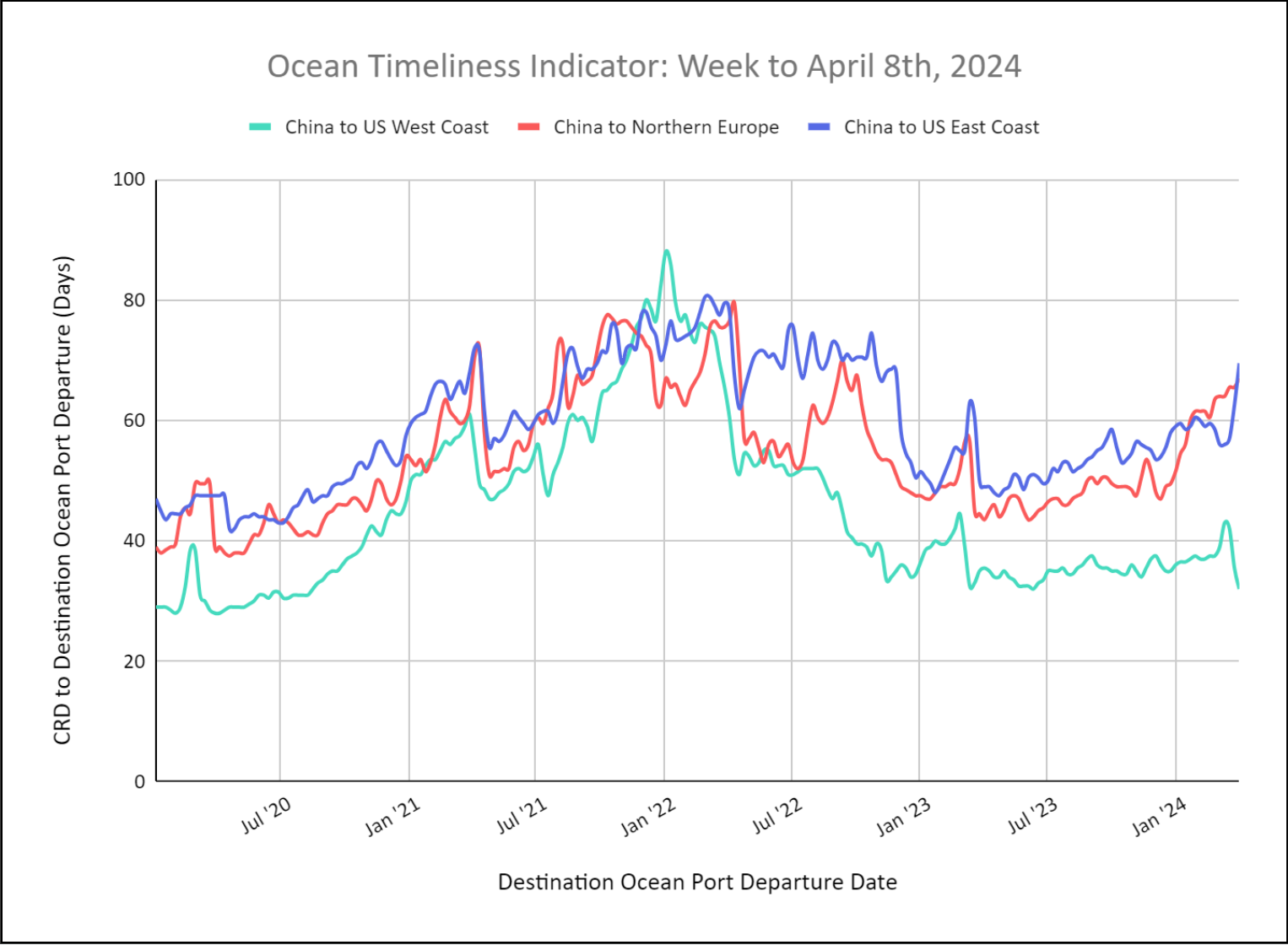

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicators for China to US West Coast Decreases, While China to US East Coast and China to Europe Increase

Week to April 8, 2024

This week, the OTI for China to Northern Europe increased slightly to 67 days due to continued re-routings from the Suez Canal around the Cape of Good Hope. The OTI for China to the US East Coast also increased significantly to 69 days as some carriers route westward around Cape of Good Hope. Most have decided to use the Panama Canal despite continued slot restrictions. We do not expect the Baltimore situation to impact the China to East Coast OTI overall. The OTI for China to the US West Coast continued to decrease this week to 32 days.

Source from Flexport.com