The Ocean Alliance could be the next major ship-sharing agreement to sink, possibly sometime this year, as its members chart different strategies and look to gain market share during the current “rate war” among ocean carriers, industry analyst Lars Jensen said Wednesday.

Speaking at the Journal of Commerce’s TPM23 conference in Long Beach, Jensen said ocean carriers face a market similar to the one seen during the 2008-09 financial crisis when a massive buildup of ship capacity came up against weakening demand.

While demand could recover should inventory destocking occur through the spring and US consumers keep spending, Jensen said the industry faces other headwinds, such as political scrutiny over the alliances’ anti-trust exemptions and higher costs from stringent carbon emissions rules. The result, he added, is that carriers are thinking more about “who do I want to spend the next few years with” as has happened with the pending dissolution of the 2M Alliance.

“It’s a normal downcycle we are going through, then there are some elements that are slightly different,” Jensen, CEO and partner of Vespucci Maritime and a Journal of Commerce analyst, said. “Rates are coming down faster than they went up. It is a rate war.”

“2M is the just the first domino to fall,” he added. “When it was formed, you had two parties with the same strategic interest. Now you have two parties whose interests are no longer aligned.”

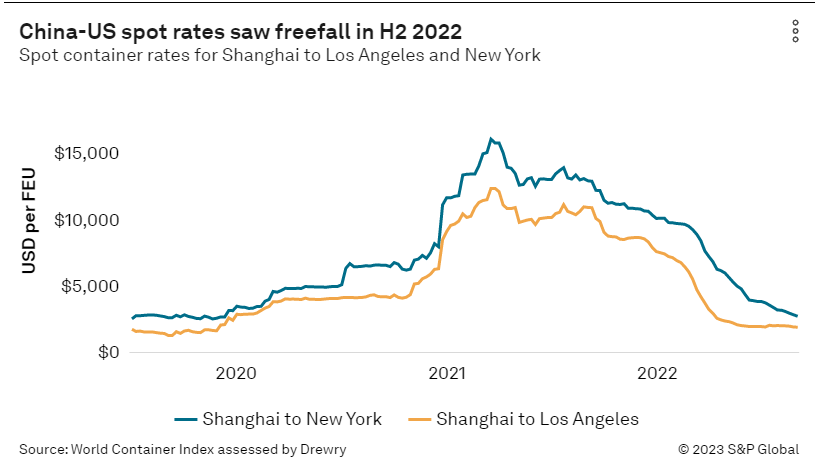

China-US spot rates saw freefall in H2 2022

Spot container rates for Shanghai to Los Angeles and New

Cosco has second-largest orderbook

Jensen, one of the first to predict the breakup of 2M, said at the time that Mediterranean Shipping Co.’s large orderbook of new vessels allowed it to operate on a standalone basis across many trade lanes, without having to share space on Maersk vessels. A similar dynamic could play out with Ocean Alliance member Cosco Shipping, which has the second-largest orderbook of new ships behind MSC, Jensen said.

Cosco faces renewed urgency to fill those new vessels due to a loss of market share over the last two years that Jensen attributed to China’s COVID-19 lockdowns and the resulting shipping delays out of the country.

“I’m going to expect Cosco to be very aggressively going after market share,” Jensen said. “Who’s the easiest prey to go after? That would be customers already on your ships through your alliance partners.”

“That’s not going to sit well with [Ocean Alliance members] CMA CGM and Evergreen Marine,” Jensen said, adding that Taiwan’s Evergreen faces the additional tension of working with a China-based carrier.

Indeed, Cosco recently upsized capacity on an Asia to US Gulf service it operates on a standalone basis, but that is also offered through the Ocean Alliance. The new capacity on that Cosco service now evenly matches one that CMA CGM also offers on a standalone basis to the US Gulf.

Likewise, CMA CGM is pursuing a strategy not similar to Maersk’s, “but somewhere in the same direction,” Jensen said.

As does Maersk, CMA CGM looks to own US terminal assets after striking acquisition deals on the US East and West coasts. CMA CGM’s North American President Peter Levesque said during his appearance at TPM23 Tuesday that owning terminals allows the carrier to “determine our own destiny.”

The Ocean Alliance’s agreement is set to expire in 2027, Jensen said, but he noted the current market uncertainty and the pending breakup of 2M could hasten a decision not to renew the Ocean Alliance in 2023.

Regarding THE Alliance, Jensen said “it’s slightly stable” due to similar operating strategies and less aggressive ship ordering. However, he said the changing carrier landscape may make THE Alliance’s two biggest members, Hapag-Lloyd and Ocean Network Express (ONE), reconsider their partnerships. Jensen even posited that the two could decide to merge as a way to take on ever-larger ocean carriers.

“This is not the first time we’ve seen alliances break up and get re-formed,” he said. “The challenge is once everyone’s dance card is open, Hapag and ONE will have some thinking to do about who do we actually want to be lined up with now that everything is shifting.”