Trends To Watch

- [Ocean] On Transpacific Eastbound (TPEB), effective capacity remains at an oversupply with carriers continuing to announce more blank sailings in an attempt to reign in further rate drops. Meanwhile, the trends of shifting imports to the U.S. East Coast (USEC), as well as Canada & the Gulf, from the U.S. West Coast (USWC) continues to be seen in YoY volume data.

- [Ocean] Meanwhile, on Transatlantic Westbound (TAWB), rates continue their downward trend as demand is not recovering and capacity continues to increase. Expect this trend to continue for all Q2 2023 and beyond. Further, equipment is now widely available in all major European ports.

- [Air] A portion of Beijing Airport, the 3rd busiest in the country, is shut down for maintenance through the month of April. This is expected to remove approximately ⅓ of the facility’s air cargo volume, or ~2.6% of China’s overall air cargo volume.

- [Air] Transatlantic routes are continuing to see increasing numbers of passenger flights being scheduled, thereby increasing belly capacity from Europe to N. America. This has brought capacity on these routes back to pre-COVID levels; however rates remain high due to fuel prices.

- [Trucking] The majority of US and Canadian ports and rail ramps are fluid, and not experiencing any significant delays—gulf ports are slightly congested but truck power is available nationwide and highway diesel rates remain stable.

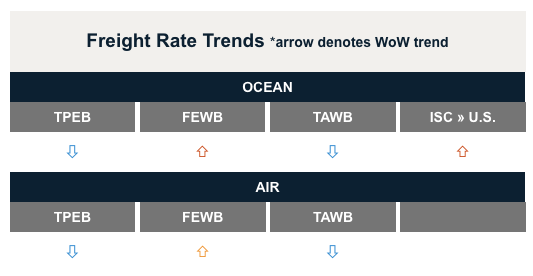

Freight Rates

The Week In News

A key inflation gauge tracked by the Fed slowed in February

The Consumer Price Index rose 0.3% in February, which is less than expected. Core inflation, which strips out food and energy prices, decreased to 5.5% from 5.6%, the lowest since late 2021. This is encouraging news for policymakers, as it indicates that inflation may be stabilizing after a period of rapid growth. According to Flexport’s Chief Economist Phil Levy, “You look at this report and think, we’ve got to keep applying the brakes.”

European Shippers Sign Up for Waterborne Biofuel Initiative

Seventeen European shippers, led by Dutch multimodal operator Samskip, have signed on to the “Switch to Zero” campaign by the Port of Rotterdam Authority and GoodShipping. The Renewable Energy Directive (RED II) mandates that 32% of all energy usage in the EU, including at least 14% of all energy in road and rail transport fuels, must come from renewable sources such as biofuels. Flexport also partners with GoodShipping to enable our customers to work toward carbon neutrality via the Impact Dashboard, part of the Flexport platform.

Source from Flexport.com